8524 Elburg St Unit C Paramount, CA 90723

Estimated Value: $480,000 - $545,000

3

Beds

2

Baths

1,002

Sq Ft

$506/Sq Ft

Est. Value

About This Home

This home is located at 8524 Elburg St Unit C, Paramount, CA 90723 and is currently estimated at $506,569, approximately $505 per square foot. 8524 Elburg St Unit C is a home located in Los Angeles County with nearby schools including Harry Wirtz Elementary School, Paramount Park Middle School, and Paramount High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 7, 2004

Sold by

Juarez Dolores

Bought by

Juarez Salvador

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$114,000

Outstanding Balance

$49,170

Interest Rate

3.87%

Mortgage Type

Negative Amortization

Estimated Equity

$457,399

Purchase Details

Closed on

Sep 27, 2004

Sold by

Rosales Juan and Rosales Angelica

Bought by

Rosales Juan and Rosales Angelica

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$114,000

Outstanding Balance

$49,170

Interest Rate

3.87%

Mortgage Type

Negative Amortization

Estimated Equity

$457,399

Purchase Details

Closed on

Oct 12, 1999

Sold by

Bank United

Bought by

Rosales Juan and Rosales Angelica

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$91,083

Interest Rate

7.77%

Mortgage Type

FHA

Purchase Details

Closed on

Apr 9, 1999

Sold by

Diaz Aurora

Bought by

Bank United

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Juarez Salvador | -- | Ticor Title Company | |

| Rosales Juan | -- | Ticor Title Company | |

| Rosales Juan | $94,000 | Fidelity National Title Co | |

| Bank United | $92,491 | Fidelity National Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rosales Juan | $114,000 | |

| Closed | Rosales Juan | $91,083 | |

| Closed | Rosales Juan | $2,817 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,808 | $205,313 | $84,241 | $121,072 |

| 2024 | $2,808 | $201,289 | $82,590 | $118,699 |

| 2023 | $2,756 | $197,343 | $80,971 | $116,372 |

| 2022 | $2,682 | $193,475 | $79,384 | $114,091 |

| 2021 | $2,618 | $189,682 | $77,828 | $111,854 |

| 2019 | $2,673 | $184,058 | $75,520 | $108,538 |

| 2018 | $2,495 | $180,450 | $74,040 | $106,410 |

| 2016 | $2,242 | $173,445 | $71,166 | $102,279 |

| 2015 | $2,120 | $170,841 | $70,098 | $100,743 |

| 2014 | $2,170 | $167,495 | $68,725 | $98,770 |

Source: Public Records

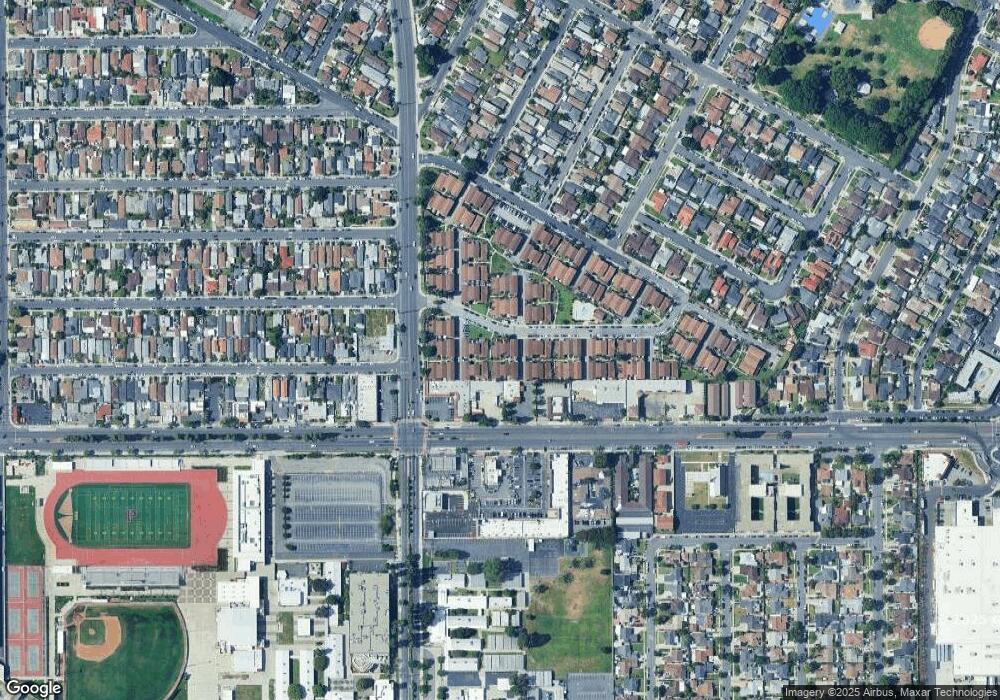

Map

Nearby Homes

- 8754 Parkcliff St

- 8415 Elburg St

- 8600 Contreras St Unit 68

- 8600 Contreras St Unit 37

- 8600 Contreras St Unit 27

- 8237 Rosecrans Ave

- 13331 Blvd

- 14819 Downey Ave Unit 121

- 13440 Lakewood Blvd Unit 97

- 13440 Lakewood Blvd Unit 98

- 13440 Lakewood Blvd Unit 95

- 13440 Lakewood Blvd Unit 99

- 13317 Bixler Ave

- 9130 Hargill St

- 14134 Orizaba Ave

- 15000 Downey Ave Unit 343

- 15000 Downey Ave Unit 249

- 8314 Somerset Ranch Rd Unit D

- 8225 2nd St

- 8356 Gardendale St

- 8558 Elburg St Unit 91

- 8626 Century Blvd

- 8624 Century Blvd

- 8534 Elburg St

- 8630 Elburg St Unit B

- 8558 Elburg St Unit A

- 8558 Elburg St Unit B

- 8558 Elburg St Unit C

- 8624 Century Blvd Unit A

- 8626 Century Blvd Unit A

- 8626 Century Blvd Unit B

- 8626 Century Blvd Unit C

- 8626 Century Blvd Unit D

- 8630 Century Blvd Unit D

- 8630 Century Blvd Unit C

- 8558 Elburg St Unit D

- 8612 Elburg St Unit D

- 8612 Elburg St Unit C

- 8612 Elburg St Unit B

- 8612 Elburg St Unit A