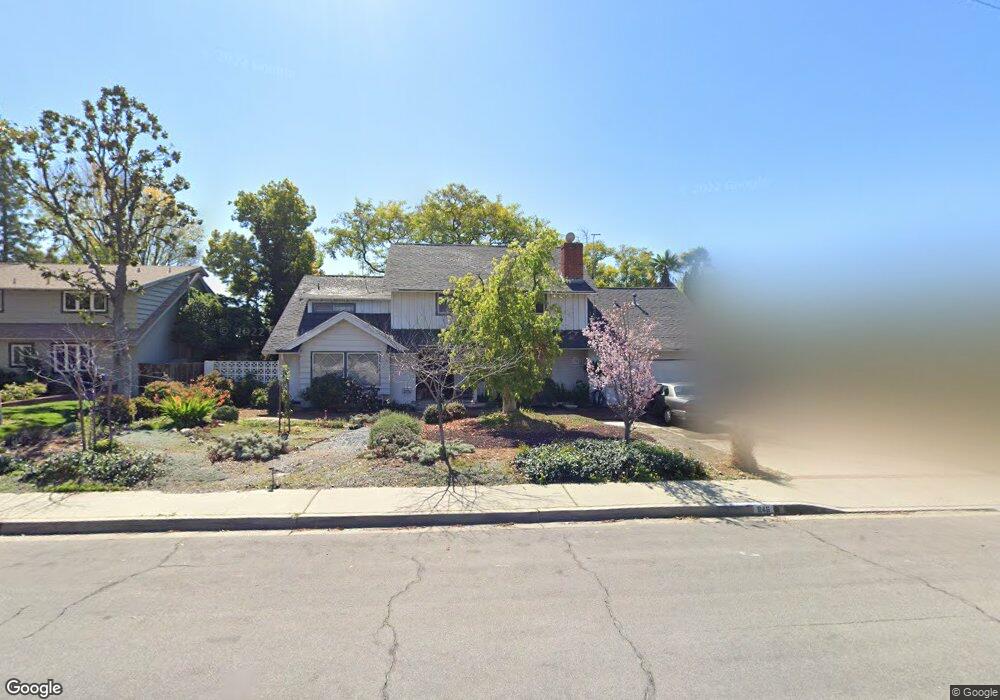

846 W 10th St Claremont, CA 91711

Estimated Value: $1,246,000 - $1,399,017

5

Beds

3

Baths

3,300

Sq Ft

$396/Sq Ft

Est. Value

About This Home

This home is located at 846 W 10th St, Claremont, CA 91711 and is currently estimated at $1,306,754, approximately $395 per square foot. 846 W 10th St is a home located in Los Angeles County with nearby schools including Mountain View Elementary School, El Roble Intermediate School, and Claremont High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 2, 2020

Sold by

Kijak Stephen and Kijak Adrienne

Bought by

Kijak Stephen P and Kijak Adrienne

Current Estimated Value

Purchase Details

Closed on

Sep 22, 2006

Sold by

Christian Herbert Marion and Christian Carlynn Chaffee

Bought by

Kijak Stephen and Kijak Adrienne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$580,000

Outstanding Balance

$342,968

Interest Rate

6.39%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$963,786

Purchase Details

Closed on

Aug 24, 2005

Sold by

Christian Herbert M and Christian Carlynn C

Bought by

Christian Herbert Marion and Christian Carlynn Chaffee

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kijak Stephen P | -- | None Available | |

| Kijak Stephen | $725,000 | Fidelity National Title | |

| Christian Herbert Marion | -- | Equity Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kijak Stephen | $580,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,805 | $971,330 | $687,305 | $284,025 |

| 2024 | $11,805 | $952,285 | $673,829 | $278,456 |

| 2023 | $11,558 | $933,614 | $660,617 | $272,997 |

| 2022 | $11,373 | $915,309 | $647,664 | $267,645 |

| 2021 | $11,195 | $897,363 | $634,965 | $262,398 |

| 2019 | $10,677 | $870,749 | $616,133 | $254,616 |

| 2018 | $10,439 | $853,676 | $604,052 | $249,624 |

| 2016 | $9,724 | $820,529 | $580,597 | $239,932 |

| 2015 | $9,584 | $808,204 | $571,876 | $236,328 |

| 2014 | $9,505 | $792,373 | $560,674 | $231,699 |

Source: Public Records

Map

Nearby Homes

- 750 W 8th St

- 976 Butte St

- 584 W 9th St

- 555 W 9th St

- 4053 N Towne Ave

- The Maple Plan at Descanso Walk

- The Eucalyptus Plan at Descanso Walk

- The Aspen Plan at Descanso Walk

- The Redwood Plan at Descanso Walk

- 171 Evergreen Ln

- 470 W 11th St

- 540 W Baughman Ave

- 944 Richmond Dr

- 1086 Foothill Blvd

- 1090 Foothill Blvd

- 1080 Foothill Blvd

- 464 W 8th St

- 460 University Cir

- 425 W 10th St

- 3069 Carrizo Dr