8850 91st St S Cottage Grove, MN 55016

Estimated Value: $390,000 - $414,000

4

Beds

2

Baths

1,320

Sq Ft

$304/Sq Ft

Est. Value

About This Home

This home is located at 8850 91st St S, Cottage Grove, MN 55016 and is currently estimated at $401,075, approximately $303 per square foot. 8850 91st St S is a home located in Washington County with nearby schools including Armstrong Elementary School, Cottage Grove Middle School, and Park Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 9, 2022

Sold by

Lindeman Patricia A and Lindeman Phil

Bought by

Pgpa Lindeman Family Trust

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$238,000

Outstanding Balance

$187,562

Interest Rate

2.43%

Mortgage Type

New Conventional

Estimated Equity

$213,513

Purchase Details

Closed on

May 3, 2021

Sold by

Lindeman Philip G and Lindeman Patricia A

Bought by

Lindeman Phil and Lindeman Patricia A

Purchase Details

Closed on

Dec 17, 2004

Sold by

Norton Randy A and Norton Karol A

Bought by

Lindeman Philip G and Lindeman Patricia A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pgpa Lindeman Family Trust | -- | None Listed On Document | |

| Lindeman Patricia A | $30,000 | None Listed On Document | |

| Lindeman Phil | -- | None Available | |

| Lindeman Philip G | $254,800 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lindeman Patricia A | $238,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,960 | $380,900 | $110,000 | $270,900 |

| 2023 | $4,960 | $383,200 | $115,000 | $268,200 |

| 2022 | $4,050 | $345,600 | $95,800 | $249,800 |

| 2021 | $3,976 | $287,100 | $79,600 | $207,500 |

| 2020 | $3,952 | $284,500 | $87,500 | $197,000 |

| 2019 | $3,754 | $274,600 | $77,000 | $197,600 |

| 2018 | $3,580 | $255,000 | $72,000 | $183,000 |

| 2017 | $3,290 | $239,200 | $70,000 | $169,200 |

| 2016 | $3,434 | $223,400 | $55,000 | $168,400 |

| 2015 | $3,110 | $208,700 | $55,500 | $153,200 |

| 2013 | -- | $182,600 | $53,000 | $129,600 |

Source: Public Records

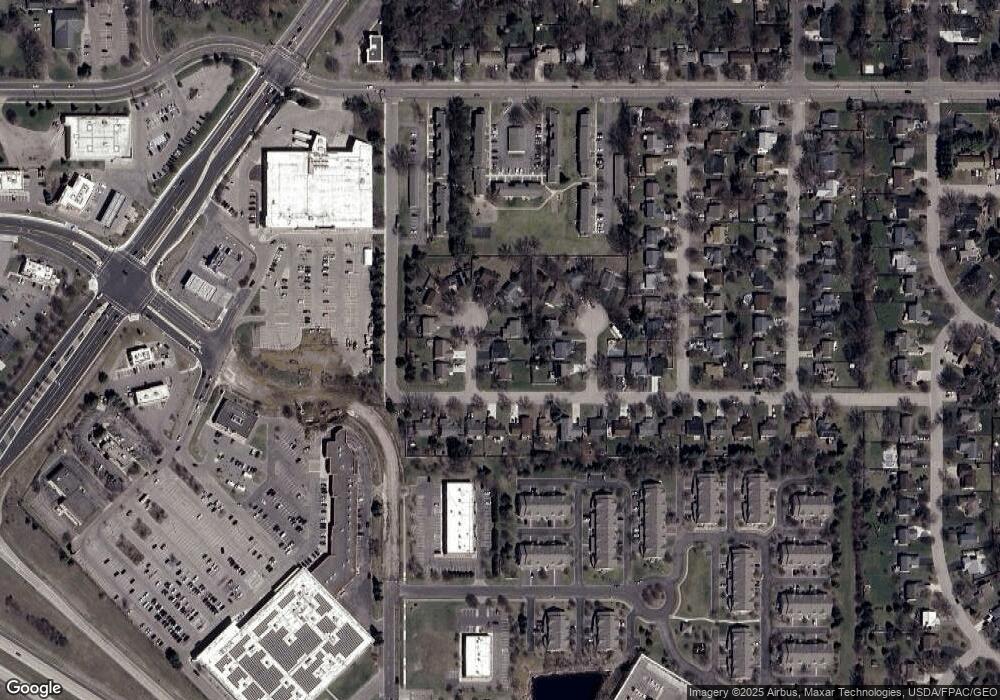

Map

Nearby Homes

- 8870 92nd St S

- The Becker Plan at Mississippi Landing

- The Barrett Plan at Mississippi Landing

- The Brookston Plan at Mississippi Landing

- The Biscay Plan at Mississippi Landing

- 9455 Jarrod Ave S

- 8664 88th St S

- 9159 Jeffery Ave S

- 8594 88th St S

- 9229 E Point Douglas Ln S

- 9235 E Point Douglas Ln S

- 8331 88th St S

- 8458 Ivywood Ave S

- 8769 Jewel Ave S

- 8656 Imperial Ave S

- 8355 Foothill Rd S

- 8178 Hillside Trail S

- 8963 Joliet Ave S

- The Bryant II Plan at Ravine Crossing

- The Rushmore Plan at Ravine Crossing