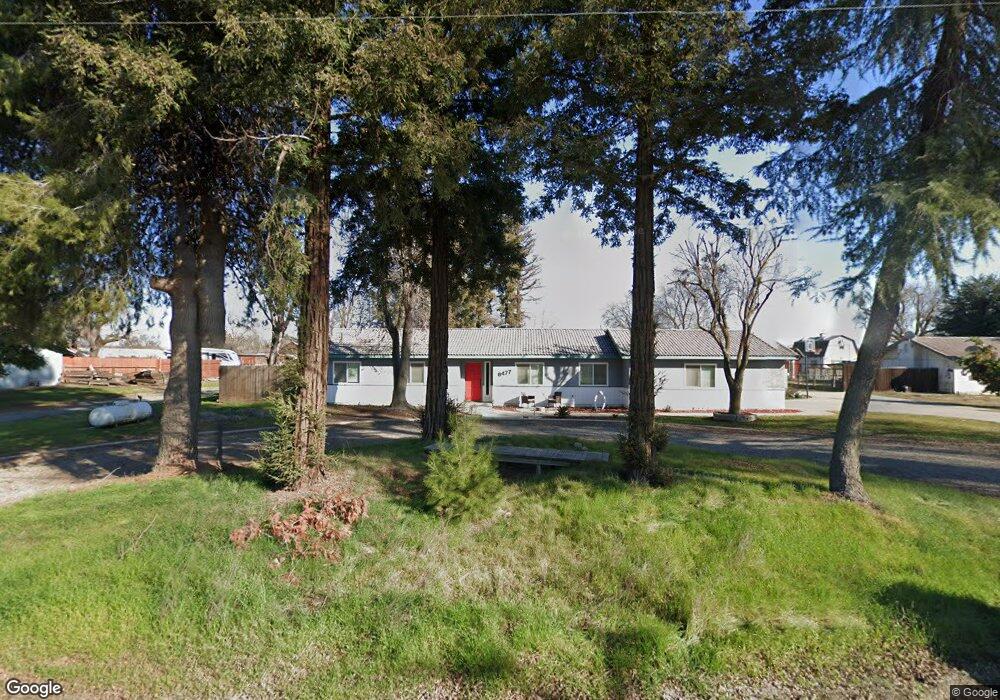

8477 20 1/2 Ave Lemoore, CA 93245

Estimated Value: $497,000 - $528,864

3

Beds

2

Baths

1,753

Sq Ft

$292/Sq Ft

Est. Value

About This Home

This home is located at 8477 20 1/2 Ave, Lemoore, CA 93245 and is currently estimated at $511,466, approximately $291 per square foot. 8477 20 1/2 Ave is a home located in Kings County with nearby schools including Lemoore High School and Island Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 2, 2024

Sold by

Allison Margaret D and Allison Jonathan D

Bought by

Garcia Tiffany and Garcia Matthew R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$398,000

Outstanding Balance

$393,488

Interest Rate

6.86%

Mortgage Type

New Conventional

Estimated Equity

$117,978

Purchase Details

Closed on

Jun 22, 2016

Sold by

Chastain Gary G and Chastain Karen E

Bought by

Allison Margaret D and Allison Jonathan D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$251,831

Interest Rate

3.54%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 22, 2001

Sold by

Costanzo Lance P and Costanzo Elizabeth T

Bought by

Chastain Gary G and Chastain Karen E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,000

Interest Rate

7.12%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Garcia Tiffany | $498,000 | Stewart Title Of California | |

| Allison Margaret D | $275,000 | Stewart Title Of Ca Inc | |

| Chastain Gary G | $160,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Garcia Tiffany | $398,000 | |

| Previous Owner | Allison Margaret D | $251,831 | |

| Previous Owner | Chastain Gary G | $152,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,243 | $498,000 | $140,000 | $358,000 |

| 2023 | $3,243 | $306,765 | $139,439 | $167,326 |

| 2022 | $3,417 | $300,751 | $136,705 | $164,046 |

| 2021 | $3,338 | $294,855 | $134,025 | $160,830 |

| 2020 | $3,314 | $291,832 | $132,651 | $159,181 |

| 2019 | $3,281 | $286,110 | $130,050 | $156,060 |

| 2018 | $3,159 | $280,500 | $127,500 | $153,000 |

| 2017 | $3,153 | $275,000 | $125,000 | $150,000 |

| 2016 | $2,142 | $203,665 | $58,554 | $145,111 |

| 2015 | $2,132 | $200,605 | $57,674 | $142,931 |

| 2014 | $2,070 | $196,675 | $56,544 | $140,131 |

Source: Public Records

Map

Nearby Homes

- 9415 21st Ave

- 9200 Highway 41

- 21734 Fremont Ave

- 18896 Grangeville Blvd

- 9368 22nd Ave

- 22311 Grangeville Blvd

- 22750 Fairfax Ave

- 0 W Glendale Ave

- 0 Highway 41

- 18429 W Lacey Blvd

- 1523 Quartz Ave

- 1513 Quartz Ave

- 1505 Quartz Ave

- Libbie Plan at Valorleaf - Libertie Series

- Prosper Plan at Valorleaf - Libertie Series

- Indy Plan at Valorleaf - Libertie Series

- 1522 Quartz Ave

- 1512 Quartz Ave

- 1504 Quartz Ave

- 1358 Peachwood St

- 8477 20 1 2 Ave

- 8505 20 1/2 Ave

- 8435 20 1/2 Ave

- 8521 20 1/2 Ave

- 8521 20 1 2 Ave

- 8417 20 1/2 Ave

- 8557 20 1 2 Ave

- 8557 20 1/2 Ave

- 8335 20 1/2 Ave

- 8317 20 1/2 Ave

- 8290 20 1 2 Ave

- 8290 20 1/2 Ave

- 8585 20 1/2 Ave

- 8480 20 1/2 Ave

- 8299 20 1/2 Ave

- 8360 20 1 2 Ave

- 8360 20 1/2 Ave

- 8265 20 1/2 Ave

- 8272 20 1 2 Ave

- 8272 20 1/2 Ave

Your Personal Tour Guide

Ask me questions while you tour the home.