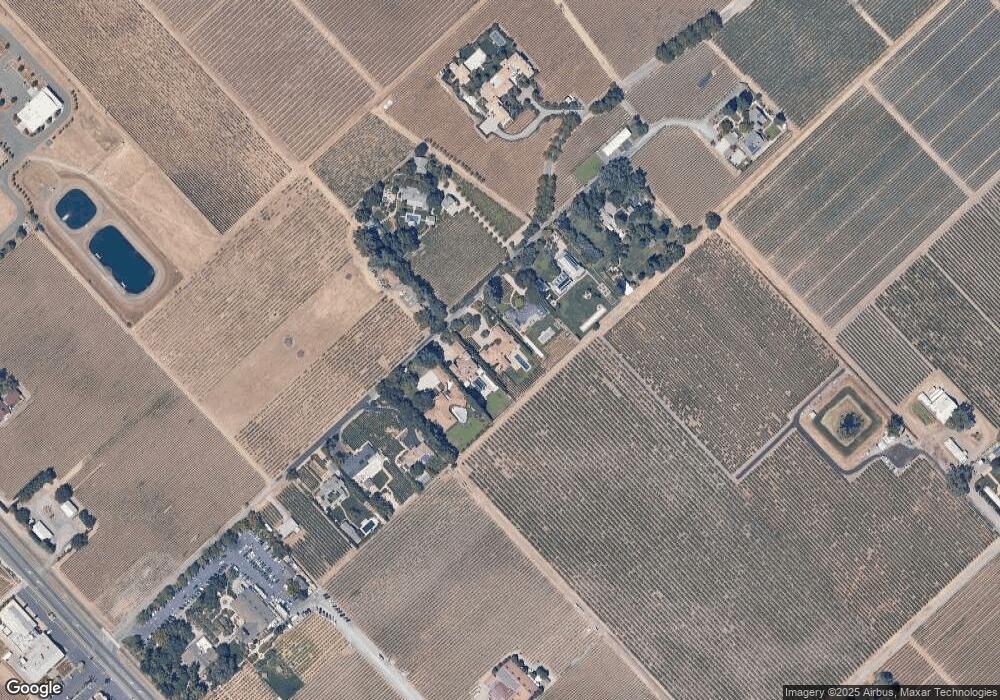

845 White Ln Saint Helena, CA 94574

Estimated Value: $5,388,000 - $8,771,000

4

Beds

5

Baths

4,500

Sq Ft

$1,534/Sq Ft

Est. Value

About This Home

This home is located at 845 White Ln, Saint Helena, CA 94574 and is currently estimated at $6,903,928, approximately $1,534 per square foot. 845 White Ln is a home located in Napa County with nearby schools including Saint Helena Primary School, Saint Helena Elementary School, and Robert Louis Stevenson Intermediate School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 17, 2008

Sold by

Land Holdings Iv White Lane Llc

Bought by

Binder Robert and Jost Walter

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$729,750

Outstanding Balance

$468,038

Interest Rate

6.04%

Mortgage Type

Unknown

Estimated Equity

$6,435,890

Purchase Details

Closed on

Dec 7, 2005

Sold by

Spalding Mary L

Bought by

Land Holdings Iv White Lane Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$2,825,000

Interest Rate

6.14%

Mortgage Type

Construction

Purchase Details

Closed on

Jan 10, 2000

Sold by

Spalding George R and Spalding Mary L

Bought by

Spalding George R and Spalding Mary L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Binder Robert | -- | First American Title Company | |

| Land Holdings Iv White Lane Llc | $1,600,000 | First Amer Title Co Of Napa | |

| Spalding George R | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Binder Robert | $729,750 | |

| Previous Owner | Land Holdings Iv White Lane Llc | $2,825,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $60,006 | $5,812,321 | $2,298,657 | $3,513,664 |

| 2024 | $60,006 | $5,698,355 | $2,253,586 | $3,444,769 |

| 2023 | $60,006 | $5,586,624 | $2,209,399 | $3,377,225 |

| 2022 | $57,545 | $5,477,083 | $2,166,078 | $3,311,005 |

| 2021 | $56,801 | $5,369,690 | $2,123,606 | $3,246,084 |

| 2020 | $56,243 | $5,314,632 | $2,101,832 | $3,212,800 |

| 2019 | $55,270 | $5,210,424 | $2,060,620 | $3,149,804 |

| 2018 | $54,376 | $5,108,260 | $2,020,216 | $3,088,044 |

| 2017 | $53,364 | $5,008,099 | $1,980,604 | $3,027,495 |

| 2016 | $52,243 | $4,909,902 | $1,941,769 | $2,968,133 |

| 2015 | $51,748 | $4,836,151 | $1,912,602 | $2,923,549 |

| 2014 | $44,797 | $4,175,325 | $1,651,650 | $2,523,675 |

Source: Public Records

Map

Nearby Homes

- 1251 Garden Ave

- 79 Zinfandel Ln

- 1390 Garden Ave

- 218 Zinfandel Ln

- 1316 Sulphur Springs Ave

- 1388 Sulphur Springs Ave

- 1594 Arrowhead Dr

- 1586 Arrowhead Dr

- 22 S Crane Ave

- 1001 Silverado Trail S

- 1003 Charter Oak Ave

- 691 Silverado Trail S

- 2060 Olive Ave

- 2040 Olive Ave

- 1430 Wallis Ct

- 1005 Valley View St

- 1123 Oak Ave

- 1133 Oak Ave

- 1149 Hudson Ave

- 613 Harvest Ln

- 867 White Ln

- 789 White Ln

- 955 White Ln

- 757 White Ln

- 1005 White Ln

- 250 Zinfandel Ln

- 707 White Ln

- 1031 White Ln

- 1039 White Ln

- 1049 White Ln

- 1110 Victoria Dr

- 1110 Mountain View Ave

- 1111 Mountain View Ave

- 1115 Victoria Dr

- 699 Saint Helena Hwy

- 1130 Mountain View Ave

- 971 Stice Ln

- 1248 Inglewood Ave

- 811 Saint Helena Hwy S Unit 201

- 811 Saint Helena Hwy S Unit 203