8555 Moss Ct Granite Bay, CA 95746

Estimated Value: $1,987,241 - $2,297,000

4

Beds

3

Baths

4,788

Sq Ft

$447/Sq Ft

Est. Value

About This Home

This home is located at 8555 Moss Ct, Granite Bay, CA 95746 and is currently estimated at $2,138,080, approximately $446 per square foot. 8555 Moss Ct is a home located in Placer County with nearby schools including Del Oro High School and Loomis Basin Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 8, 2019

Sold by

Hagel Don and Hagel Heather

Bought by

Hagel Donald L and Hagel Heather A

Current Estimated Value

Purchase Details

Closed on

Apr 5, 2011

Sold by

Mckernan Jennifer M and Mckernan Trent D

Bought by

Hagel Don and Hagel Heather

Purchase Details

Closed on

Feb 8, 2005

Sold by

Cino Gary L and Cino Janet S

Bought by

Mckernan Trent D and Mckernan Jennifer M

Purchase Details

Closed on

May 14, 2004

Sold by

Hamamoto Goichi J and Hamamoto Max M

Bought by

Cino Gary L and Cino Janet S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$581,250

Interest Rate

5.75%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hagel Donald L | -- | None Available | |

| Hagel Don | $1,090,000 | Placer Title Company | |

| Mckernan Trent D | -- | -- | |

| Cino Gary L | $775,000 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Cino Gary L | $581,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $14,655 | $1,396,473 | $256,230 | $1,140,243 |

| 2023 | $14,655 | $1,342,248 | $246,281 | $1,095,967 |

| 2022 | $14,444 | $1,315,930 | $241,452 | $1,074,478 |

| 2021 | $14,088 | $1,290,128 | $236,718 | $1,053,410 |

| 2020 | $13,924 | $1,276,900 | $234,291 | $1,042,609 |

| 2019 | $13,690 | $1,251,864 | $229,698 | $1,022,166 |

| 2018 | $12,974 | $1,227,319 | $225,195 | $1,002,124 |

| 2017 | $12,760 | $1,203,255 | $220,780 | $982,475 |

| 2016 | $12,498 | $1,179,662 | $216,451 | $963,211 |

| 2015 | $12,247 | $1,161,943 | $213,200 | $948,743 |

| 2014 | $12,063 | $1,139,183 | $209,024 | $930,159 |

Source: Public Records

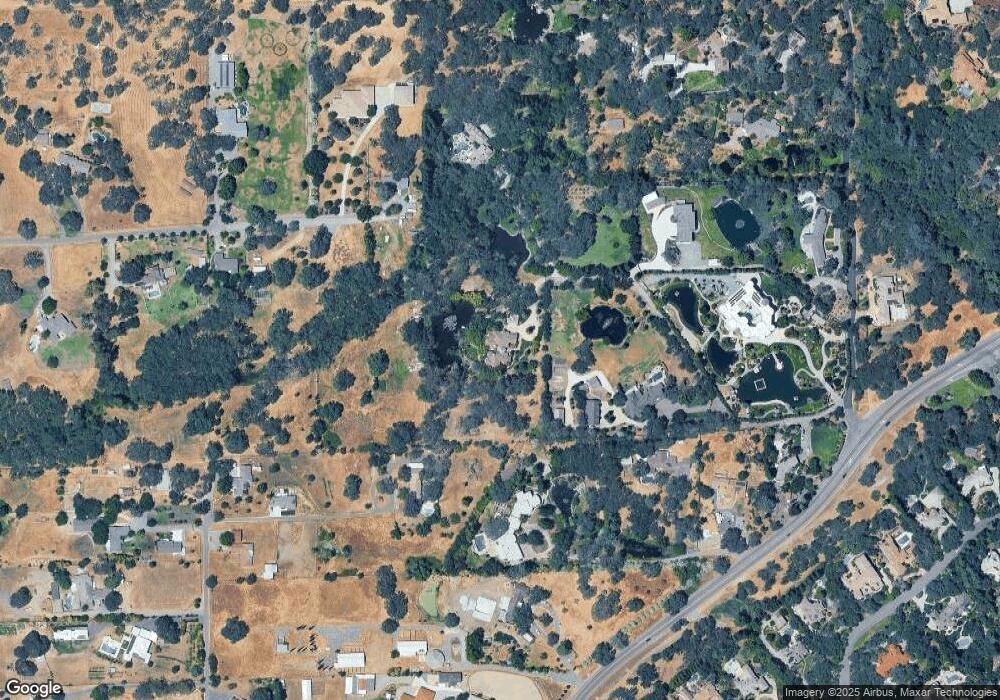

Map

Nearby Homes

- 6275 Barcelona Ct

- 6120 Terracina Ct

- 8985 Vista de Lago Ct

- 8167 N Lake Cir

- 9195 Los Lagos Cir S Unit S

- 8920 Vista de Lago Ct

- 6006 Via Alicante

- 5713 Via Montecito

- 8232 N Lake Cir Unit N

- 5001 Auburn Folsom Rd

- 5535 Eden Roc Dr

- 4800 Auburn Folsom Rd Unit 59

- 4800 Auburn Folsom Rd Unit 77

- 4800 Auburn Folsom Rd Unit 38

- 4800 Auburn Folsom Rd Unit 70

- 7730 Suzuki Ln

- 9212 Vista Ravine Ct

- 7332 West Ln

- 6333 Indian Springs Rd

- 4800 Miners Cove Cir

- 6005 Oak View Dr

- 8455 Moss Ct

- 8185 Quinn Place

- 8120 Lone Pine Place

- 8500 Moss Ct

- 8247 Lone Pine Place

- 8155 Quinn Place

- 8145 Quinn Place

- 6070 Auburn Folsom Rd

- 6015 Oak View Dr

- 8300 Moss Ct

- 8297 Lone Pine Place

- 5750 Moss Ln

- 6031 Oak View Dr

- 8303 Moss Ct

- 8135 Quinn Place

- 8060 Quinn Place

- 5982 Oak View Dr

- 5780 Moss Ln

- 5860 Moss Ln