8900 Jason Ct North Richland Hills, TX 76182

Estimated Value: $420,805 - $433,000

3

Beds

2

Baths

1,949

Sq Ft

$220/Sq Ft

Est. Value

About This Home

This home is located at 8900 Jason Ct, North Richland Hills, TX 76182 and is currently estimated at $427,951, approximately $219 per square foot. 8900 Jason Ct is a home located in Tarrant County with nearby schools including W.A. Porter Elementary School, Smithfield Middle School, and Birdville High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 31, 2018

Sold by

Busch David and Busch Linda

Bought by

Harrison Laureen and Phee Liam

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$198,400

Outstanding Balance

$172,660

Interest Rate

4.5%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$255,291

Purchase Details

Closed on

Jul 17, 2006

Sold by

Schwarz Richard J and Schwarz Sybile L

Bought by

Busch David and Busch Linda

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$148,500

Interest Rate

6.62%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Harrison Laureen | -- | First American Title Co | |

| Busch David | -- | Alamo Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Harrison Laureen | $198,400 | |

| Previous Owner | Busch David | $148,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,541 | $233,740 | $65,000 | $168,740 |

| 2024 | $5,541 | $377,000 | $65,000 | $312,000 |

| 2023 | $6,732 | $417,372 | $65,000 | $352,372 |

| 2022 | $6,713 | $345,708 | $45,000 | $300,708 |

| 2021 | $6,453 | $253,610 | $45,000 | $208,610 |

| 2020 | $6,453 | $253,610 | $45,000 | $208,610 |

| 2019 | $6,679 | $253,610 | $45,000 | $208,610 |

| 2018 | $5,945 | $225,747 | $45,000 | $180,747 |

| 2017 | $6,265 | $232,854 | $45,000 | $187,854 |

| 2016 | $5,112 | $190,000 | $18,000 | $172,000 |

| 2015 | $4,269 | $158,900 | $18,000 | $140,900 |

| 2014 | $4,269 | $158,900 | $18,000 | $140,900 |

Source: Public Records

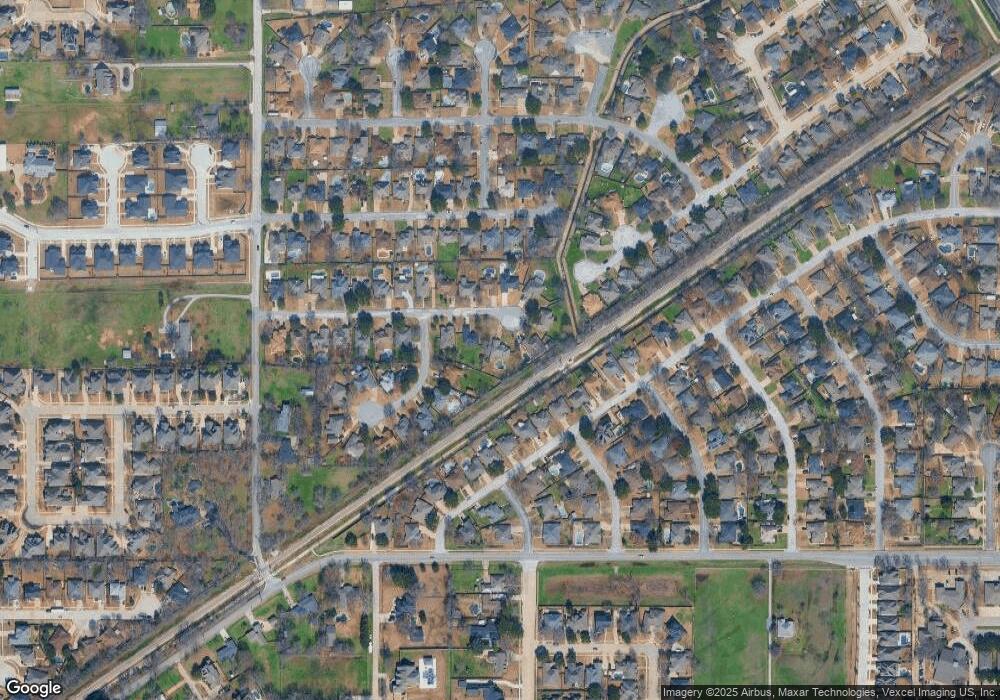

Map

Nearby Homes

- 7020 Live Oak Dr

- 7104 Melissa Ct

- 8966 Hialeah Cir S

- 7321 Fallen Oak Dr

- 7216 Everglade Dr

- 7317 Hialeah Cir W

- 9205 Cooper Ct

- 3317 S Riley Ct

- 6708 Nob Hill Ct

- 6704 Nob Hill Ct

- 717 Reese Ln

- 9017 Rumfield Rd

- 3229 David Dr

- 713 Paul Dr

- 6801 Woodland Hills Dr

- 3233 David Dr

- 6625 Crane Rd

- 8440 Stephanie Dr

- TBD Kirk Ln

- 6509 Paula Ct

- 8836 Jason Ct

- 8904 Jason Ct

- 8820 Hilary Ct

- 8832 Jason Ct

- 8908 Jason Ct

- 8816 Hilary Ct

- 8901 Jason Ct

- 9209 Meandering Dr

- 8905 Jason Ct

- 9213 Meandering Dr

- 9205 Meandering Dr

- 8835 Jason Ct

- 8909 Jason Ct

- 9217 Meandering Dr

- 9201 Meandering Dr

- 8831 Jason Ct

- 9221 Meandering Dr

- 8824 Jason Ct

- 8950 Bradley Dr

- 9121 Meandering Dr