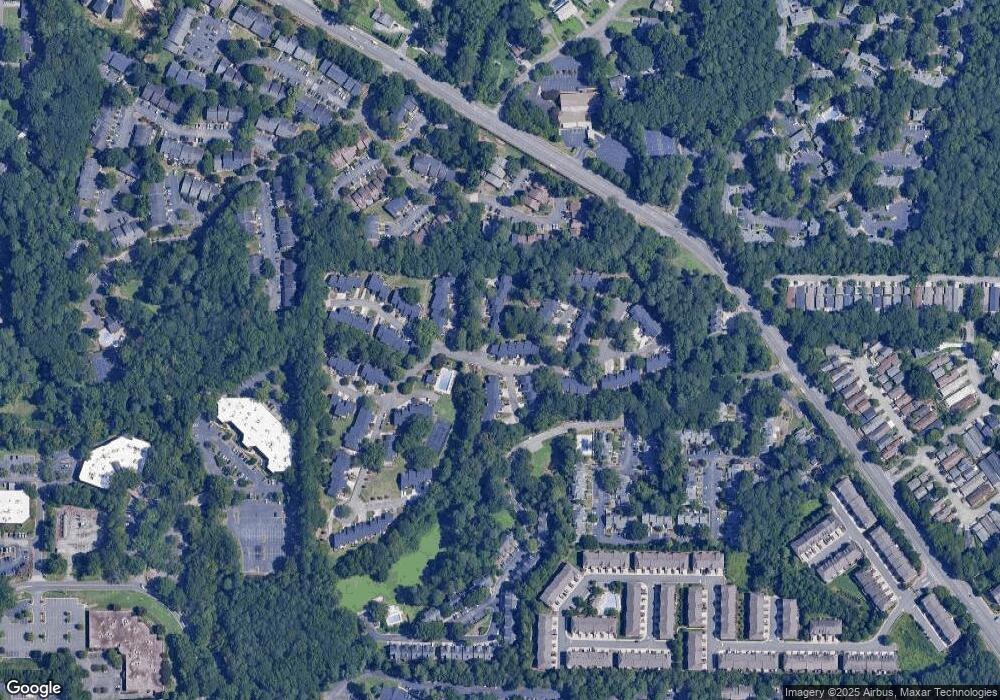

893 Cedar Creek N Unit 893 Marietta, GA 30067

Estimated Value: $268,000 - $318,000

3

Beds

3

Baths

1,576

Sq Ft

$192/Sq Ft

Est. Value

About This Home

This home is located at 893 Cedar Creek N Unit 893, Marietta, GA 30067 and is currently estimated at $302,050, approximately $191 per square foot. 893 Cedar Creek N Unit 893 is a home located in Cobb County with nearby schools including Eastvalley Elementary School, East Cobb Middle School, and Wheeler High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 4, 2022

Sold by

Chiu Everest L

Bought by

Chiu Samia I

Current Estimated Value

Purchase Details

Closed on

Oct 11, 2019

Sold by

Thames Murff Real Estate Investment Co

Bought by

Chiu Samia

Purchase Details

Closed on

May 23, 2019

Sold by

Yarde Elaine I

Bought by

Thames Murff Real Estate Investment Co

Purchase Details

Closed on

Sep 27, 2011

Sold by

Federal National Mortgage Association

Bought by

Yarde Elaine I

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,528

Interest Rate

4.26%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 4, 2011

Sold by

Brewer Camille A

Bought by

Federal Natl Mtg Assn Fnma

Purchase Details

Closed on

Jul 30, 2004

Sold by

Weisberg Loretta G

Bought by

Brewer Camille A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$102,400

Interest Rate

6.75%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chiu Samia I | -- | None Listed On Document | |

| Chiu Samia | $198,000 | -- | |

| Thames Murff Real Estate Investment Co | $123,000 | -- | |

| Yarde Elaine I | $50,660 | -- | |

| Federal Natl Mtg Assn Fnma | $104,475 | -- | |

| Brewer Camille A | $128,000 | -- | |

| Weisberg Loretta G | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Yarde Elaine I | $40,528 | |

| Previous Owner | Weisberg Loretta G | $102,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,239 | $116,440 | $34,000 | $82,440 |

| 2023 | $2,423 | $116,440 | $34,000 | $82,440 |

| 2022 | $2,553 | $84,104 | $28,000 | $56,104 |

| 2021 | $2,324 | $76,580 | $14,000 | $62,580 |

| 2020 | $2,324 | $76,580 | $14,000 | $62,580 |

| 2019 | $283 | $49,896 | $14,000 | $35,896 |

| 2018 | $259 | $41,812 | $8,800 | $33,012 |

| 2017 | $236 | $41,812 | $8,800 | $33,012 |

| 2016 | $232 | $39,620 | $8,800 | $30,820 |

| 2015 | $206 | $27,104 | $6,000 | $21,104 |

| 2014 | $210 | $27,104 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 2638 Stoney Creek Rd SE

- 738 Brentwood Place SE

- 2471 Cedar Brook W

- 2497 Cedar Canyon Place SE

- 708 Hanover Ln SE

- 2240 Runnymead Ridge SE

- 2685 Meadowlawn Dr SE

- 2683 Meadowlawn Dr SE

- 2238 Surrey Ct SE

- 1035 Willow Field Ln SE

- 936 Bobcat Ct SE

- 940 Bobcat Ct SE

- 935 Bobcat Ct SE

- 946 Bobcat Ct SE

- 2960 Black Bear Dr SE

- 2774 Birch Grove Ln SE Unit 11

- 731 Smithstone Ct SE

- 2961 Hawk Ct SE

- 887 Cedar Creek N Unit 5

- 885 Cedar Creek N Unit 885

- 885 Cedar Creek N Unit 5

- 895 Cedar Creek N

- 893 Cedar Creek N

- 887 Cedar Creek N

- 885 Cedar Creek N

- 895 Cedar Creek N Unit 895

- 895 Cedar Creek N Unit 5

- 895 Cedar Creek N

- 889 Cedar Creek N

- N Cedar Creek

- 891 Cedar Creek N

- 861 Cedar Creek N

- 0 Cedar Creek Ct

- 2521 Cedar Canyon Rd SE Unit 2521

- 2525 Cedar Canyon Rd SE

- 2519 Cedar Canyon Rd SE

- 2517 Cedar Canyon Rd SE

- 2515 Cedar Canyon Rd SE