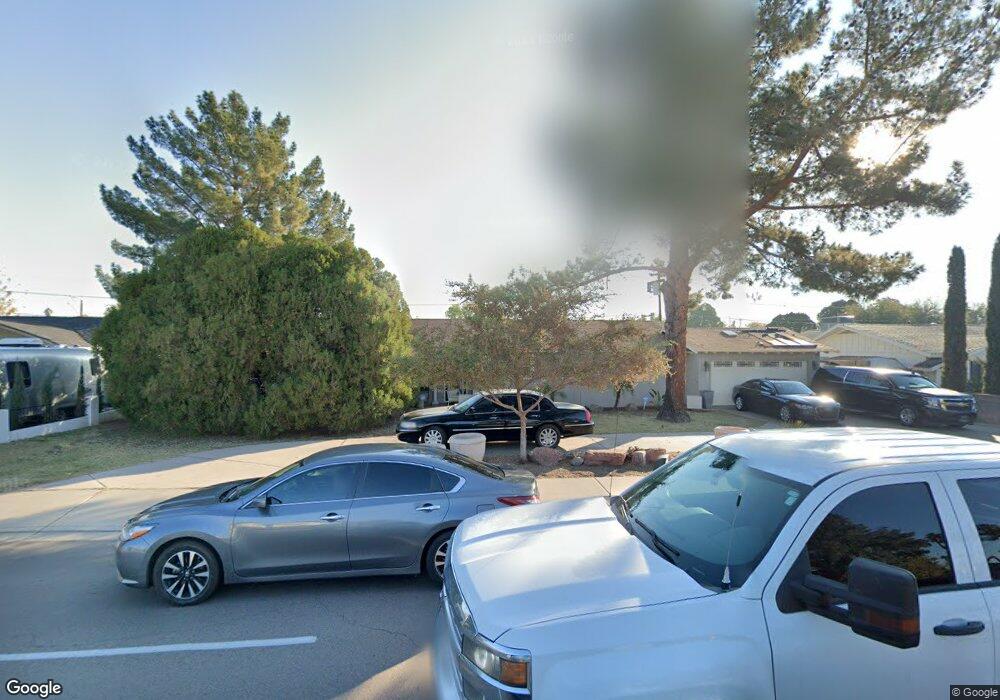

8517 N 7th Ave Phoenix, AZ 85021

North Central NeighborhoodEstimated Value: $569,000 - $645,000

3

Beds

2

Baths

1,800

Sq Ft

$337/Sq Ft

Est. Value

About This Home

This home is located at 8517 N 7th Ave, Phoenix, AZ 85021 and is currently estimated at $606,667, approximately $337 per square foot. 8517 N 7th Ave is a home located in Maricopa County with nearby schools including Richard E Miller School, Royal Palm Middle School, and Sunnyslope High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 7, 2025

Sold by

Vincent Judith E

Bought by

Wagner Norman P and Roman Misael R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$190,000

Outstanding Balance

$188,389

Interest Rate

6.96%

Mortgage Type

Seller Take Back

Estimated Equity

$418,278

Purchase Details

Closed on

Jul 25, 2000

Sold by

Hogstrom Coleton Conrad

Bought by

Vincent Kenneth J and Vincent Judith E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$121,200

Interest Rate

8.12%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wagner Norman P | $325,000 | Empire Title Agency | |

| Vincent Kenneth J | $151,500 | Fidelity National Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wagner Norman P | $190,000 | |

| Previous Owner | Vincent Kenneth J | $121,200 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,849 | $25,587 | -- | -- |

| 2024 | $3,073 | $24,368 | -- | -- |

| 2023 | $3,073 | $47,260 | $9,450 | $37,810 |

| 2022 | $2,972 | $34,100 | $6,820 | $27,280 |

| 2021 | $3,011 | $30,920 | $6,180 | $24,740 |

| 2020 | $2,588 | $29,300 | $5,860 | $23,440 |

| 2019 | $2,540 | $26,750 | $5,350 | $21,400 |

| 2018 | $2,469 | $24,730 | $4,940 | $19,790 |

| 2017 | $2,461 | $23,430 | $4,680 | $18,750 |

| 2016 | $2,418 | $22,080 | $4,410 | $17,670 |

| 2015 | $2,242 | $19,060 | $3,810 | $15,250 |

Source: Public Records

Map

Nearby Homes

- 640 W Echo Ln

- 8464 N 7th Ave

- 625 W Echo Ln

- 333 W Seldon Ln

- 702 W Why Worry Ln

- 225 W Orchid Ln

- 10414 N 11th Ave

- 225 W Alice Ave

- 135 W Alice Ave

- 8915 N Drey Ln

- 524 W Harmont Dr

- 110 W Las Palmaritas Dr

- 8220 N 1st Ave

- 1234 W Orchid Ln

- 8540 N Central Ave Unit 5

- 8502 N Central Ave Unit 5

- 8502 N Central Ave Unit 14

- 8037 N 7th Ave

- 9001 N 7th Ave

- 21 W Casa Hermosa Dr

- 8525 N 7th Ave

- 8509 N 7th Ave

- 8514 N 6th Dr

- 8522 N 6th Dr

- 538 W Butler Dr

- 702 W Seldon Ln

- 8501 N 7th Ave

- 701 W Seldon Ln

- 8530 N 7th Ave

- 525 W Seldon Ln

- 8601 N 7th Ave

- 526 W Butler Dr

- 702 W Butler Dr

- 8602 N 6th Dr

- 710 W Seldon Ln

- 709 W Seldon Ln

- 527 W Butler Dr

- 709 W Orchid Ln

- 517 W Seldon Ln

- 8609 N 7th Ave

Your Personal Tour Guide

Ask me questions while you tour the home.