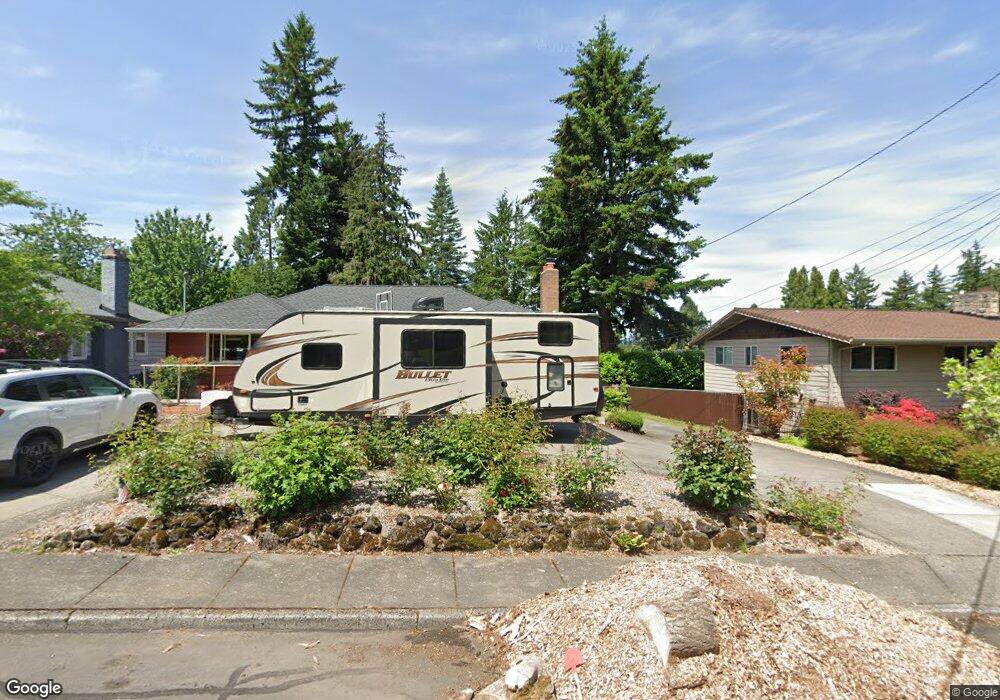

845 NW 8th St Unit 855 Gresham, OR 97030

Northwest Gresham NeighborhoodEstimated Value: $605,419 - $651,000

4

Beds

3

Baths

2,138

Sq Ft

$294/Sq Ft

Est. Value

About This Home

This home is located at 845 NW 8th St Unit 855, Gresham, OR 97030 and is currently estimated at $628,605, approximately $294 per square foot. 845 NW 8th St Unit 855 is a home located in Multnomah County with nearby schools including Dexter McCarty Middle School, Gresham High School, and Gresham Arthur Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 2, 2019

Sold by

Currey Debra J and Linnehan James M

Bought by

Bower Danielle A and Gebhardt Stephen D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$365,250

Outstanding Balance

$321,144

Interest Rate

4.7%

Mortgage Type

New Conventional

Estimated Equity

$307,461

Purchase Details

Closed on

Sep 25, 2006

Sold by

Gray Lynn H

Bought by

Linnehan James M and Currey Debra J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$272,000

Interest Rate

6.43%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bower Danielle A | $487,000 | Fidelity Natl Title Of Orego | |

| Linnehan James M | $340,000 | Lawyers Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bower Danielle A | $365,250 | |

| Previous Owner | Linnehan James M | $272,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,208 | $255,910 | -- | -- |

| 2024 | $4,985 | $248,460 | -- | -- |

| 2023 | $4,542 | $241,230 | $0 | $0 |

| 2022 | $4,415 | $234,210 | $0 | $0 |

| 2021 | $4,304 | $227,390 | $0 | $0 |

| 2020 | $4,049 | $220,770 | $0 | $0 |

| 2019 | $3,943 | $214,340 | $0 | $0 |

| 2018 | $3,760 | $208,100 | $0 | $0 |

| 2017 | $3,607 | $202,040 | $0 | $0 |

| 2016 | $3,181 | $196,160 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 994 NW Wallula Ave

- 1113 W Powell Blvd

- 1745 NW 7th Place

- 54 NW 13th St

- 159 SW Florence Ave Unit 64

- 159 SW Florence Ave

- 200 SW Florence Ave Unit C6

- 200 SW Florence Ave Unit D15

- 0 NE 5th St

- 2036 NW 14th St

- 1758 NW 18th Ct

- 318 NE Roberts Ave Unit 308

- 1387 NW Riverview Ave Unit 14B

- 1711 NW 19th St

- 638 SW 7th St

- 2360 NW 3rd St

- 512 SW Eastman Pkwy Unit 13

- 317 SW Angeline Ave

- 272 NW Mawrcrest Ave

- 256 NW Mawrcrest Ave