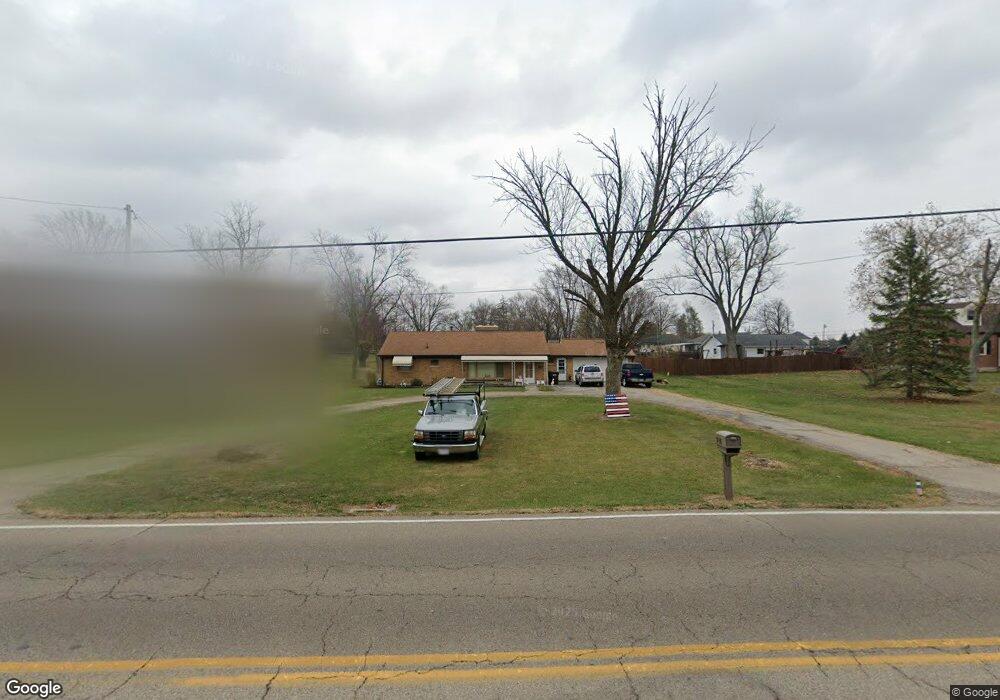

8538 Peters Pike Vandalia, OH 45377

Estimated Value: $152,000 - $227,000

2

Beds

1

Bath

1,288

Sq Ft

$153/Sq Ft

Est. Value

About This Home

This home is located at 8538 Peters Pike, Vandalia, OH 45377 and is currently estimated at $196,769, approximately $152 per square foot. 8538 Peters Pike is a home located in Montgomery County with nearby schools including Helke Elementary School, Morton Middle School, and Butler High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 29, 2021

Sold by

Watson Gary and Watson Deborah

Bought by

Barney Ernest E and Barney Kathleen

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$212,505

Outstanding Balance

$194,425

Interest Rate

2.88%

Mortgage Type

VA

Estimated Equity

$2,344

Purchase Details

Closed on

May 21, 2009

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Watson Gary and Watson Deborah

Purchase Details

Closed on

Oct 21, 2008

Sold by

Medlar Joyce A

Bought by

Federal Home Loan Mortgage Corp

Purchase Details

Closed on

Jan 17, 2001

Sold by

Klotzbach Howard E and Klotzbach Ida M

Bought by

Medlar Joyce A

Purchase Details

Closed on

Nov 15, 2000

Sold by

Klotzbach Inez M

Bought by

Klotzbach Howard E

Purchase Details

Closed on

Sep 12, 2000

Sold by

Estate Of Charles E Klotzbach

Bought by

Kletzbach Inez M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Barney Ernest E | $121,600 | Home Services Title Llc | |

| Watson Gary | $50,100 | Attorney | |

| Federal Home Loan Mortgage Corp | $65,336 | None Available | |

| Medlar Joyce A | -- | -- | |

| Klotzbach Howard E | -- | -- | |

| Kletzbach Inez M | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Barney Ernest E | $212,505 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,663 | $52,250 | $15,070 | $37,180 |

| 2023 | $2,663 | $52,250 | $15,070 | $37,180 |

| 2022 | $2,449 | $40,310 | $11,600 | $28,710 |

| 2021 | $3,123 | $40,310 | $11,600 | $28,710 |

| 2020 | $3,115 | $40,310 | $11,600 | $28,710 |

| 2019 | $3,267 | $38,570 | $9,180 | $29,390 |

| 2018 | $3,272 | $38,570 | $9,180 | $29,390 |

| 2017 | $3,251 | $38,570 | $9,180 | $29,390 |

| 2016 | $3,225 | $37,540 | $9,660 | $27,880 |

| 2015 | $3,058 | $37,540 | $9,660 | $27,880 |

| 2014 | $3,058 | $37,540 | $9,660 | $27,880 |

| 2012 | -- | $37,020 | $9,660 | $27,360 |

Source: Public Records

Map

Nearby Homes

- 8375 Peters Pike

- 3431 Mulberry Rd

- 1588 Middle Park Dr

- 3465 Turtle Shell Dr

- 727 Paula St

- 3361 Sea Turtle Dr

- 1051 Bailey Ave

- 1072 Pool Ave

- Bellamy Plan at Yorkshire Reserve - The Oaks at Yorkshire Reserve

- Newcastle Plan at Yorkshire Reserve - The Oaks at Yorkshire Reserve

- Chatham Plan at Yorkshire Reserve - The Oaks at Yorkshire Reserve

- Holcombe Plan at Yorkshire Reserve - The Oaks at Yorkshire Reserve

- Milford Plan at Yorkshire Reserve - The Oaks at Yorkshire Reserve

- Johnstown Plan at Yorkshire Reserve - The Oaks at Yorkshire Reserve

- 910 Bright Ave

- 7612 Turtleback Dr

- 7568 Yorkshire Dr

- 7562 Yorkshire Dr

- 3114 Northerton Ct

- 1631 Ashley Place

- 8566 Peters Pike

- 8500 Peters Pike

- 8586 Peters Pike

- 3305 Stonequarry Rd

- 3309 Stonequarry Rd

- 8606 Peters Pike

- 3300 Stonequarry Rd

- 8640 Peters Pike

- 3313 Stonequarry Rd

- 3290 Stonequarry Rd

- 1272 Bramley Ct

- 3321 Stonequarry Rd

- 3284 Stonequarry Rd

- 8445 Peters Pike

- 1268 Bramley Ct

- 8678 Peters Pike

- 1301 Stonequarry Rd

- 1256 Bramley Ct

- 1235 Greystone Cir

- 3280 Stonequarry Rd