85 Grampian Ct Unit 85 Marietta, GA 30008

Estimated Value: $338,000 - $352,000

2

Beds

3

Baths

2,006

Sq Ft

$172/Sq Ft

Est. Value

About This Home

This home is located at 85 Grampian Ct Unit 85, Marietta, GA 30008 and is currently estimated at $345,349, approximately $172 per square foot. 85 Grampian Ct Unit 85 is a home located in Cobb County with nearby schools including Fair Oaks Elementary School, Osborne High School, and International Academy of Smyrna.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 29, 2017

Sold by

Russell Brian K

Bought by

Harris Sheryl

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$173,794

Outstanding Balance

$143,919

Interest Rate

4.12%

Mortgage Type

FHA

Estimated Equity

$201,430

Purchase Details

Closed on

Jul 15, 2010

Sold by

Federal Natl Mtg Assn Fnma

Bought by

Russell Brian K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$133,107

Interest Rate

4.87%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 2, 2010

Sold by

Suntrust Mtg Inc

Bought by

Federal Natl Mtg Assn Fnma

Purchase Details

Closed on

Aug 15, 2007

Sold by

Ed Oak Constr Llc

Bought by

Brettle John

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,600

Interest Rate

6.62%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Harris Sheryl | $177,000 | -- | |

| Russell Brian K | -- | -- | |

| Federal Natl Mtg Assn Fnma | -- | -- | |

| Suntrust Mtg Inc | $175,682 | -- | |

| Brettle John | $200,800 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Harris Sheryl | $173,794 | |

| Previous Owner | Russell Brian K | $133,107 | |

| Previous Owner | Brettle John | $160,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $896 | $140,508 | $40,000 | $100,508 |

| 2024 | $857 | $126,556 | $40,000 | $86,556 |

| 2023 | $651 | $126,556 | $40,000 | $86,556 |

| 2022 | $768 | $97,024 | $20,000 | $77,024 |

| 2021 | $2,146 | $84,840 | $20,000 | $64,840 |

| 2020 | $2,146 | $84,840 | $20,000 | $64,840 |

| 2019 | $1,924 | $74,668 | $20,000 | $54,668 |

| 2018 | $1,746 | $66,536 | $16,000 | $50,536 |

| 2017 | $1,913 | $66,536 | $16,000 | $50,536 |

| 2016 | $1,913 | $66,536 | $16,000 | $50,536 |

| 2015 | $1,685 | $57,208 | $12,000 | $45,208 |

| 2014 | $1,700 | $57,208 | $0 | $0 |

Source: Public Records

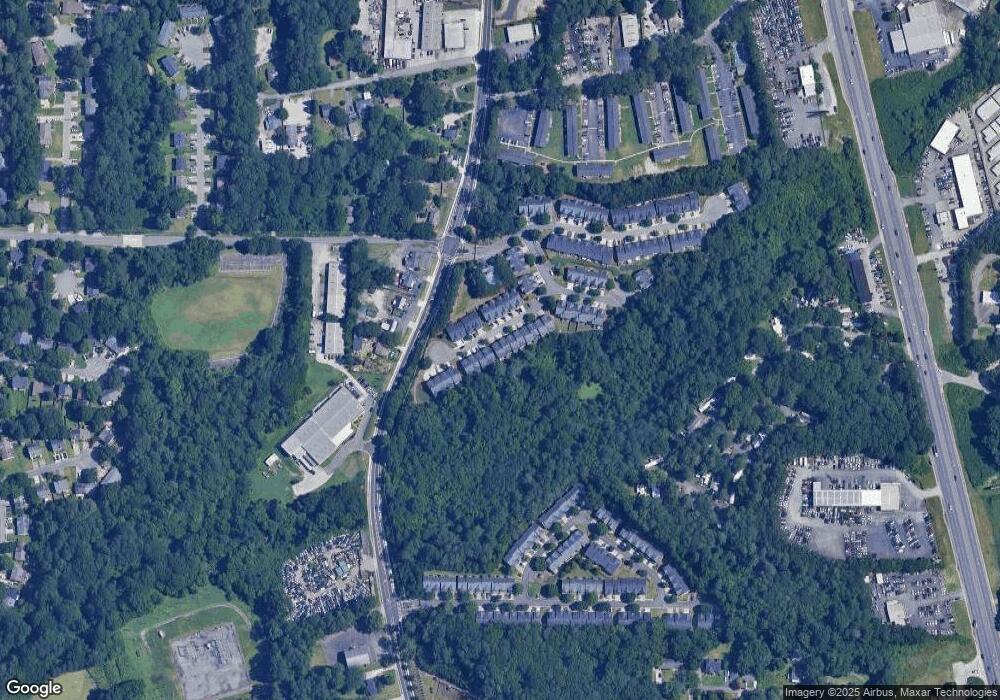

Map

Nearby Homes

- 1239 Grampian Pass Unit 11

- 1252 Grampian Pass Unit 9

- 105 Grampian Ct Unit 13

- 150 Creighton Ln

- 209 Clay Dr SE Unit H3-5

- 220 Clay Dr SE Unit 11

- 264 Juliet Ln SW

- 209 Walthall Ave SE

- 1166 Booth Rd SW Unit 407

- 1166 Booth Rd SW Unit 205

- 1166 Booth Rd SW Unit 906

- 1166 Booth Rd SW Unit 908

- 1166 Booth Rd SW Unit 610

- 141 Dunleith Pkwy SW

- 393 Cedar Trace SW Unit 1

- 1479 Bellemeade Farms Rd SW

- 243 Brownstone Cir Unit 25

- 1048 Brownstone Dr Unit 3

- 95 Cochran Rd SE

- 85 Grampian Ct Unit 12

- 85 Grampian Ct

- 81 Grampian Ct Unit 12

- 81 Grampian Ct

- 77 Grampian Ct Unit 12

- 97 Grampian Ct Unit 13

- 73 Grampian Ct Unit 12

- 0 Grampian Ct Unit 8687495

- 0 Grampian Ct Unit 8426672

- 0 Grampian Ct Unit 8348611

- 0 Grampian Ct Unit 7530726

- 0 Grampian Ct Unit 7522899

- 0 Grampian Ct Unit 8517054

- 0 Grampian Ct Unit 8720343

- 0 Grampian Ct

- 101 Grampian Ct Unit 13

- 101 Grampian Ct Unit 64

- 93 Grampian Ct Unit 13

- 69 Grampian Ct Unit 57

- 69 Grampian Ct Unit 12