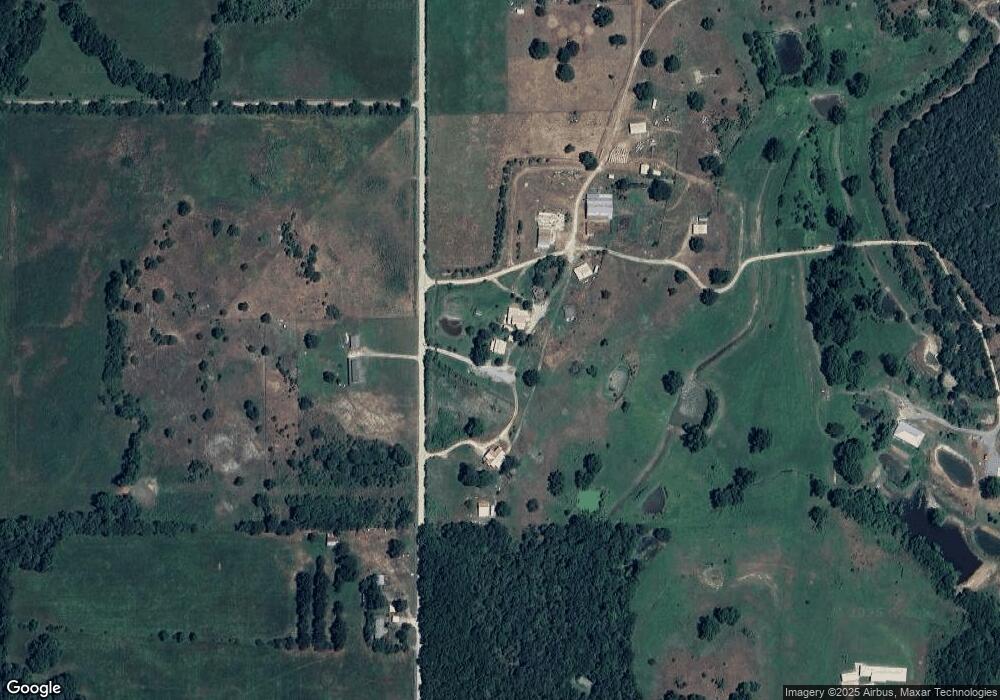

8668 N 380 Rd Locust Grove, OK 74352

Estimated Value: $340,223 - $507,000

3

Beds

2

Baths

1,120

Sq Ft

$356/Sq Ft

Est. Value

About This Home

This home is located at 8668 N 380 Rd, Locust Grove, OK 74352 and is currently estimated at $399,074, approximately $356 per square foot. 8668 N 380 Rd is a home located in Cherokee County with nearby schools including Locust Grove Early Lrning Center, Locust Grove Upper Elementary School, and Locust Grove Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 25, 2022

Sold by

Lawless Mike M and Lawless Kathryn M

Bought by

Pudewa Andrew and Pudewa Robin

Current Estimated Value

Purchase Details

Closed on

Nov 18, 2005

Sold by

Hogan Mark Wade

Bought by

Lawless Michael W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$314,500

Interest Rate

6.25%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Feb 2, 2001

Sold by

Troy and Lorene Spencer

Bought by

Mark Wade Hogan

Purchase Details

Closed on

Dec 19, 1994

Sold by

Reeder J B

Bought by

Troy W Spencer

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pudewa Andrew | -- | None Listed On Document | |

| Lawless Michael W | $370,000 | Cherokee Capitol Closign Ser | |

| Mark Wade Hogan | $240,000 | -- | |

| Troy W Spencer | $175,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lawless Michael W | $314,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,583 | $16,712 | $3,879 | $12,833 |

| 2023 | $1,537 | $16,225 | $3,879 | $12,346 |

| 2022 | $1,723 | $18,353 | $1,453 | $16,900 |

| 2021 | $1,707 | $17,818 | $1,410 | $16,408 |

| 2020 | $1,681 | $17,299 | $1,369 | $15,930 |

| 2019 | $1,634 | $16,795 | $1,361 | $15,434 |

| 2018 | $1,617 | $16,306 | $1,253 | $15,053 |

| 2017 | $1,016 | $10,238 | $944 | $9,294 |

| 2016 | $973 | $10,037 | $950 | $9,087 |

| 2015 | $918 | $9,744 | $1,067 | $8,677 |

| 2014 | $918 | $9,461 | $1,014 | $8,447 |

Source: Public Records

Map

Nearby Homes

- 14209 S 439

- 8465 W 660 Rd

- 8465 W 660 Rd Hulbert Unit OK 74441

- 0 Rural Route Unit 25-1842

- 0 Rural Route Unit 2536190

- 34190 E 651 Way

- 0 650 Rd E Unit 25-1213

- 0 W 710 Rd Unit 2438380

- 0 W 710 Rd Unit 2438372

- 0 W 710 Rd Unit 2438367

- Lake Crest

- Lake Crest

- E E 651 Rd

- S S 337 Rd

- 33684 E 650 Dr

- 13017 N Quail Ave

- 13235 Red Bud Dr

- 0 Crest Dr

- 0 W 650 Rd Unit 2529559

- 34159 E 698 Rd