8713 NW 10th St Unit C101 Plantation, FL 33322

Estimated Value: $165,000 - $182,000

2

Beds

2

Baths

1,046

Sq Ft

$166/Sq Ft

Est. Value

About This Home

This home is located at 8713 NW 10th St Unit C101, Plantation, FL 33322 and is currently estimated at $174,133, approximately $166 per square foot. 8713 NW 10th St Unit C101 is a home located in Broward County with nearby schools including Mirror Lake Elementary School, Plantation Middle School, and Plantation High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 13, 2012

Sold by

Prisco Michael and Prisco Michelina

Bought by

Selberg James and Selberg Pamela

Current Estimated Value

Purchase Details

Closed on

Feb 14, 2006

Sold by

Prisco Michael and Prisco Michelina

Bought by

Prisco Michael and Prisco Michelina

Purchase Details

Closed on

Apr 20, 1998

Sold by

Giorello Anthony and Arango Kathleen

Bought by

Prisco Michael and Prisco Michelina

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$30,400

Interest Rate

7.14%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 1, 1986

Sold by

Available Not

Bought by

Available Not

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Selberg James | $64,900 | Attorney | |

| Prisco Michael | -- | Attorney | |

| Prisco Michael | $123,714 | -- | |

| Available Not | $25,714 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Prisco Michael | $30,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,120 | $157,460 | -- | -- |

| 2024 | $2,860 | $157,460 | -- | -- |

| 2023 | $2,860 | $130,140 | $0 | $0 |

| 2022 | $2,536 | $118,310 | $0 | $0 |

| 2021 | $2,285 | $107,560 | $0 | $0 |

| 2020 | $2,157 | $116,740 | $11,670 | $105,070 |

| 2019 | $2,015 | $110,990 | $11,100 | $99,890 |

| 2018 | $1,710 | $85,520 | $8,550 | $76,970 |

| 2017 | $1,726 | $73,480 | $0 | $0 |

| 2016 | $1,546 | $66,800 | $0 | $0 |

| 2015 | $1,489 | $60,730 | $0 | $0 |

| 2014 | $1,225 | $55,210 | $0 | $0 |

| 2013 | -- | $58,410 | $5,840 | $52,570 |

Source: Public Records

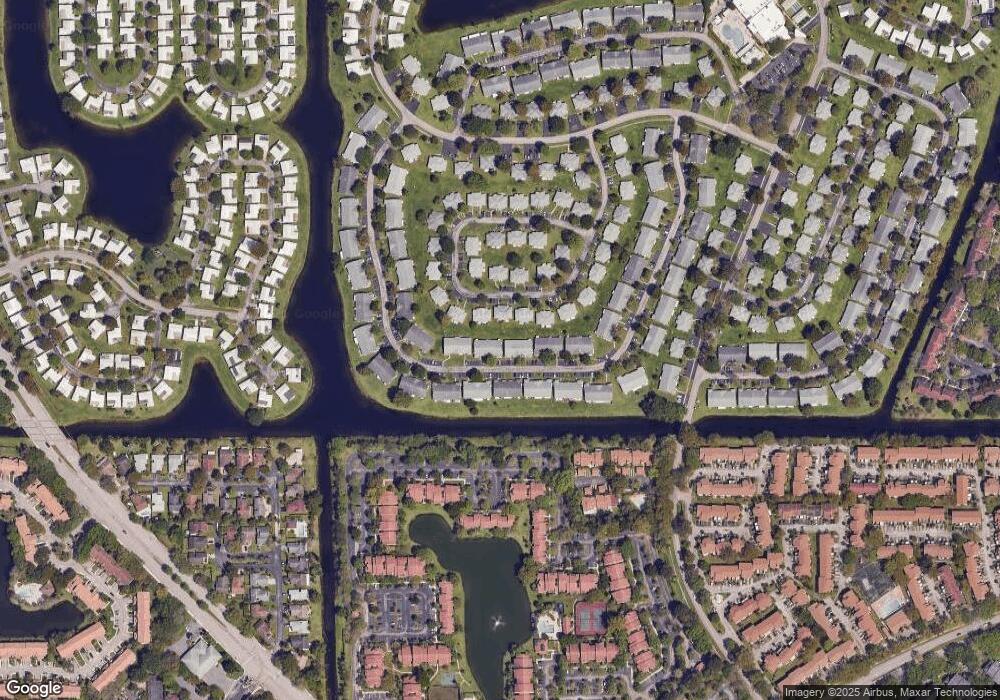

Map

Nearby Homes

- 1035 NW 88th Ave Unit C89

- 8932 NW 9th Place

- 1081 NW 89th Ave

- 990 NW 89th Ave

- 971 NW 89th Ave

- 967 NW 89th Ave

- 8551 NW 11th St Unit B163

- 8566 NW 12th St Unit D172

- 8256 NW 9th Ct Unit 2

- 1024 NW 90th Way

- 8248 NW 9th St Unit 6

- 1025 NW 90th Way

- 8226 NW 8th Place Unit 6

- 1057 NW 83rd Ave Unit D47

- 8233 NW 8th Ct

- 9162 Vineyard Lake Dr

- 8203 NW 9th Ct Unit 2

- 1110 NW 90th Way

- 8239 NW 8th St Unit 3

- 8216 NW 8th St Unit 3

- 8715 NW 10th St Unit B101

- 8711 NW 10th St Unit D101

- 8717 NW 10th St Unit A101

- 8707 NW 10th St Unit A102

- 1020 NW 88th Ave Unit D100

- 1022 NW 88th Ave Unit C100

- 8703 NW 10th St Unit B102

- 1024 NW 88th Ave Unit B100

- 8662 NW 10th Ct Unit B127

- 8662 NW 10th Ct Unit B127

- 8660 NW 10th Ct Unit A127

- 8660 NW 10th Ct

- 8714 NW 10th St Unit C85

- 1031 NW 87th Ave Unit A128

- 8716 NW 10th St Unit D85

- 8701 NW 10th St Unit D102

- 8712 NW 10th St Unit B85

- 8720 NW 10th St Unit A86

- 1026 NW 88th Ave Unit A100