87 Highview Blvd Columbus, OH 43207

Obetz-Lockbourne NeighborhoodEstimated Value: $913,285

--

Bed

--

Bath

4,949

Sq Ft

$185/Sq Ft

Est. Value

About This Home

This home is located at 87 Highview Blvd, Columbus, OH 43207 and is currently estimated at $913,285, approximately $184 per square foot. 87 Highview Blvd is a home located in Franklin County with nearby schools including Cedarwood Alternative Elementary School @ Stockbri, Buckeye Middle School, and Marion-Franklin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 1, 2022

Sold by

Cif Holdings Llc

Bought by

Strick Enterprises Inc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$596,000

Outstanding Balance

$523,985

Interest Rate

3.89%

Mortgage Type

Credit Line Revolving

Estimated Equity

$389,300

Purchase Details

Closed on

Jun 24, 2020

Sold by

Awood Investments Llc

Bought by

Cjf Holdings Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$600,000

Interest Rate

3.2%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Jul 28, 2010

Sold by

Mchugh Joanne

Bought by

Awood Investments Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Strick Enterprises Inc | $745,000 | Northwest Title | |

| Cjf Holdings Llc | $650,000 | Northwest Title | |

| Awood Investments Llc | -- | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Strick Enterprises Inc | $596,000 | |

| Previous Owner | Cjf Holdings Llc | $600,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $13,509 | $182,010 | $79,980 | $102,030 |

| 2023 | $13,295 | $182,000 | $79,975 | $102,025 |

| 2022 | $17,061 | $227,500 | $95,970 | $131,530 |

| 2021 | $10,456 | $134,470 | $95,970 | $38,500 |

| 2020 | $10,737 | $134,470 | $95,970 | $38,500 |

| 2019 | $11,594 | $128,100 | $91,420 | $36,680 |

| 2018 | $10,387 | $128,100 | $91,420 | $36,680 |

| 2017 | $10,538 | $128,100 | $91,420 | $36,680 |

| 2016 | $10,661 | $122,500 | $91,420 | $31,080 |

| 2015 | $9,898 | $122,500 | $91,420 | $31,080 |

| 2014 | $9,893 | $122,500 | $91,420 | $31,080 |

| 2013 | $4,902 | $122,500 | $91,420 | $31,080 |

Source: Public Records

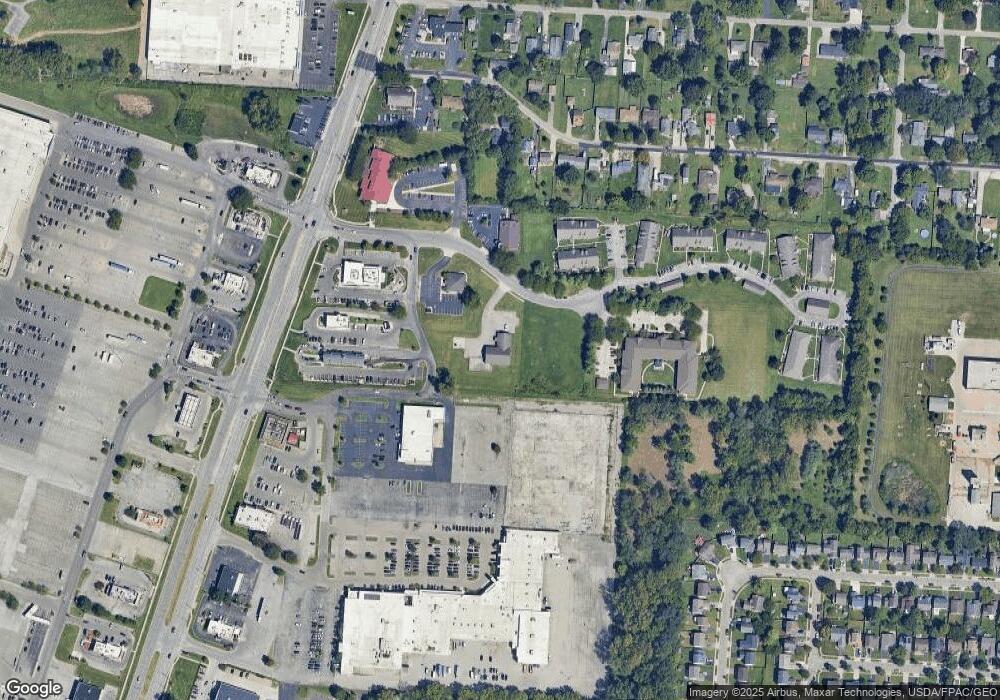

Map

Nearby Homes

- 245 Marilla Rd

- 0 Jana Kay Ct

- 312 Harland Dr

- 202 Williams Rd

- 3714 Parsons Ave

- 0 Parsons Ave Unit 225012522

- 525 Ashwood Rd

- 256 Rumsey Rd Unit 258

- 552 Harland Dr

- 3380 Parsons Ave

- 3691 Ferman Rd

- 3861 Frazier Rd W

- 3691 Abney Rd

- 568 Glendora Rd

- 400 Colton Rd

- 236 Roundtop Rd

- 3863 Edendale Rd

- 3927 Frazier Rd E

- 4125 Martinsburg Dr

- 3735 Christie Rd W