8824 Glade Rd Loveland, CO 80538

Estimated Value: $775,318 - $952,000

3

Beds

2

Baths

1,834

Sq Ft

$471/Sq Ft

Est. Value

About This Home

This home is located at 8824 Glade Rd, Loveland, CO 80538 and is currently estimated at $864,080, approximately $471 per square foot. 8824 Glade Rd is a home located in Larimer County with nearby schools including Big Thompson Elementary School, Walt Clark Middle School, and Thompson Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 12, 2015

Sold by

Larson Jan F

Bought by

8824 Glade Road Llc

Current Estimated Value

Purchase Details

Closed on

Jun 4, 2012

Sold by

Larson Jan F

Bought by

Larson Jan F

Purchase Details

Closed on

Feb 6, 2007

Sold by

Larson Jan F and Larson Shellie K

Bought by

Larson Jan F and Larson Shellie K

Purchase Details

Closed on

Jan 19, 2007

Sold by

Larson Jan F and Larson Shellie

Bought by

Larson Jan F and Larson Shellie K

Purchase Details

Closed on

Dec 27, 2006

Sold by

Larson Jan F and Larson Shellie

Bought by

Larson Jan F and Larson Shellie

Purchase Details

Closed on

Sep 25, 2006

Sold by

Larson Jan F and Larson Shellie

Bought by

Larson Jan F and Larson Shellie

Purchase Details

Closed on

Sep 1, 1993

Sold by

Larson Shellie K

Bought by

Larson Shellie K

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| 8824 Glade Road Llc | -- | None Available | |

| Larson Jan F | -- | None Available | |

| Larson Jan F | -- | None Available | |

| Larson Jan F | -- | None Available | |

| Larson Jan F | -- | None Available | |

| Larson Jan F | -- | None Available | |

| Larson Shellie K | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,426 | $45,761 | $25,795 | $19,966 |

| 2024 | $3,307 | $45,761 | $25,795 | $19,966 |

| 2022 | $2,205 | $27,967 | $4,379 | $23,588 |

| 2021 | $2,263 | $28,772 | $4,505 | $24,267 |

| 2020 | $1,684 | $21,408 | $4,505 | $16,903 |

| 2019 | $1,655 | $21,408 | $4,505 | $16,903 |

| 2018 | $1,388 | $17,035 | $4,536 | $12,499 |

| 2017 | $1,194 | $17,035 | $4,536 | $12,499 |

| 2016 | $1,126 | $15,530 | $5,015 | $10,515 |

| 2015 | $1,117 | $15,530 | $5,010 | $10,520 |

| 2014 | -- | $14,820 | $5,010 | $9,810 |

Source: Public Records

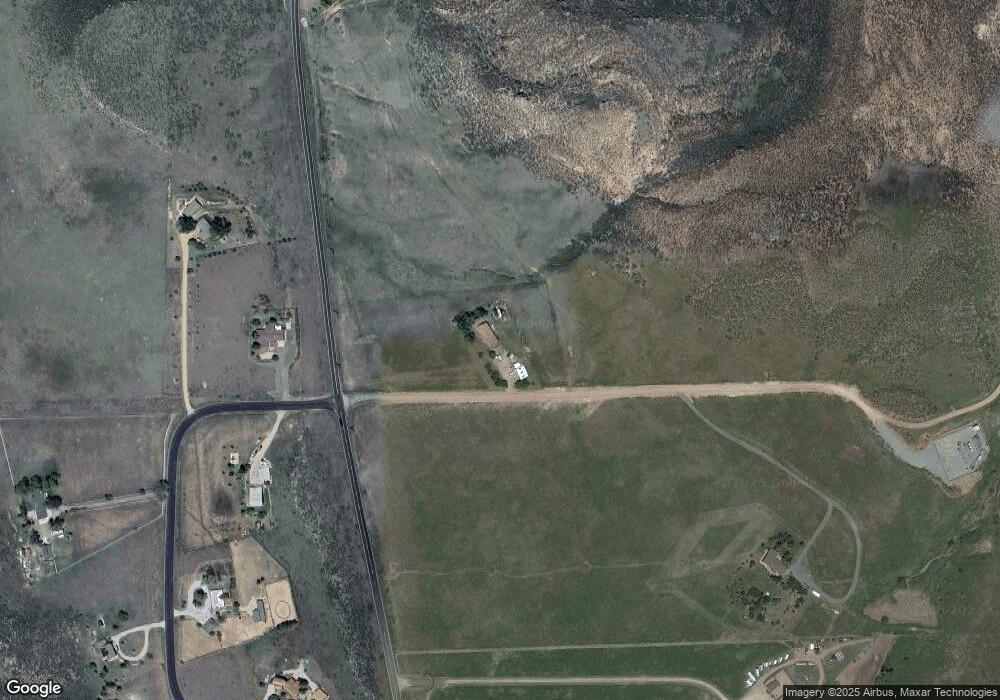

Map

Nearby Homes

- 8205 Stag Hollow Rd

- 9680 W County Road 38e

- 9680 W County Road 38 E

- 12711 N Co Road 27

- 9126 Gold Mine Rd

- 9840 Buckhorn Rd

- 4736 Rim Rock Ridge Rd

- 5801 Norwood Ave

- 5817 Harrison Dr

- 5000 Foothills Dr

- 4820 Key Largo Dr

- 6534 Gindler Ranch Rd

- 4809 Foothills Dr

- 5000 Holiday Dr

- 4801 W County Road 38 E Unit 1

- 4633 Canyon View Dr

- 4841 Deer Trail Ct

- 4904 Deer Trail Ct

- 0 Soaring Eagle Unit 1024864

- 5815 Bighorn Crossing

- 8612 Glade Rd

- 8504 Glade Rd

- 8504 Glade Rd

- 8002 Firethorn Dr

- 8001 Firethorn Dr

- 8010 Firethorn Dr

- 8029 Firethorn Dr

- 8041 Firethorn Dr

- 8049 Firethorn Dr

- 9151 Glade Rd

- 8018 Firethorn Dr

- 8030 Firethorn Dr

- 7955 Stag Hollow Rd

- 7625 Stag Hollow Rd

- 8057 Firethorn Dr

- 6609 Tamarax Ct

- 8054 Firethorn Dr

- 8060 Firethorn Dr

- 6600 Tamarax Ct

- 8889 W County Road 38 E