8807 N 143rd Ave E Owasso, OK 74055

Estimated Value: $343,000 - $354,000

Studio

2

Baths

2,220

Sq Ft

$157/Sq Ft

Est. Value

About This Home

This home is located at 8807 N 143rd Ave E, Owasso, OK 74055 and is currently estimated at $348,074, approximately $156 per square foot. 8807 N 143rd Ave E is a home located in Tulsa County with nearby schools including Pamela Hodson Elementary School, Owasso 6th Grade Center, and Owasso 8th Grade Center.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 16, 2024

Sold by

Vogt Daniel and Vogt Meghan

Bought by

Holman Brandy and Jones Kathryn

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$285,388

Outstanding Balance

$281,499

Interest Rate

7.03%

Mortgage Type

New Conventional

Estimated Equity

$66,575

Purchase Details

Closed on

Dec 17, 2020

Sold by

Miller Michelle R and Miller Rene Michelle

Bought by

Miller Heath T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$230,644

Interest Rate

2.7%

Mortgage Type

FHA

Purchase Details

Closed on

Dec 11, 2020

Sold by

Miller Heath T and Miller Jennifer

Bought by

Vogt Daniel and Vogt Meghan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$230,644

Interest Rate

2.7%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 29, 2018

Sold by

Easton Lee and Fletcher Steven

Bought by

Miller Heath T and Miller Michelle R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$163,200

Interest Rate

4.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 22, 2016

Sold by

Hopkins Kenneth L and Hopkins Shannon

Bought by

Easton Lee and Fletcher Steven

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$190,000

Interest Rate

3.79%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 22, 2013

Sold by

National Residential Nominee Services In

Bought by

Hopkins Kenneth L and Hopkins Shannon

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$181,649

Interest Rate

3.63%

Mortgage Type

FHA

Purchase Details

Closed on

Apr 18, 2013

Sold by

Oshields James B and Oshields Mary S

Bought by

National Residential Nominee Services In

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$181,649

Interest Rate

3.63%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 12, 2004

Sold by

Village Development Group Llc

Bought by

Oshields James B and Oshields Mary S

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Holman Brandy | $349,000 | Colonial Title | |

| Miller Heath T | -- | Firstitle & Abstract Service | |

| Vogt Daniel | $235,000 | Firstitle & Abstract Services | |

| Miller Heath T | $204,000 | Apex Title & Closing Svcs Ll | |

| Easton Lee | $200,000 | None Available | |

| Hopkins Kenneth L | $185,000 | Tulsa Abstract & Title Comp | |

| National Residential Nominee Services In | $185,000 | Tulsa Abstract & Title Compa | |

| Oshields James B | $174,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Holman Brandy | $285,388 | |

| Previous Owner | Vogt Daniel | $230,644 | |

| Previous Owner | Miller Heath T | $163,200 | |

| Previous Owner | Easton Lee | $190,000 | |

| Previous Owner | Hopkins Kenneth L | $181,649 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,813 | $33,836 | $2,970 | $30,866 |

| 2024 | $2,954 | $28,500 | $2,485 | $26,015 |

| 2023 | $2,954 | $27,143 | $2,502 | $24,641 |

| 2022 | $2,938 | $25,850 | $2,970 | $22,880 |

| 2021 | $2,909 | $25,850 | $2,970 | $22,880 |

| 2020 | $2,524 | $22,440 | $2,970 | $19,470 |

| 2019 | $2,513 | $22,440 | $2,970 | $19,470 |

| 2018 | $2,387 | $22,000 | $2,970 | $19,030 |

| 2017 | $2,395 | $22,000 | $2,970 | $19,030 |

| 2016 | $2,224 | $20,350 | $2,970 | $17,380 |

| 2015 | $2,240 | $20,350 | $2,970 | $17,380 |

| 2014 | $2,261 | $20,350 | $2,970 | $17,380 |

Source: Public Records

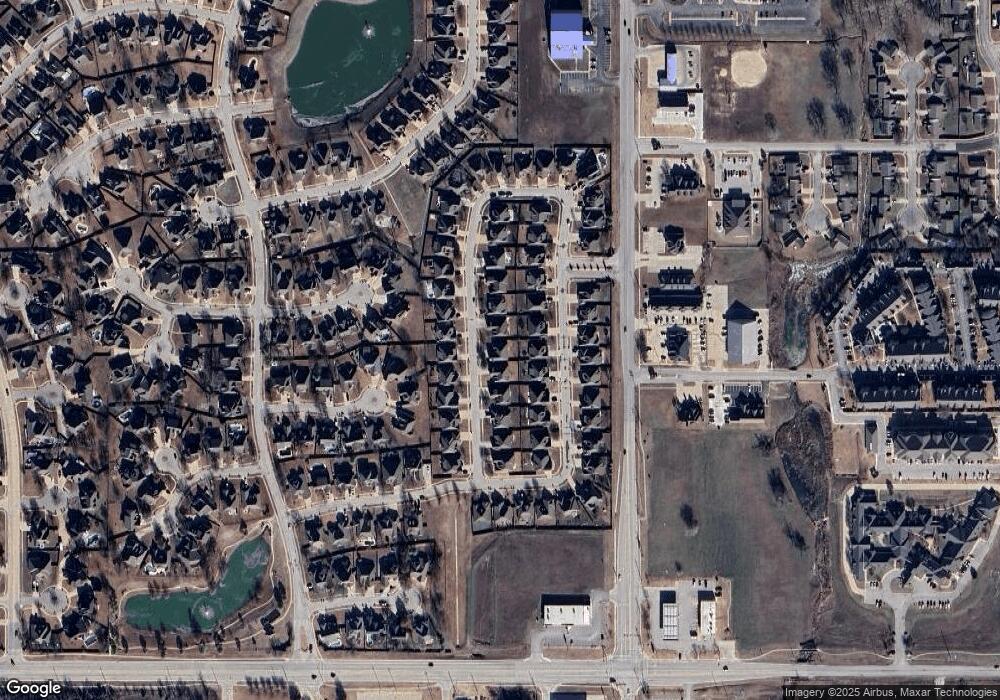

Map

Nearby Homes

- 8813 N 144th East Ave

- 0 E 86th St N Unit 2546696

- 14309 E 88th Terrace N

- 14119 E 88th St N

- 8702 N 140th East Terrace

- 13812 E 87th St N

- 14900 E 87th St N

- 8949 N 139th East Ave

- 9220 N 144th East Ave

- 9001 N 137th East Ave

- 9218 N 141st East Ave

- 9124 N 138th East Ave

- 14440 E 94th St N

- 11406 E 93rd Place N

- 14511 E 80th Ct N

- 14504 E 80th Ct N

- 9502 N 143rd East Ct

- 9400 N 138th East Ave

- 8007 N 146th East Ave

- 9513 N 144th East Ave

- 8807 N 143rd East Ave

- 8803 N 143rd East Ave

- 8811 N 143rd East Ave

- 8804 N 144th East Ave

- 8800 N 144th East Ave

- 8713 N 143rd East Ave

- 8808 N 144th East Ave

- 8815 N 143rd East Ave

- 8713 N Ave

- 8800 N 144th Ave E

- 8713 N 143rd Ave E

- 8806 N 143rd East Ave

- 8802 N 143rd Ave E

- 8810 N 143rd East Ave

- 8802 N 143rd East Ave

- 8714 N 144th East Ave

- 8812 N 144th East Ave

- 8714 N 144th Ave E

- 8814 N 143rd East Ave

- 8709 N 143rd East Ave

Your Personal Tour Guide

Ask me questions while you tour the home.