Estimated Value: $181,327 - $225,000

1

Bed

1

Bath

1,488

Sq Ft

$136/Sq Ft

Est. Value

About This Home

This home is located at 8815 W Golf Rd Unit 4H, Niles, IL 60714 and is currently estimated at $202,082, approximately $135 per square foot. 8815 W Golf Rd Unit 4H is a home located in Cook County with nearby schools including Mark Twain Elementary School, Gemini Middle School, and Maine East High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 23, 2003

Sold by

Tsimis Alla

Bought by

Shulman Anna

Current Estimated Value

Purchase Details

Closed on

Oct 12, 1999

Sold by

Shleyfman Allan

Bought by

Tsimis Alla

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$78,500

Interest Rate

7.91%

Mortgage Type

Balloon

Purchase Details

Closed on

Dec 3, 1997

Sold by

Golin Edward and Golin Shirley

Bought by

Shleyfman Allan and Shleyfman Alla

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$77,425

Interest Rate

7.12%

Purchase Details

Closed on

Nov 7, 1995

Sold by

Golin Edward and Golin Shirley

Bought by

Golin Edward and Edward Golin Living Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shulman Anna | $140,000 | Ticor Title Insurance | |

| Tsimis Alla | -- | -- | |

| Shleyfman Allan | $81,500 | -- | |

| Golin Edward | -- | -- | |

| Golin Shirley | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Tsimis Alla | $78,500 | |

| Previous Owner | Shleyfman Allan | $77,425 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,438 | $12,743 | $98 | $12,645 |

| 2023 | $2,266 | $12,743 | $98 | $12,645 |

| 2022 | $2,266 | $12,743 | $98 | $12,645 |

| 2021 | $1,937 | $9,950 | $151 | $9,799 |

| 2020 | $1,894 | $9,950 | $151 | $9,799 |

| 2019 | $1,871 | $11,133 | $151 | $10,982 |

| 2018 | $944 | $6,923 | $132 | $6,791 |

| 2017 | $954 | $6,923 | $132 | $6,791 |

| 2016 | $1,109 | $6,923 | $132 | $6,791 |

| 2015 | $939 | $6,055 | $113 | $5,942 |

| 2014 | $918 | $6,055 | $113 | $5,942 |

| 2013 | $887 | $6,055 | $113 | $5,942 |

Source: Public Records

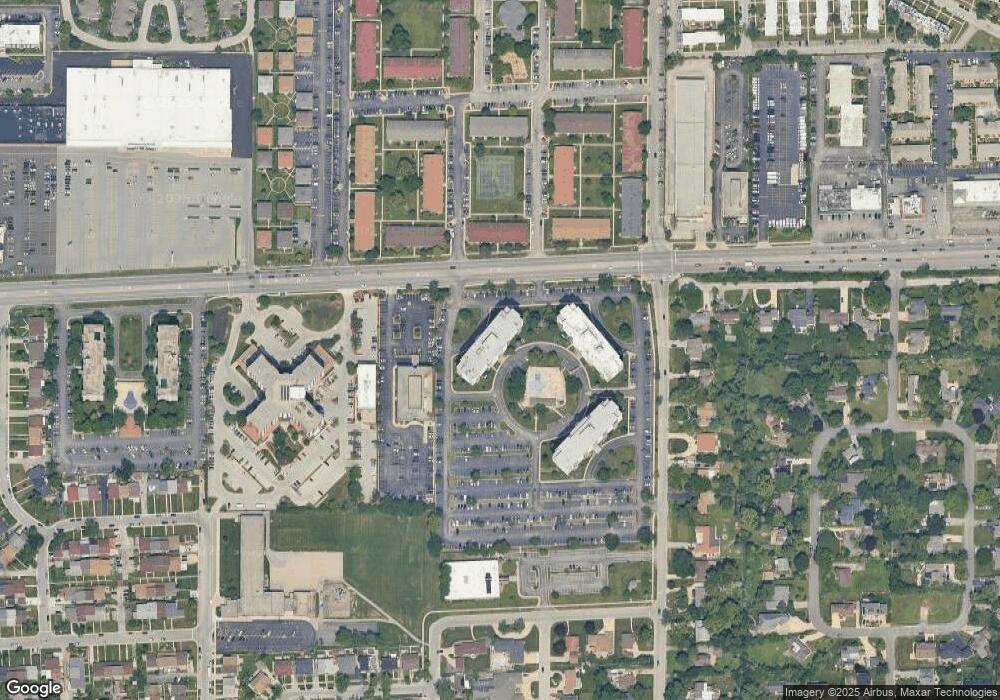

Map

Nearby Homes

- 8815 W Golf Rd Unit 6D

- 8815 W Golf Rd Unit 11C

- 8815 W Golf Rd Unit 10C

- 8815 W Golf Rd Unit 3D

- 8815 W Golf Rd Unit 6B

- 8815 W Golf Rd Unit 7A

- 8801 W Golf Rd Unit 10C

- 8801 W Golf Rd Unit 12B

- 8809 W Golf Rd Unit 10C

- 8809 W Golf Rd Unit 11F

- 8804 Golf Rd Unit 2F

- 8896 David Place Unit 1H

- 8888 Steven Dr Unit 1H

- 9532 Greenwood Dr

- 8916 Kenneth Dr Unit 1E

- 9631 Brandy Ct Unit 7

- 8868 Kenneth Dr Unit 2F

- 9404 Hamlin Ave

- 8966 W Heathwood Cir Unit C2

- 9344 N Lincoln Ave

- 8815 W Golf Rd Unit 5C

- 8815 W Golf Rd Unit 5F

- 8815 W Golf Rd Unit 6J

- 8815 W Golf Rd Unit 7I

- 8815 W Golf Rd Unit 8D

- 8815 W Golf Rd Unit 8J

- 8815 W Golf Rd Unit 9D

- 8815 W Golf Rd Unit 7D

- 8815 W Golf Rd Unit 4G

- 8815 W Golf Rd Unit 2G

- 8815 W Golf Rd Unit 5E

- 8815 W Golf Rd Unit 10I

- 8815 W Golf Rd Unit 10A

- 8815 W Golf Rd Unit 12A

- 8815 W Golf Rd Unit 8C

- 8815 W Golf Rd Unit 9J

- 8815 W Golf Rd Unit 11E

- 8815 W Golf Rd Unit 9A

- 8815 W Golf Rd Unit 1J

- 8815 W Golf Rd Unit 9I