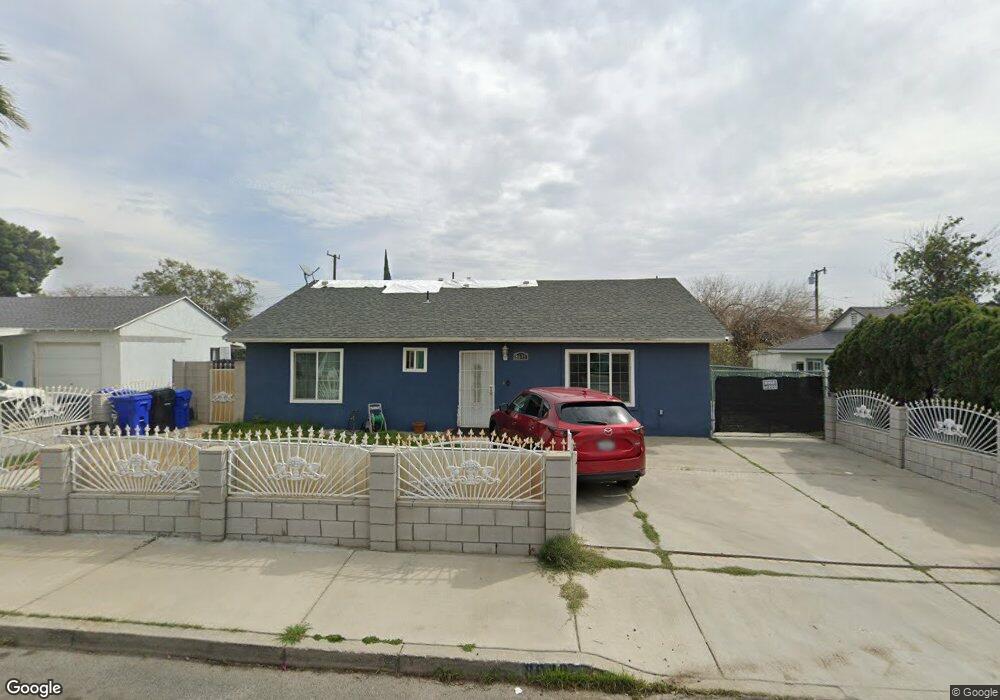

8639 Williams Rd Fontana, CA 92335

Estimated Value: $519,000 - $565,000

3

Beds

2

Baths

1,550

Sq Ft

$349/Sq Ft

Est. Value

About This Home

This home is located at 8639 Williams Rd, Fontana, CA 92335 and is currently estimated at $541,681, approximately $349 per square foot. 8639 Williams Rd is a home located in San Bernardino County with nearby schools including Ted Porter Elementary School, Alder Middle School, and Fontana A. B. Miller High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 22, 2021

Sold by

Alanis Samuel Frutis

Bought by

Alanis Samuel Frutis and Frutis Elsa

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$134,000

Outstanding Balance

$119,511

Interest Rate

2.67%

Mortgage Type

New Conventional

Estimated Equity

$422,170

Purchase Details

Closed on

Dec 9, 2010

Sold by

Frutis Elsa

Bought by

Alanis Samuel Frutis

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,940

Interest Rate

4.75%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 22, 2010

Sold by

Tronconi Inc

Bought by

Alanis Samuel Frutis

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,940

Interest Rate

4.75%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 26, 2010

Sold by

Rcm Homes Llc

Bought by

Tronconi Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

4.71%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 16, 2010

Sold by

Castro Rolando

Bought by

Rcm Homes Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

4.71%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 16, 2006

Sold by

Castro Sylvia Ann

Bought by

Castro Rolando

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$266,250

Interest Rate

6.9%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 7, 2005

Sold by

Castro Sylvia Ann

Bought by

Castro Rolando

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,500

Interest Rate

5.9%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 30, 2000

Sold by

Castro Sylvia Ann

Bought by

Castro Rolando

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$45,000

Interest Rate

7.88%

Purchase Details

Closed on

Apr 24, 1995

Sold by

Fehn Cecelia M

Bought by

Fehn Cecelia M and Fehn Neil

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Alanis Samuel Frutis | -- | Lawyers Title | |

| Alanis Samuel Frutis | -- | Advantage Title Inc | |

| Alanis Samuel Frutis | $180,000 | Advantage Title Inc | |

| Tronconi Inc | -- | Accommodation | |

| Rcm Homes Llc | $100,000 | Advantage Title Inc | |

| Castro Rolando | -- | Ticor Title Co | |

| Castro Rolando | -- | Diversified Title & Escrow | |

| Castro Rolando | -- | Northern Counties Title | |

| Castro Rolando | $15,000 | Northern Counties Title | |

| Fehn Cecelia M | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Alanis Samuel Frutis | $134,000 | |

| Previous Owner | Alanis Samuel Frutis | $152,940 | |

| Previous Owner | Rcm Homes Llc | $100,000 | |

| Previous Owner | Castro Rolando | $266,250 | |

| Previous Owner | Castro Rolando | $157,500 | |

| Previous Owner | Castro Rolando | $45,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,046 | $230,614 | $57,654 | $172,960 |

| 2024 | $2,849 | $226,093 | $56,524 | $169,569 |

| 2023 | $2,338 | $221,660 | $55,416 | $166,244 |

| 2022 | $2,329 | $217,313 | $54,329 | $162,984 |

| 2021 | $2,300 | $213,052 | $53,264 | $159,788 |

| 2020 | $2,294 | $210,868 | $52,718 | $158,150 |

| 2019 | $3,470 | $206,733 | $51,684 | $155,049 |

| 2018 | $3,504 | $202,680 | $50,671 | $152,009 |

| 2017 | $2,246 | $198,705 | $49,677 | $149,028 |

| 2016 | $2,208 | $194,809 | $48,703 | $146,106 |

| 2015 | $2,180 | $191,882 | $47,971 | $143,911 |

| 2014 | $2,182 | $188,123 | $47,031 | $141,092 |

Source: Public Records

Map

Nearby Homes

- 8573 Williams Rd

- 18239 Orange Way

- 8787 Locust Ave Unit 24

- 8787 Locust Ave Unit 69

- 8787 Locust Ave Unit 1

- 18013 Arrow Blvd

- 1531 W Rialto Ave

- 193 N Maple Ave

- 18206 Seville Ave

- 17923 Dorsey Way

- 8820 Buckeye Dr

- 18236 Owen St

- 250 N Linden Ave Unit 124

- 250 N Linden Ave Unit 248

- 250 N Linden Ave Unit Spc 148

- 250 N Linden Ave Unit 327

- 250 N Linden Ave Unit 250

- 250 N Linden Ave

- 1510 W Merrill Ave

- 9050 Dumond Dr

- 8631 Williams Rd

- 8649 Williams Rd

- 8621 Williams Rd

- 8659 Williams Rd

- 8642 Dumond Dr

- 8632 Dumond Dr

- 8652 Dumond Dr

- 8613 Williams Rd

- 8622 Dumond Dr

- 8660 Dumond Dr

- 8640 Williams Rd

- 8632 Williams Rd

- 8650 Williams Rd

- 8622 Williams Rd

- 8660 Williams Rd

- 8614 Dumond Dr

- 8605 Williams Rd

- 18213 Orange Way

- 8614 Williams Rd

- 18221 Orange Way

Your Personal Tour Guide

Ask me questions while you tour the home.