8932 Thornton Garden Ln Raleigh, NC 27616

Forestville NeighborhoodEstimated Value: $257,860 - $286,000

3

Beds

3

Baths

1,364

Sq Ft

$194/Sq Ft

Est. Value

About This Home

This home is located at 8932 Thornton Garden Ln, Raleigh, NC 27616 and is currently estimated at $264,965, approximately $194 per square foot. 8932 Thornton Garden Ln is a home located in Wake County with nearby schools including Wildwood Forest Elementary, East Millbrook Middle, and Wakefield High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 14, 2018

Sold by

Magram Richard O and Chang Qing

Bought by

Dark Star Properties Llc

Current Estimated Value

Purchase Details

Closed on

Jul 1, 2018

Sold by

Villanueva Ailea and Rock Zachary David

Bought by

Magram Richard O

Purchase Details

Closed on

May 17, 2018

Sold by

Bravo Matthew and Bravo Jennifer

Bought by

Villanueva Ailea

Purchase Details

Closed on

Feb 1, 2006

Sold by

Anderson Homes Inc

Bought by

Bravo Matthew and Villanueva Ailea

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$104,112

Interest Rate

5.87%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dark Star Properties Llc | -- | None Available | |

| Magram Richard O | $158,000 | None Available | |

| Villanueva Ailea | -- | None Available | |

| Bravo Matthew | $130,500 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bravo Matthew | $104,112 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,376 | $270,111 | $65,000 | $205,111 |

| 2024 | $2,366 | $270,111 | $65,000 | $205,111 |

| 2023 | $1,779 | $161,361 | $35,000 | $126,361 |

| 2022 | $1,654 | $161,361 | $35,000 | $126,361 |

| 2021 | $1,590 | $161,361 | $35,000 | $126,361 |

| 2020 | $1,561 | $161,361 | $35,000 | $126,361 |

| 2019 | $1,512 | $128,759 | $26,000 | $102,759 |

| 2018 | $0 | $128,759 | $26,000 | $102,759 |

| 2017 | $1,359 | $128,759 | $26,000 | $102,759 |

| 2016 | $1,332 | $128,759 | $26,000 | $102,759 |

| 2015 | $1,335 | $126,987 | $26,000 | $100,987 |

| 2014 | -- | $126,987 | $26,000 | $100,987 |

Source: Public Records

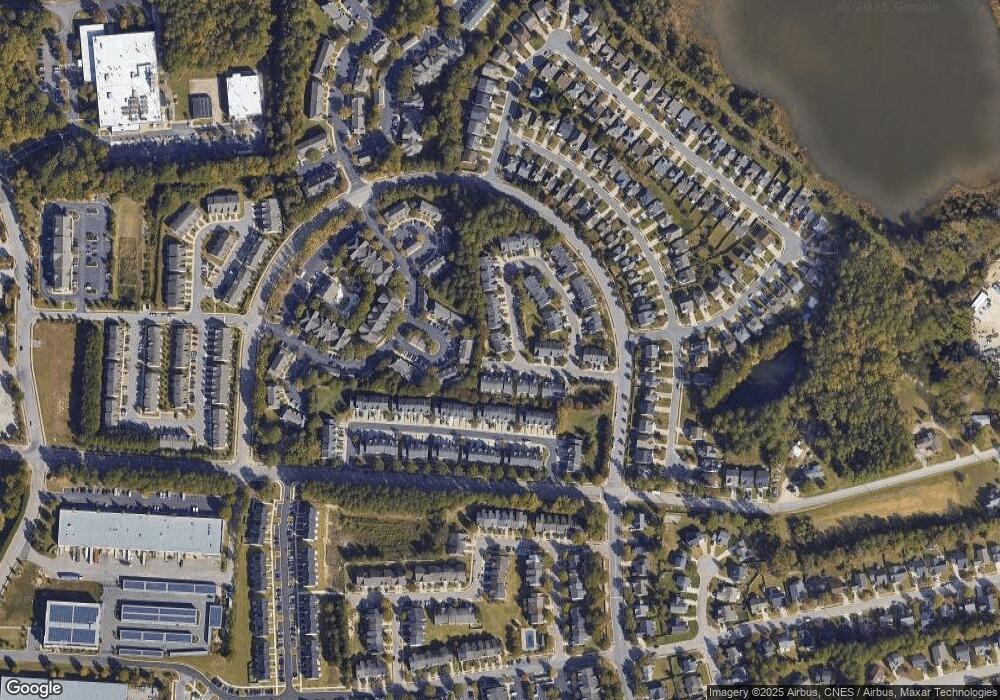

Map

Nearby Homes

- 8857 Thornton Town Place

- 5163 Sandy Banks Rd

- 5107 Sandy Banks Rd

- 8957 Commons Townes Dr

- 5121 Neuse Commons Ln

- 8707 River Keeper Way

- 8620 Neuse Club Ln Unit 107

- 8620 Neuse Club Ln Unit 111

- 8610 Neuse Landing Ln Unit 103

- JONATHAN Plan at Thornton Townes

- SYDNEY Plan at Thornton Townes

- 4821 Gossamer Ln Unit 105

- 4820 Gossamer Ln Unit 101 & 102

- 4820 Gossamer Ln Unit 104

- 8611 Brushfoot Way Unit 107

- 8702 Neuse Town Dr

- 8529 Beckett Chase Way

- 8523 Beckett Chase Way

- 8521 Beckett Chase Way

- 8519 Beckett Chase Way

- 8930 Thornton Garden Ln

- 8928 Thornton Garden Ln

- 8922 Thornton Garden Ln

- 5115 Thornton Knoll Way

- 8920 Thornton Garden Ln

- 5108 Thornton Knoll Way

- 5110 Thornton Knoll Way

- 5106 Thornton Knoll Way

- 5106 Thornton Noll Way

- 5104 Thornton Noll Way

- 5112 Thornton Knoll Way

- 5104 Thornton Knoll Way

- 8918 Thornton Garden Ln

- 5117 Thornton Knoll Way

- 5102 Thornton Knoll Way

- 5114 Thornton Knoll Way

- 8916 Thornton Garden Ln

- 5116 Thornton Knoll Way

- 5119 Thornton Noll Way

- 5119 Thornton Knoll Way