Estimated Value: $186,000 - $209,755

2

Beds

2

Baths

1,321

Sq Ft

$152/Sq Ft

Est. Value

About This Home

This home is located at 8836 SW 116th Place Rd, Ocala, FL 34481 and is currently estimated at $200,189, approximately $151 per square foot. 8836 SW 116th Place Rd is a home located in Marion County with nearby schools including Marion Oaks Elementary School, Horizon Academy At Marion Oaks, and West Port High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 14, 2024

Sold by

Richter Debra Kay

Bought by

Richter Debra and Unverfhrt David C

Current Estimated Value

Purchase Details

Closed on

Sep 23, 2021

Sold by

Hight June E Richter

Bought by

Hight June E Richter and Richter Debra K

Purchase Details

Closed on

Jul 28, 2017

Sold by

Mansfield Jeannette

Bought by

Richter Hight June E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Interest Rate

3.9%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 28, 2017

Sold by

Latson Maya Renolds and Estate Of Howard E Redmond

Bought by

Mansfield Jeannette

Purchase Details

Closed on

Jun 1, 2016

Bought by

Hight June E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Richter Debra | $100 | None Listed On Document | |

| Richter Debra | $100 | None Listed On Document | |

| Hight June E Richter | -- | None Available | |

| Richter Hight June E | $100,000 | Sunbelt Title Svcs In | |

| Mansfield Jeannette | $75,000 | First International Title In | |

| Hight June E | $100 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Richter Hight June E | $80,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,163 | $160,511 | -- | -- |

| 2023 | $3,019 | $145,919 | $0 | $0 |

| 2022 | $2,400 | $132,654 | $33,000 | $99,654 |

| 2021 | $1,111 | $89,568 | $0 | $0 |

| 2020 | $1,098 | $88,331 | $0 | $0 |

| 2019 | $1,076 | $86,345 | $19,250 | $67,095 |

| 2018 | $1,144 | $92,083 | $17,550 | $74,533 |

| 2017 | $1,452 | $71,937 | $9,500 | $62,437 |

| 2016 | $803 | $65,592 | $0 | $0 |

| 2015 | $804 | $65,136 | $0 | $0 |

| 2014 | $765 | $64,619 | $0 | $0 |

Source: Public Records

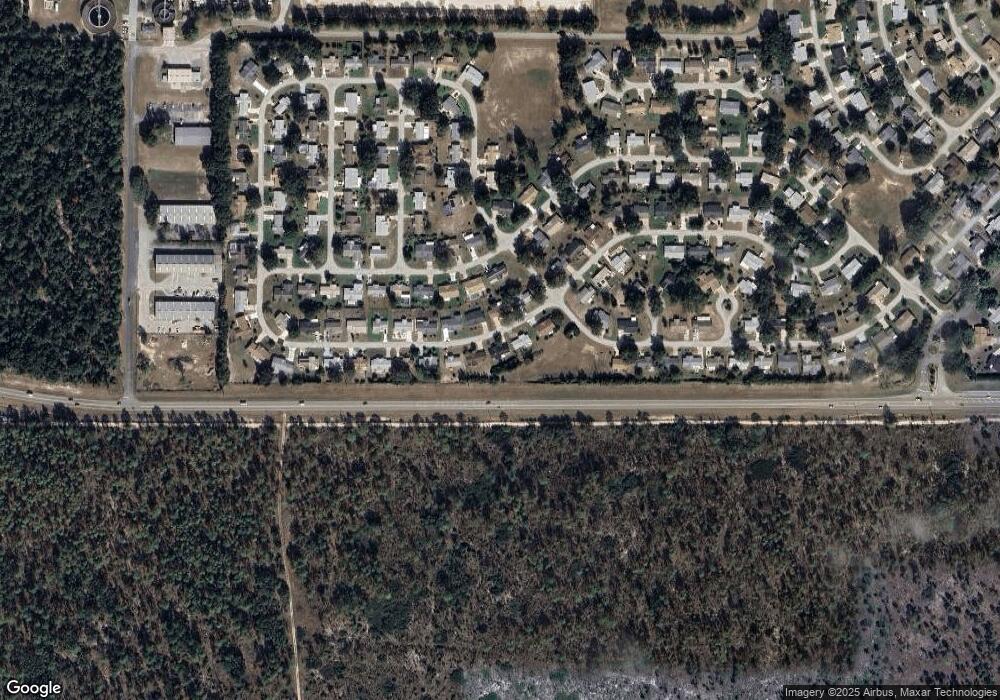

Map

Nearby Homes

- 8850 SW 116th Place Rd

- 8849 SW 116th Place Rd

- 8896 SW 116th Place Rd

- 8968 SW 116th Place Rd

- 8771 SW 115th St

- 8602 SW 116th Place Rd

- 11525 SW 85th Ct

- 11475 SW 85th Ave

- 11631 SW 82nd Terrace

- 11385 SW 85th Ct

- 8748 SW 109th Ln

- 10989 SW 86th Ave

- 10958 SW 86th Ct

- 11445 SW 84th Avenue Rd

- 8954 SW 109th Ln

- 8137 SW 117th Loop

- 9440 SW 114th St

- 8396 SW 109th Ln

- 10891 SW 90th Terrace

- 10888 SW 90th Ct

- 8818 SW 116th Place Rd

- 8868 SW 116th Place Rd

- 8825 SW 116th Place Rd

- 8802 SW 116th Place Rd

- 8865 SW 116th Place Rd

- 8811 SW 116th Place Rd

- 8852 SW 116th Street Rd

- 8886 SW 116th Place Rd

- 8870 SW 116th Street Rd

- 8881 SW 116th Place Rd

- 8836 SW 116th Street Rd

- 8882 SW 116th Street Rd

- 8899 SW 116th Place Rd

- 8797 SW 116th Place Rd

- 8771 SW 116th Lane Rd

- 8762 SW 116th Lane Rd

- 8900 SW 116th Street Rd

- 8824 SW 116th Street Rd

- 8910 SW 116th Place Rd

- 8869 SW 116th Street Rd