8738 Elba St Pico Rivera, CA 90660

Estimated Value: $632,000 - $770,000

2

Beds

1

Bath

852

Sq Ft

$814/Sq Ft

Est. Value

About This Home

This home is located at 8738 Elba St, Pico Rivera, CA 90660 and is currently estimated at $693,771, approximately $814 per square foot. 8738 Elba St is a home located in Los Angeles County with nearby schools including North Ranchito Elementary School, North Park Middle School, and Ruben Salazar Continuation School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 28, 2006

Sold by

Diaz Elvis Fernando and Diaz Maria Francisca

Bought by

Reyes Jorge Serrano

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$340,000

Outstanding Balance

$202,263

Interest Rate

6.22%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$491,508

Purchase Details

Closed on

Nov 16, 2001

Sold by

Diaz Elvis F and Diaz Maria Francisca

Bought by

Diaz Elvis F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$146,160

Interest Rate

7.17%

Purchase Details

Closed on

Dec 29, 1995

Sold by

Perez Miguel and Perez Lisa

Bought by

Diaz Elvis F and Batres Maria Francisca

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$137,066

Interest Rate

7.25%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Reyes Jorge Serrano | $425,000 | Fidelity National Title Co | |

| Diaz Elvis F | -- | Chicago Title Co | |

| Diaz Elvis F | $137,000 | Benefit Land Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Reyes Jorge Serrano | $340,000 | |

| Previous Owner | Diaz Elvis F | $146,160 | |

| Previous Owner | Diaz Elvis F | $137,066 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,610 | $569,395 | $455,522 | $113,873 |

| 2024 | $7,610 | $558,232 | $446,591 | $111,641 |

| 2023 | $7,397 | $547,287 | $437,835 | $109,452 |

| 2022 | $7,058 | $536,556 | $429,250 | $107,306 |

| 2021 | $6,919 | $526,036 | $420,834 | $105,202 |

| 2019 | $6,134 | $448,000 | $358,000 | $90,000 |

| 2018 | $5,972 | $448,000 | $358,000 | $90,000 |

| 2016 | $4,433 | $346,000 | $276,000 | $70,000 |

| 2015 | $4,143 | $321,000 | $256,000 | $65,000 |

| 2014 | $3,811 | $290,000 | $231,000 | $59,000 |

Source: Public Records

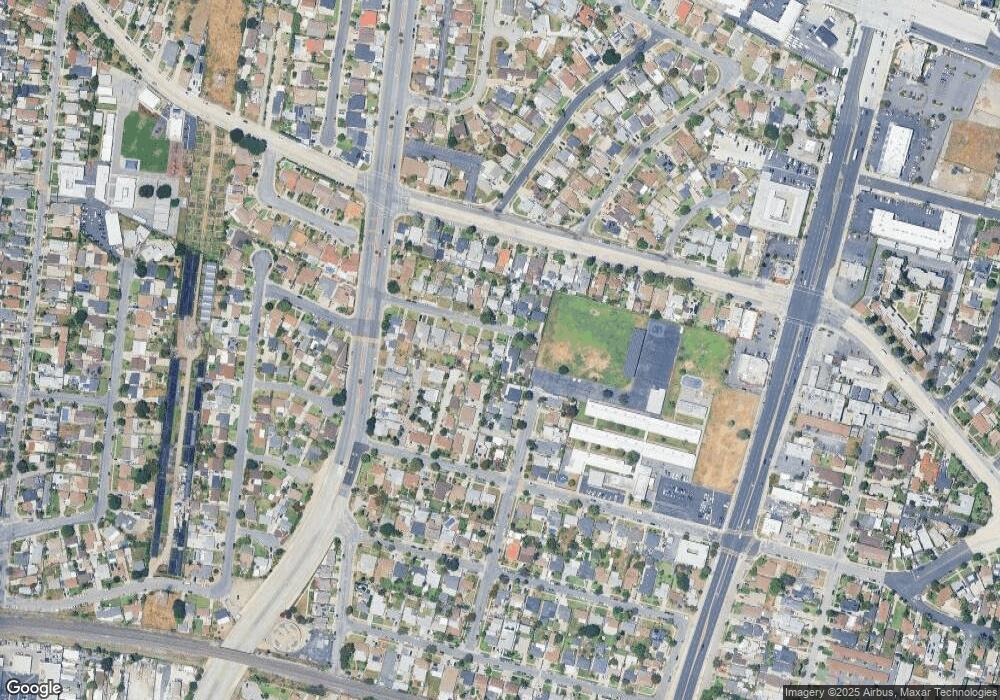

Map

Nearby Homes

- 8630 Elba St

- 4568 Los Toros Ave

- 4707 Rosemead Blvd

- 4424 Calada Ave

- 4653 Pine St

- 4758 Oak St

- 4918 Rosemead Blvd

- 8509 Beverly Blvd

- 4709 Grape St

- 8421 Culp Dr

- 4724 Orange St

- 4753 Orange St

- 9339 Via Azul

- 9335 Via Azul

- 9331 Via Azul

- 9324 Via Azul

- 9326 Via Azul

- 9328 Via Azul

- Plan 1560 at Azul

- Plan 1680 at Azul