885 Courtyards Loop Lincoln, CA 95648

Estimated Value: $455,000 - $507,000

3

Beds

2

Baths

1,809

Sq Ft

$270/Sq Ft

Est. Value

About This Home

This home is located at 885 Courtyards Loop, Lincoln, CA 95648 and is currently estimated at $488,719, approximately $270 per square foot. 885 Courtyards Loop is a home located in Placer County with nearby schools including Scott M. Leaman, Twelve Bridges Middle School, and John Adams Academy - Lincoln.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 26, 2010

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Keltner Kelly M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,265

Interest Rate

5.21%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 23, 2009

Sold by

Santander Enato L and Santander Edith

Bought by

Federal Home Loan Mortgage Corporation

Purchase Details

Closed on

Sep 27, 2006

Sold by

Morrison Homes Inc

Bought by

Santander Renato L and Santander Edita

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$69,224

Interest Rate

6.53%

Mortgage Type

Credit Line Revolving

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Keltner Kelly M | $165,000 | Ticor Title Redlands | |

| Federal Home Loan Mortgage Corporation | $173,680 | Accommodation | |

| Santander Renato L | $346,500 | First American Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Keltner Kelly M | $168,265 | |

| Previous Owner | Santander Renato L | $69,224 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,364 | $212,841 | $25,809 | $187,032 |

| 2023 | $5,364 | $204,577 | $24,807 | $179,770 |

| 2022 | $5,163 | $200,567 | $24,321 | $176,246 |

| 2021 | $5,107 | $196,636 | $23,845 | $172,791 |

| 2020 | $5,071 | $194,621 | $23,601 | $171,020 |

| 2019 | $4,965 | $190,806 | $23,139 | $167,667 |

| 2018 | $4,857 | $187,066 | $22,686 | $164,380 |

| 2017 | $5,201 | $183,399 | $22,242 | $161,157 |

| 2016 | $5,072 | $179,804 | $21,806 | $157,998 |

| 2015 | $4,978 | $177,104 | $21,479 | $155,625 |

| 2014 | $4,867 | $173,636 | $21,059 | $152,577 |

Source: Public Records

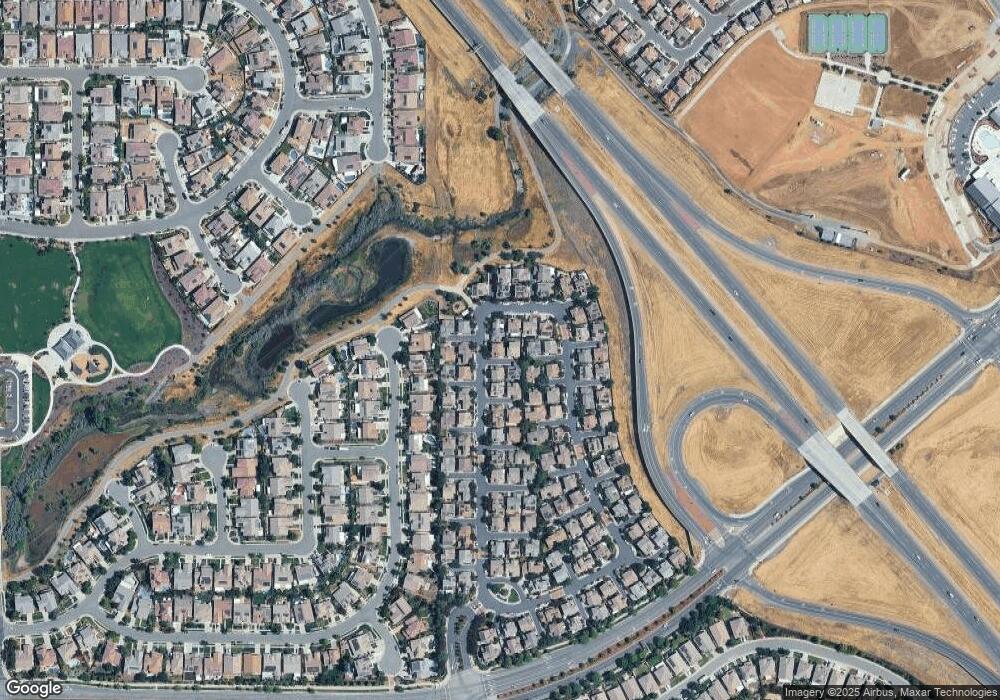

Map

Nearby Homes

- 769 Courtyards Loop

- 1624 Midford Ln

- 1879 Salerno Place

- 1842 Salerno Place

- 1437 Coral St

- 1270 Incline Dr Unit 3

- 1715 Montrose Ln

- 1080 Sierra View Cir Unit 3

- 906 Pesaro Place

- 2030 Sierra View Cir Unit 3

- 1159 Davmore Ln

- 2060 Sierra View Cir Unit 2

- 102 Pellegrino Ct

- 2249 Comstock Ln

- 1214 Forebridge Ln

- 670 Tara Bella Dr

- 1408 Seymour Cir

- 1345 Seymour Cir

- 1236 Hillwood Loop

- 301 Falkirk Ct

- 889 Courtyards Loop

- 881 Courtyards Loop

- 897 Courtyards Loop

- 873 Courtyards Loop

- 893 Courtyards Loop

- 910 Courtyards Loop

- 825 Courtyards Loop

- 914 Courtyards Loop

- 898 Courtyards Loop

- 901 Courtyards Loop

- 869 Courtyards Loop

- 817 Courtyards Loop

- 905 Courtyards Loop

- 906 Courtyards Loop

- 902 Courtyards Loop

- 918 Courtyards Loop

- 829 Courtyards Loop

- 865 Courtyards Loop

- 878 Courtyards Loop

- 926 Courtyards Loop