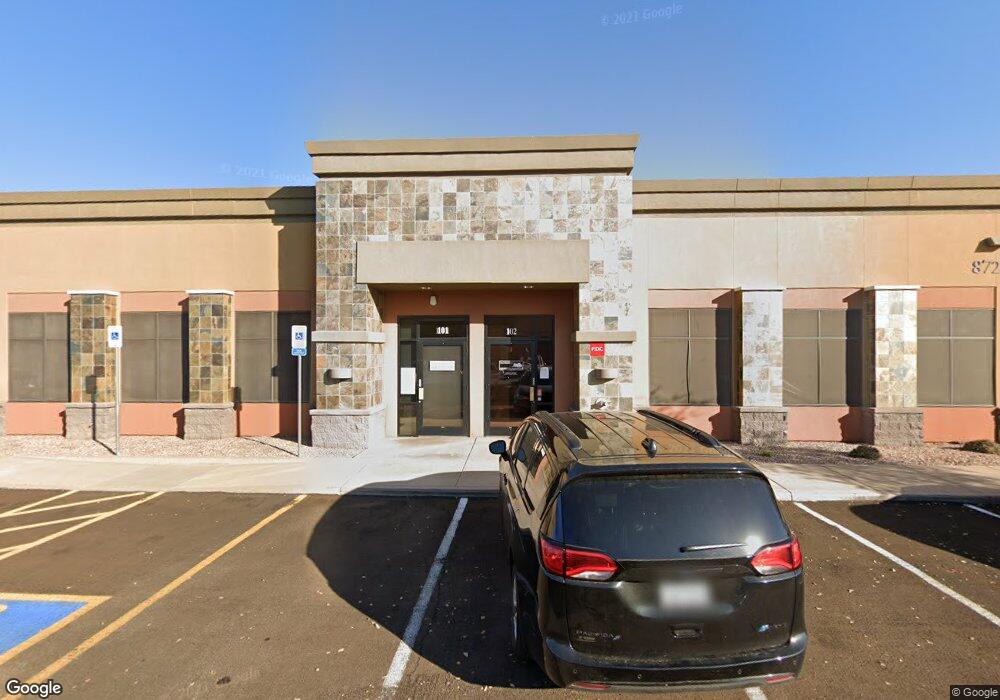

8727 S Priest Dr Unit 103 Tempe, AZ 85284

South Tempe NeighborhoodEstimated Value: $520,592

--

Bed

--

Bath

5,918

Sq Ft

$88/Sq Ft

Est. Value

About This Home

This home is located at 8727 S Priest Dr Unit 103, Tempe, AZ 85284 and is currently estimated at $520,592, approximately $87 per square foot. 8727 S Priest Dr Unit 103 is a home located in Maricopa County with nearby schools including Kyrene de la Mariposa Elementary School, Kyrene Middle School, and Mountain Pointe High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 28, 2017

Sold by

Azca Property Llc

Bought by

8727 S Priest Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$227,250

Outstanding Balance

$189,872

Interest Rate

3.92%

Mortgage Type

Future Advance Clause Open End Mortgage

Estimated Equity

$330,720

Purchase Details

Closed on

May 28, 2017

Sold by

Laguna Equity Investors Llc

Bought by

Azca Property Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$130,717

Interest Rate

4.02%

Mortgage Type

Commercial

Purchase Details

Closed on

Sep 25, 2006

Sold by

Warner & Priest Equity Investors Llc

Bought by

Laguna Equity Investors Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$330,000

Interest Rate

6.51%

Mortgage Type

Commercial

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| 8727 S Priest Llc | $303,000 | Pioneer Title Agency Inc | |

| Azca Property Llc | $253,000 | None Available | |

| Laguna Equity Investors Llc | $271,765 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | 8727 S Priest Llc | $227,250 | |

| Previous Owner | Azca Property Llc | $130,717 | |

| Previous Owner | Laguna Equity Investors Llc | $330,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,066 | $28,132 | -- | -- |

| 2024 | $3,082 | $27,629 | -- | -- |

| 2023 | $3,082 | $52,700 | $10,540 | $42,160 |

| 2022 | $3,026 | $47,338 | $9,468 | $37,870 |

| 2021 | $3,182 | $47,070 | $9,414 | $37,656 |

| 2020 | $3,111 | $43,830 | $8,766 | $35,064 |

| 2019 | $3,019 | $39,924 | $7,974 | $31,950 |

| 2018 | $2,927 | $34,848 | $6,966 | $27,882 |

| 2017 | $2,815 | $32,580 | $6,516 | $26,064 |

| 2016 | $2,840 | $31,356 | $6,264 | $25,092 |

| 2015 | $2,692 | $27,714 | $5,532 | $22,182 |

Source: Public Records

Map

Nearby Homes

- 9132 S Parkside Dr

- 1047 W Caroline Ln

- 9342 S Wally Ave

- 7087 W Knox Rd

- 1020 W Myrna Ln

- 5204 E Saguaro Cir

- 5202 E Tamblo Dr

- 1250 N Abbey Ln Unit 245

- 1250 N Abbey Ln Unit 254

- 5133 E Keresan St

- 1365 W Courtney Ln Unit 1

- 11604 S Ki Rd

- 5114 E Nambe St

- 5038 E Bannock St

- 12154 S Ki Rd

- 1284 W Stacey Ln Unit 1

- 5047 E Mesquite Wood Ct

- 5015 E Cheyenne Dr Unit 14

- 12243 S Chippewa Dr

- 5015 E Shomi St

- 8727 S Priest Dr

- 8675 S Priest Dr Unit 102

- 8747 S Priest Dr Unit 104

- 8655 S Priest Dr Unit 101/104

- 8611 S Priest Dr Unit 101

- 8611 S Priest Dr Unit 101/102

- 8611 S Priest Dr Unit 102

- 8611 S Priest Dr Unit 104

- 8631 S Priest Dr Unit 102

- 8631 S Priest Dr Unit 101

- 8631 S Priest Dr

- 8601 S Priest Dr Unit 104

- 8601 S Priest Dr Unit 102

- 8601 S Priest Dr Unit 101

- 8601 S Priest Dr Unit 102/104

- 8575 S Priest Dr Unit 1

- 8900 S Priest Dr

- 1715 W Ruby Dr Unit 103

- 1715 W Ruby Dr Unit B-106

- 1715 W Ruby Dr Unit 105