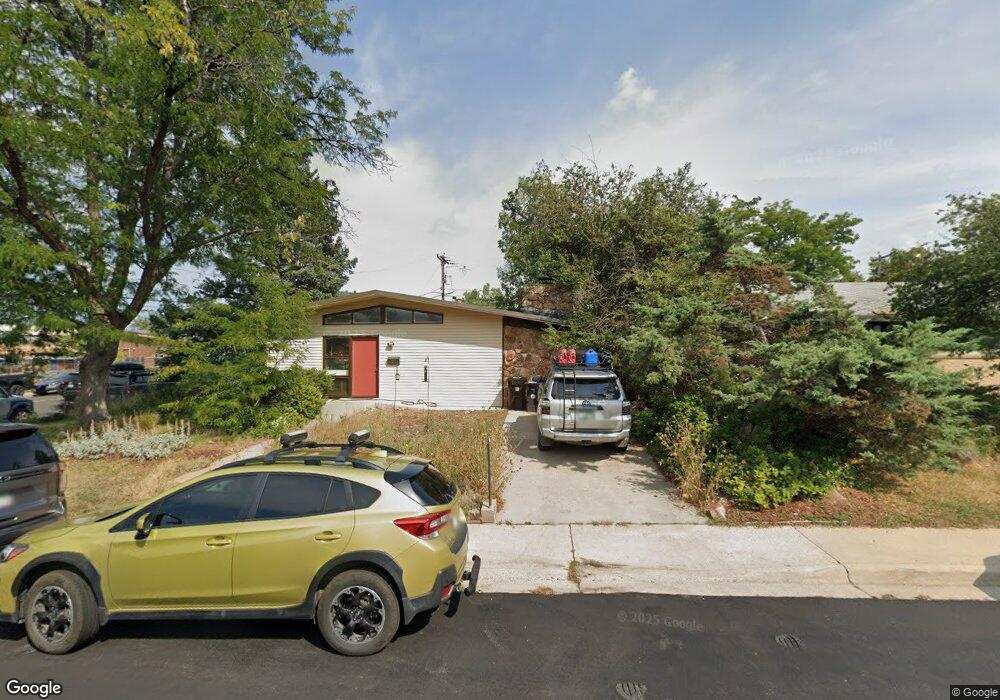

880 39th St Boulder, CO 80303

East Aurora NeighborhoodEstimated Value: $777,590 - $849,000

3

Beds

1

Bath

1,432

Sq Ft

$577/Sq Ft

Est. Value

About This Home

This home is located at 880 39th St, Boulder, CO 80303 and is currently estimated at $825,648, approximately $576 per square foot. 880 39th St is a home located in Boulder County with nearby schools including Creekside Elementary School, Manhattan Middle School of the Arts & Academics, and Fairview High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 21, 2008

Sold by

Lee Gerard F and Lee Rachel A

Bought by

Sorensen Stephen E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$285,600

Outstanding Balance

$186,939

Interest Rate

6.36%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$638,709

Purchase Details

Closed on

Sep 23, 2005

Sold by

Eggert Fred John and Eggert Dorothy M

Bought by

Lavine Rachel A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$224,000

Interest Rate

5.73%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jan 25, 1961

Bought by

Sorensen Stephen E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sorensen Stephen E | $357,000 | First Colorado Title | |

| Lavine Rachel A | $320,000 | Fahtco | |

| Sorensen Stephen E | $13,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sorensen Stephen E | $285,600 | |

| Previous Owner | Lavine Rachel A | $224,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,878 | $48,807 | $27,913 | $20,894 |

| 2024 | $4,878 | $48,807 | $27,913 | $20,894 |

| 2023 | $4,793 | $55,503 | $36,776 | $22,412 |

| 2022 | $4,196 | $45,189 | $26,556 | $18,633 |

| 2021 | $4,002 | $46,489 | $27,320 | $19,169 |

| 2020 | $3,774 | $43,358 | $24,882 | $18,476 |

| 2019 | $3,716 | $43,358 | $24,882 | $18,476 |

| 2018 | $3,451 | $39,809 | $23,328 | $16,481 |

| 2017 | $3,343 | $44,010 | $25,790 | $18,220 |

| 2016 | $2,926 | $33,798 | $19,024 | $14,774 |

| 2015 | $2,770 | $29,293 | $11,781 | $17,512 |

| 2014 | $2,463 | $29,293 | $11,781 | $17,512 |

Source: Public Records

Map

Nearby Homes

- 810 37th St

- 3970 Colorado Ave Unit G

- 3161 Madison Ave Unit 313

- 4415 Laguna Place Unit 201

- 3009 Madison Ave Unit 105I

- 3009 Madison Ave Unit M-315

- 4500 Baseline Rd Unit 3303

- 4500 Baseline Rd Unit 2107

- 4500 Baseline Rd Unit 4-4402

- 3000 Colorado Ave Unit F122

- 3000 Colorado Ave Unit B206

- 2850 Aurora Ave Unit 107

- 805 29th St Unit 253

- 805 29th St Unit 157

- 805 29th St Unit 402

- 2960 Shadow Creek Dr Unit 101

- 5016 Forsythe Place

- 2850 E College Ave Unit 301

- 2902 Shadow Creek Dr Unit 204

- 695 Manhattan Dr Unit 109