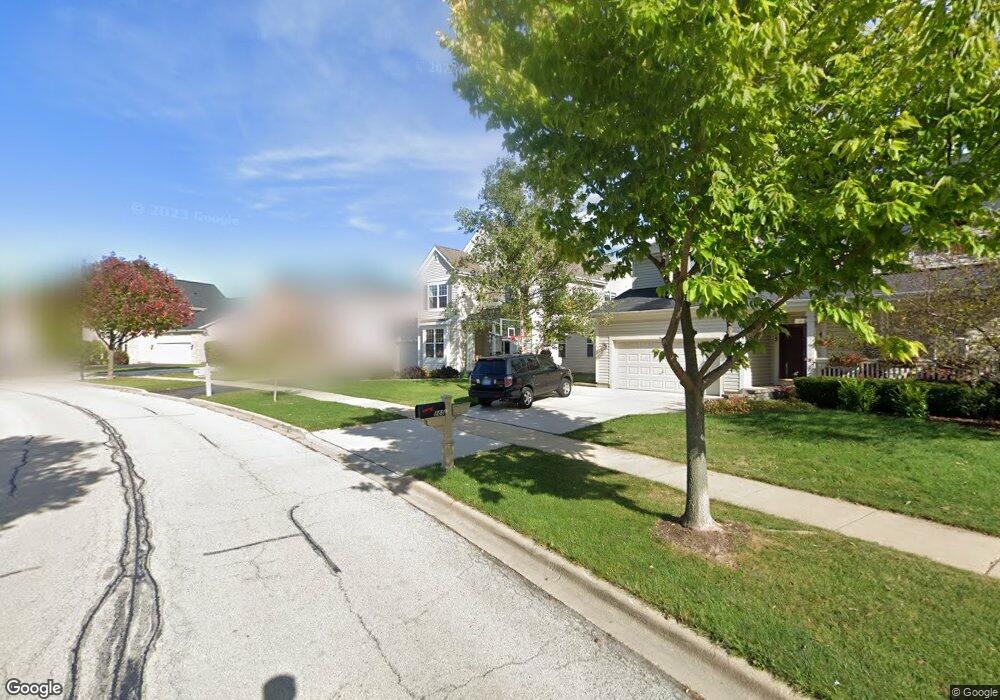

873 Clover Ridge Ln Itasca, IL 60143

North Itasca NeighborhoodEstimated Value: $664,912 - $726,000

3

Beds

3

Baths

3,349

Sq Ft

$207/Sq Ft

Est. Value

About This Home

This home is located at 873 Clover Ridge Ln, Itasca, IL 60143 and is currently estimated at $693,728, approximately $207 per square foot. 873 Clover Ridge Ln is a home located in DuPage County with nearby schools including Raymond Benson Primary School, Elmer H Franzen Intermediate School, and F.E. Peacock Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 12, 2012

Sold by

Sullivan Timothy Brian and Sullivan Suprapha

Bought by

Fezekas Denise A and Fezekas Richard

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$356,800

Outstanding Balance

$247,738

Interest Rate

3.87%

Mortgage Type

New Conventional

Estimated Equity

$445,990

Purchase Details

Closed on

Jun 17, 2004

Sold by

Us Shelter Llc

Bought by

Sullivan Timothy Brian and Sullivan Suprapha

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$391,058

Interest Rate

4.87%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fezekas Denise A | $446,000 | Chicago Title Insurance Co | |

| Sullivan Timothy Brian | $489,000 | Chicago Title Insurance Comp |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fezekas Denise A | $356,800 | |

| Previous Owner | Sullivan Timothy Brian | $391,058 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $14,053 | $212,262 | $60,525 | $151,737 |

| 2023 | $13,491 | $195,130 | $55,640 | $139,490 |

| 2022 | $13,432 | $194,160 | $55,360 | $138,800 |

| 2021 | $12,783 | $185,980 | $53,030 | $132,950 |

| 2020 | $12,126 | $178,140 | $50,790 | $127,350 |

| 2019 | $11,852 | $171,290 | $48,840 | $122,450 |

| 2018 | $12,215 | $171,290 | $48,830 | $122,460 |

| 2017 | $11,498 | $163,710 | $46,670 | $117,040 |

| 2016 | $11,143 | $148,980 | $43,090 | $105,890 |

| 2015 | $10,828 | $137,630 | $39,810 | $97,820 |

| 2014 | $10,803 | $131,000 | $31,870 | $99,130 |

| 2013 | $10,551 | $133,670 | $32,520 | $101,150 |

Source: Public Records

Map

Nearby Homes

- 244 Millers Crossing Unit 244

- 706 Cherry Ct

- 317 Nicole Way

- 421 N Elm St

- 100 S Walnut St

- 741 Old Creek Ct Unit 793

- 711 E Greenview Rd

- 909 Little Falls Ct Unit 909

- 974 Mayfair Ct Unit 83714

- 716 Clover Hill Ct

- 909 Mayfair Ct Unit 115713

- 1205 Dover Ln

- 21W051 Woodview Dr

- 328 Wellington Ave

- 1432 Mitchell Trail

- 295 Brighton Rd

- 504 Highland Pkwy

- 206 E George St

- 7N040 Eagle Terrace

- 324 Parkside Ave

- 865 Clover Ridge Ln

- 881 Clover Ridge Ln

- 889 Clover Ridge Ln

- 940 Willow St

- 942 Willow St

- 938 Willow St

- 944 Willow St

- 870 Clover Ridge Ln

- 936 Willow St

- 946 Willow St

- 849 Clover Ridge Ln

- 934 Willow St

- 880 Clover Ridge Ln

- 893 Clover Ridge Ln

- 932 Willow St

- 930 Willow St

- 950 Willow St

- 890 Clover Ridge Ln

- 952 Willow St