8851 Colonnades Ct W Unit 127 Bonita Springs, FL 34135

Council NeighborhoodEstimated Value: $175,488 - $305,000

1

Bed

1

Bath

724

Sq Ft

$294/Sq Ft

Est. Value

About This Home

This home is located at 8851 Colonnades Ct W Unit 127, Bonita Springs, FL 34135 and is currently estimated at $212,622, approximately $293 per square foot. 8851 Colonnades Ct W Unit 127 is a home located in Lee County with nearby schools including Spring Creek Elementary School, Bonita Springs Elementary School, and Pinewoods Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 4, 2021

Sold by

Meade James

Bought by

Hampel Maria

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Outstanding Balance

$90,931

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$121,691

Purchase Details

Closed on

Oct 12, 2018

Sold by

Del Ray Condominium Properties Llc

Bought by

Meade James

Purchase Details

Closed on

Jan 28, 2010

Sold by

Sidoti Joseph A

Bought by

Del Ray Condominium Properties Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,104,000

Interest Rate

4.94%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Mar 24, 2008

Sold by

Silber Nadia and Silber Nadia G

Bought by

Sidoti Joseph A

Purchase Details

Closed on

May 26, 2005

Sold by

Colonnades Development Lllp

Bought by

Silber Nadia G

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hampel Maria | $125,000 | Innovative Title & Trust | |

| Meade James | $120,000 | Attorney | |

| Del Ray Condominium Properties Llc | $1,200,000 | Attorney | |

| Sidoti Joseph A | -- | Attorney | |

| Silber Nadia G | $162,900 | Warranty Title Solutions Llc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hampel Maria | $100,000 | |

| Previous Owner | Del Ray Condominium Properties Llc | $1,104,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,254 | $138,693 | -- | -- |

| 2024 | $1,254 | $134,784 | -- | -- |

| 2023 | $1,220 | $130,858 | $0 | $0 |

| 2022 | $1,292 | $127,047 | $0 | $127,047 |

| 2021 | $1,476 | $104,432 | $0 | $104,432 |

| 2020 | $1,472 | $100,938 | $0 | $100,938 |

| 2019 | $1,428 | $96,900 | $0 | $96,900 |

| 2018 | $1,158 | $92,055 | $0 | $92,055 |

| 2017 | $1,137 | $91,248 | $0 | $91,248 |

| 2016 | $1,127 | $92,393 | $0 | $92,393 |

| 2015 | $923 | $66,100 | $0 | $66,100 |

| 2014 | $835 | $58,600 | $0 | $58,600 |

| 2013 | -- | $41,400 | $0 | $41,400 |

Source: Public Records

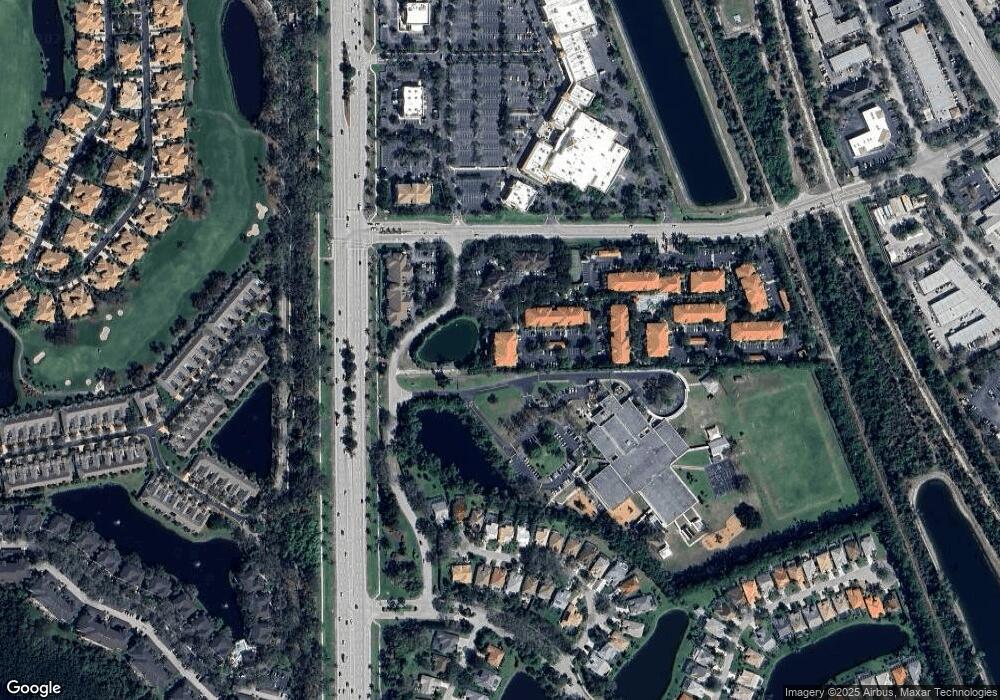

Map

Nearby Homes

- 8861 Colonnades Ct W Unit 215

- 8851 Colonnades Ct W Unit 128

- 8851 Colonnades Ct W Unit 126

- 8870 Colonnades Ct W Unit 336

- 8870 Colonnades Ct W Unit 328

- 8950 Colonnades Ct E Unit 817

- 8950 Colonnades Ct E Unit 815

- 8920 Colonnades Ct E Unit 524

- 8930 Colonnades Ct E Unit 612

- 3421 Marbella Ct

- 25350 Galashields Cir

- 3466 Pointe Creek Ct Unit 201

- 3431 Pointe Creek Ct Unit 104

- 3461 Pointe Creek Ct Unit 204

- 3461 Pointe Creek Ct Unit 102

- 3471 Pointe Creek Ct Unit 204

- 8851 Colonnades Ct W Unit 813

- 8851 Colonnades Ct W

- 8851 Colonnades Ct W Unit 136

- 8851 Colonnades Ct W Unit 134

- 8851 Colonnades Ct W Unit 117

- 8851 Colonnades Ct W Unit 125

- 8851 Colonnades Ct W Unit 112

- 8851 Colonnades Ct W Unit 135

- 8851 Colonnades Ct W Unit 121

- 8851 Colonnades Ct W Unit 111

- 8851 Colonnades Ct W Unit 137

- 8851 Colonnades Ct W Unit 115

- 8851 Colonnades Ct W Unit 132

- 8851 Colonnades Ct W Unit 124

- 8851 Colonnades Ct W Unit 123

- 8851 Colonnades Ct W Unit 133

- 8851 Colonnades Ct W Unit 118

- 8851 Colonnades Ct W Unit 113

- 8851 Colonnades Ct W Unit 131

- 8851 Colonnades Ct W Unit 138