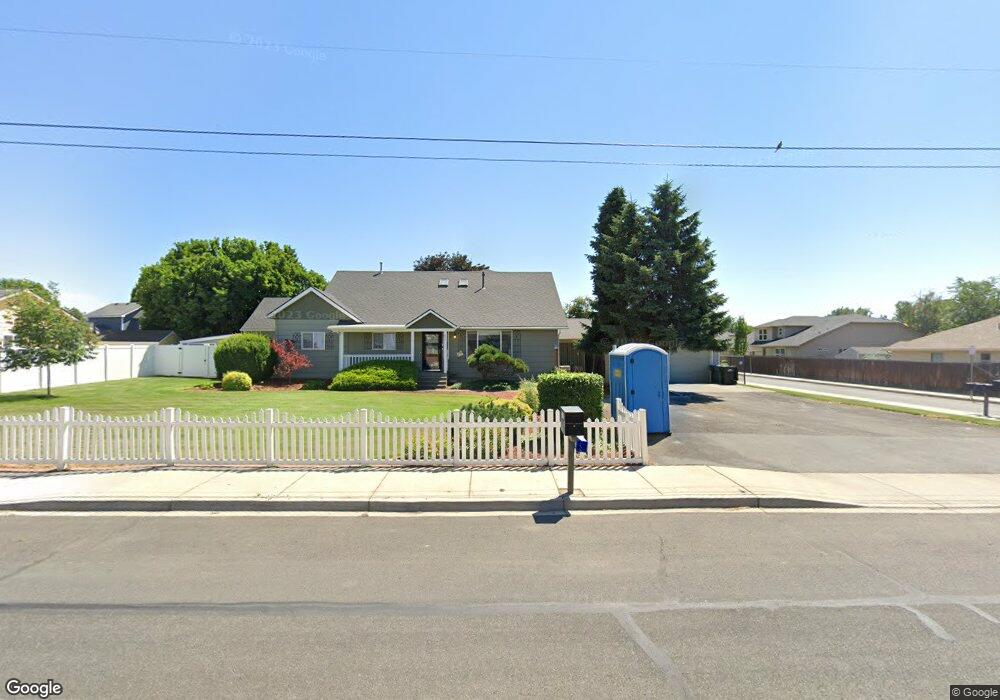

877 Whitney Rd Walla Walla, WA 99362

Estimated Value: $680,896 - $846,000

5

Beds

2

Baths

3,150

Sq Ft

$247/Sq Ft

Est. Value

About This Home

This home is located at 877 Whitney Rd, Walla Walla, WA 99362 and is currently estimated at $778,224, approximately $247 per square foot. 877 Whitney Rd is a home located in Walla Walla County with nearby schools including Prospect Point Elementary School, Garrison Middle School, and St. Basil Academy of Classical Studies.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 11, 2017

Sold by

John Wayne H and John Glenda J

Bought by

Panther David and Panther Cami

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$413,250

Outstanding Balance

$211,615

Interest Rate

3.95%

Mortgage Type

New Conventional

Estimated Equity

$566,609

Purchase Details

Closed on

Jun 2, 2005

Sold by

Gehrett Jay Michael and Gehrett Shari M

Bought by

John Wayne H and John Glenda J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$54,750

Interest Rate

5.74%

Mortgage Type

Future Advance Clause Open End Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Panther David | $435,000 | None Available | |

| John Wayne H | $364,673 | Walla Walla Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Panther David | $413,250 | |

| Previous Owner | John Wayne H | $54,750 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,024 | $757,350 | $162,230 | $595,120 |

| 2024 | $5,263 | $608,380 | $107,480 | $500,900 |

| 2023 | $5,263 | $594,210 | $107,480 | $486,730 |

| 2022 | $5,661 | $566,730 | $80,000 | $486,730 |

| 2021 | $5,025 | $522,480 | $80,000 | $442,480 |

| 2020 | $4,967 | $420,370 | $80,000 | $340,370 |

| 2019 | $4,382 | $420,370 | $80,000 | $340,370 |

| 2018 | $4,603 | $405,370 | $65,000 | $340,370 |

| 2017 | $3,814 | $348,640 | $65,000 | $283,640 |

| 2016 | $4,010 | $311,650 | $65,000 | $246,650 |

| 2015 | $3,775 | $311,650 | $65,000 | $246,650 |

| 2014 | -- | $299,900 | $65,000 | $234,900 |

| 2013 | -- | $299,900 | $65,000 | $234,900 |

Source: Public Records

Map

Nearby Homes

- 2200 Plaza Way Unit 506

- 108 Wedgewood Rd

- 619 Country Club Rd

- 1175 Mercita Dr

- 1155 Mercita Dr

- 1110 Fortune Dr

- 839 Country Club Rd

- 833 Prospect Ave

- 2021 Gemstone Dr

- 1150 Fortune Dr

- 925 Country Club Rd

- 1160 Fortune Dr

- 1186 Fortune Dr

- 1170 Fortune Dr

- 208 Dublin St

- 1230 Lancer Dr

- 2214 Leonard Dr

- 1924 Stevens St

- 1343 Highland Rd

- 1390 Highland Rd

Your Personal Tour Guide

Ask me questions while you tour the home.