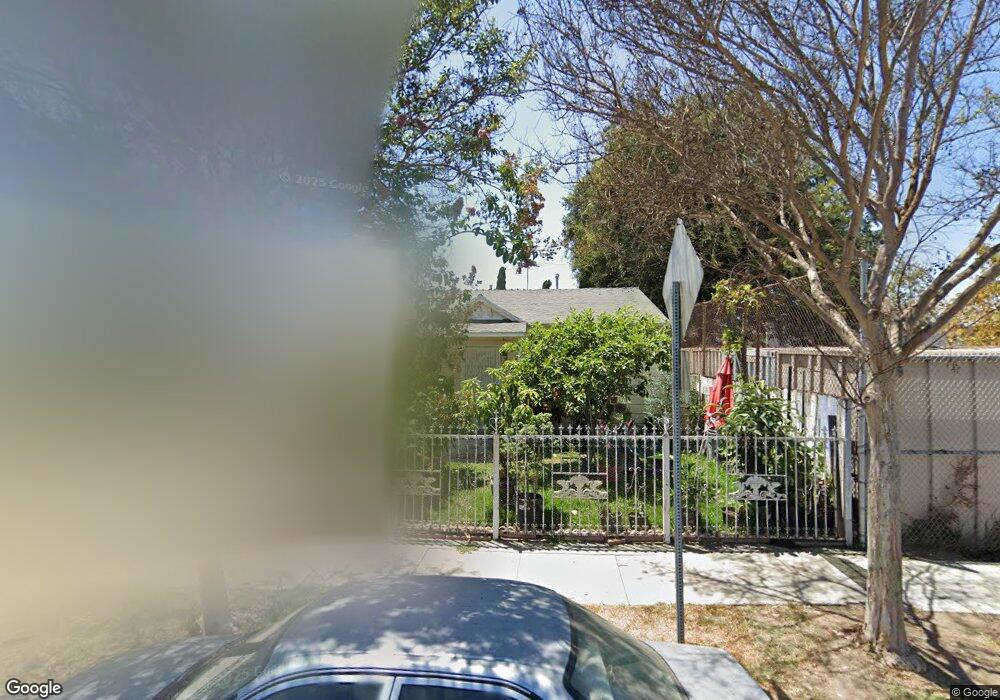

8673 San Juan Ave South Gate, CA 90280

Estimated Value: $644,000 - $684,000

3

Beds

2

Baths

1,001

Sq Ft

$659/Sq Ft

Est. Value

About This Home

This home is located at 8673 San Juan Ave, South Gate, CA 90280 and is currently estimated at $659,851, approximately $659 per square foot. 8673 San Juan Ave is a home located in Los Angeles County with nearby schools including San Gabriel Avenue Elementary School, South Gate Middle School, and Southeast Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 22, 2000

Sold by

Hud

Bought by

Lopez Efrain and Garibaldo Martha Lopez

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$137,837

Interest Rate

7.54%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 25, 2000

Sold by

Wells Fargo Home Mtg Inc

Bought by

Hud

Purchase Details

Closed on

Jun 22, 2000

Sold by

Guzman Martha L

Bought by

Wells Fargo Home Mtg Inc and Norwest Mtg Inc

Purchase Details

Closed on

Dec 7, 1999

Sold by

Guzman Martha L

Bought by

Hoover Associates

Purchase Details

Closed on

Apr 11, 1996

Sold by

Esparza Mike

Bought by

Guzman Martha L and Rangel Norma

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$145,348

Interest Rate

7.41%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lopez Efrain | $140,000 | Provident Title | |

| Hud | -- | First American Title Ins Co | |

| Wells Fargo Home Mtg Inc | $162,887 | First American Title Ins Co | |

| Hoover Associates | $1,000 | -- | |

| Guzman Martha L | $148,000 | Chicago Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lopez Efrain | $137,837 | |

| Previous Owner | Guzman Martha L | $145,348 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,050 | $210,935 | $160,167 | $50,768 |

| 2024 | $3,050 | $206,800 | $157,027 | $49,773 |

| 2023 | $3,001 | $202,747 | $153,949 | $48,798 |

| 2022 | $2,867 | $198,773 | $150,931 | $47,842 |

| 2021 | $2,832 | $194,876 | $147,972 | $46,904 |

| 2019 | $2,747 | $189,098 | $143,584 | $45,514 |

| 2018 | $2,645 | $185,391 | $140,769 | $44,622 |

| 2016 | $2,524 | $178,194 | $135,303 | $42,891 |

| 2015 | $2,484 | $175,518 | $133,271 | $42,247 |

| 2014 | $2,487 | $172,081 | $130,661 | $41,420 |

Source: Public Records

Map

Nearby Homes

- 8686 San Juan Ave

- 8669 San Gabriel Ave

- 8945 San Antonio Ave

- 3816 Liberty Blvd

- 9307 San Miguel Ave

- 9222 California Ave

- 8963 Bowman Ave

- 9529 San Juan Ave

- 9601 San Juan Ave

- 9308 Mcnerney Ave

- 8991 Victoria Ave

- 9219 Alexander Ave

- 9611 Mallison Ave

- 9528 Mcnerney Ave

- 9643 Mallison Ave

- 9525 Bowman Ave

- 4006 Broadway

- 9714 Otis St

- 9718 Otis St

- 9616 Bowman Ave

- 8677 San Juan Ave

- 8681 San Juan Ave

- 8685 San Juan Ave

- 8689 San Juan Ave

- 8680 San Gabriel Ave

- 8686 San Gabriel Ave

- 8672 San Juan Ave

- 8676 San Juan Ave

- 8668 San Juan Ave

- 8680 San Juan Ave

- 8664 San Juan Ave

- 8660 San Juan Ave

- 8690 San Juan Ave

- 8656 San Juan Ave

- 8694 San Juan Ave

- 8652 San Juan Ave

- 8648 San Juan Ave

- 8644 San Juan Ave

- 8675 San Gabriel Ave

- 8673 San Luis Ave