8670 Meadow Brook Ave Unit 210 Garden Grove, CA 92844

Estimated Value: $639,000 - $692,000

2

Beds

2

Baths

1,163

Sq Ft

$571/Sq Ft

Est. Value

About This Home

This home is located at 8670 Meadow Brook Ave Unit 210, Garden Grove, CA 92844 and is currently estimated at $664,087, approximately $571 per square foot. 8670 Meadow Brook Ave Unit 210 is a home located in Orange County with nearby schools including Meairs Elementary School, Warner Middle, and Westminster High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 26, 2021

Sold by

Matthews Jason T and Matthews Rebecca

Bought by

Tran Ai and Tran An Hoa

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$358,500

Outstanding Balance

$323,682

Interest Rate

3%

Mortgage Type

New Conventional

Estimated Equity

$340,405

Purchase Details

Closed on

Aug 24, 2015

Sold by

Howard Suezanne and Lee Suezanne

Bought by

Matthews Jason T and Matthews Rebecca

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$326,880

Interest Rate

3.78%

Mortgage Type

VA

Purchase Details

Closed on

Aug 17, 2004

Sold by

Bucher Nancy Carol

Bought by

Lee Suezanne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$271,200

Interest Rate

5.75%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tran Ai | $478,000 | Wfg National Title | |

| Matthews Jason T | $320,000 | Chicago Title Company | |

| Lee Suezanne | $339,000 | Ticor Title Fullerton |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Tran Ai | $358,500 | |

| Previous Owner | Matthews Jason T | $326,880 | |

| Previous Owner | Lee Suezanne | $271,200 | |

| Closed | Lee Suezanne | $67,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,462 | $517,402 | $399,200 | $118,202 |

| 2024 | $6,462 | $507,257 | $391,372 | $115,885 |

| 2023 | $6,249 | $497,311 | $383,698 | $113,613 |

| 2022 | $6,156 | $487,560 | $376,174 | $111,386 |

| 2021 | $4,515 | $349,965 | $239,436 | $110,529 |

| 2020 | $4,462 | $346,377 | $236,981 | $109,396 |

| 2019 | $4,410 | $339,586 | $232,335 | $107,251 |

| 2018 | $4,403 | $332,928 | $227,779 | $105,149 |

| 2017 | $4,241 | $326,400 | $223,312 | $103,088 |

| 2016 | $4,078 | $320,000 | $218,933 | $101,067 |

| 2015 | $3,855 | $309,000 | $201,770 | $107,230 |

| 2014 | -- | $271,425 | $164,195 | $107,230 |

Source: Public Records

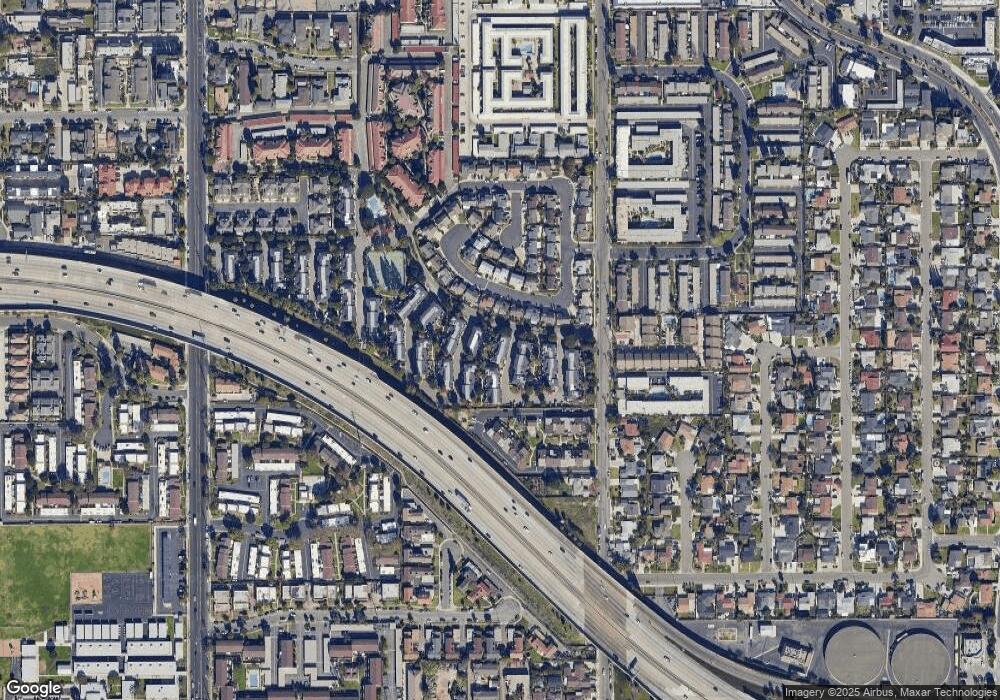

Map

Nearby Homes

- 8565 Edgebrook Dr

- 13175 Creek View Dr Unit F

- 13252 Newland St Unit A-D

- 8520 Lake Knoll Ave Unit B

- 13146 Ferndale Dr

- 8827 Brookdale Dr

- 8800 Garden Grove Blvd Unit 2

- 13068 Ansell Ct

- 13392 Lucille St

- 9002 Imperial Ave

- 9031 Bestel Ave

- 12931 Josephine St

- 13392 Magnolia St

- 8442 Trask Ave

- 13141 Monroe St

- 13782 Newland St

- 12861 Alamitos Way

- 9370 W Garden Grove Blvd

- 8784 Hewitt Place Unit 12

- 8197 Jasmine Ave

- 8670 Meadow Brook Ave Unit 207 (A)

- 8670 Meadow Brook Ave Unit C

- 8670 Meadow Brook Ave

- 8670 Meadow Brook Ave Unit C

- 8670 Meadow Brook Ave Unit A

- 8670 Meadow Brook Ave Unit D

- 8670 Meadow Brook Ave Unit 208

- 8670 Meadow Brook Ave Unit 209

- 8656 Meadow Brook Ave Unit 201 / D

- 8656 Meadow Brook Ave Unit D

- 8656 Meadow Brook Ave Unit B

- 8656 Meadow Brook Ave Unit 198

- 8680 Meadow Brook Ave Unit 220

- 8680 Meadow Brook Ave

- 8680 Meadow Brook Ave Unit A

- 8680 Meadow Brook Ave Unit E

- 8680 Meadow Brook Ave Unit 217

- 8680 Meadow Brook Ave Unit C

- 8680 Meadow Brook Ave Unit D

- 8680 Meadow Brook Ave Unit 221