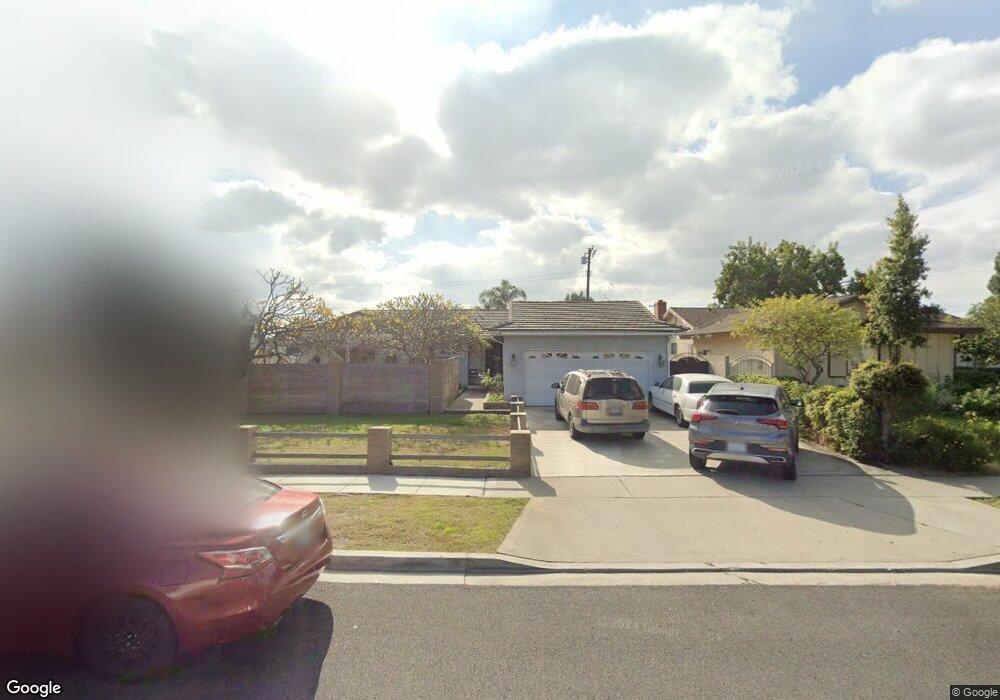

8782 Mays Ave Garden Grove, CA 92844

Estimated Value: $1,158,000 - $1,337,000

4

Beds

3

Baths

2,071

Sq Ft

$594/Sq Ft

Est. Value

About This Home

This home is located at 8782 Mays Ave, Garden Grove, CA 92844 and is currently estimated at $1,229,704, approximately $593 per square foot. 8782 Mays Ave is a home located in Orange County with nearby schools including Anderson Elementary School, Warner Middle, and Westminster High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 16, 2023

Sold by

Gurrola-Holther Ofelia

Bought by

Ofelia Gurrola-Holther Trust

Current Estimated Value

Purchase Details

Closed on

Feb 17, 2023

Sold by

David Richard Holther and David Ofelia Gurrola-H

Bought by

Gurrola-Holther Ofelia

Purchase Details

Closed on

Aug 25, 2022

Sold by

Richard Holther David and Richard Ofelia

Bought by

David Richard Holther & Ofelia Gurrola-Holthe

Purchase Details

Closed on

Feb 25, 1998

Sold by

Kent Bryant Naze and Kent Ruth P

Bought by

Carr Olivia N and Holther David R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$164,000

Interest Rate

7%

Purchase Details

Closed on

Jan 6, 1995

Sold by

Bryant Luella Kay

Bought by

Bryant Luella Kay and Bryant Naze Kent

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ofelia Gurrola-Holther Trust | -- | -- | |

| Gurrola-Holther Ofelia | -- | -- | |

| David Richard Holther & Ofelia Gurrola-Holthe | -- | -- | |

| Carr Olivia N | $217,000 | -- | |

| Bryant Luella Kay | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Carr Olivia N | $164,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,824 | $346,474 | $225,548 | $120,926 |

| 2024 | $4,824 | $339,681 | $221,126 | $118,555 |

| 2023 | $4,662 | $333,021 | $216,790 | $116,231 |

| 2022 | $4,495 | $326,492 | $212,540 | $113,952 |

| 2021 | $4,400 | $320,091 | $208,373 | $111,718 |

| 2020 | $4,348 | $316,809 | $206,236 | $110,573 |

| 2019 | $4,258 | $310,598 | $202,193 | $108,405 |

| 2018 | $4,242 | $304,508 | $198,228 | $106,280 |

| 2017 | $4,086 | $298,538 | $194,341 | $104,197 |

| 2016 | $3,933 | $292,685 | $190,531 | $102,154 |

| 2015 | $3,862 | $288,289 | $187,669 | $100,620 |

| 2014 | $3,778 | $282,642 | $183,993 | $98,649 |

Source: Public Records

Map

Nearby Homes

- 8784 Hewitt Place Unit 12

- 13711 Magnolia St

- 13839 Magnolia St

- 13782 Newland St

- 13411 Magnolia St

- 8442 Trask Ave

- 9200 Westminster Blvd Unit 25

- 13392 Magnolia St

- 8866 Grandville Cir

- 8569 Edgebrook Dr

- 13252 Newland St Unit A-D

- 8202 19th St

- 8902 Mcclure Ave

- 8196 18th St

- 8197 Jasmine Ave

- 8520 Lake Knoll Ave Unit B

- 13175 Creek View Dr Unit F

- 14431 Nola St

- 13502 Jackson St

- 8833 Brookdale Dr