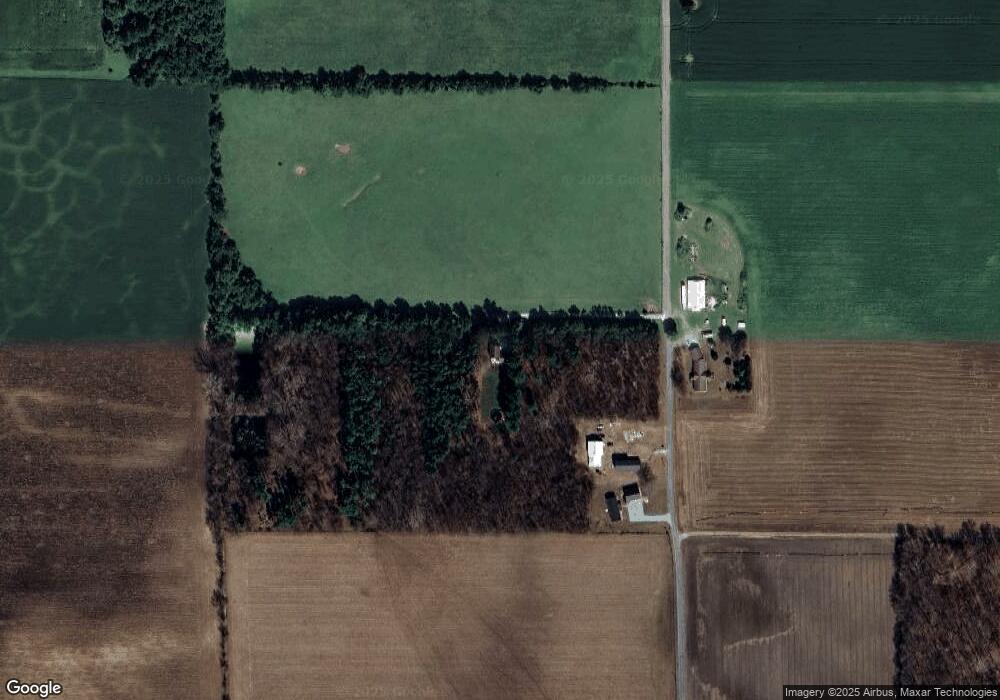

8939 Chestnut Rd Bourbon, IN 46504

Estimated Value: $245,000 - $438,954

3

Beds

4

Baths

1,924

Sq Ft

$163/Sq Ft

Est. Value

About This Home

This home is located at 8939 Chestnut Rd, Bourbon, IN 46504 and is currently estimated at $313,739, approximately $163 per square foot. 8939 Chestnut Rd is a home located in Marshall County with nearby schools including Triton Elementary School, Triton Junior-Senior High School, and Dausman Prairie School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 23, 2019

Sold by

Hepler Jeremy Christopher

Bought by

Hepler Jeremy Christopher and Richman Laura

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$164,500

Interest Rate

3.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 28, 2016

Sold by

Hepler Shannan Lynne

Bought by

Hepler Jeremy Christopher

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,000

Interest Rate

4.08%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hepler Jeremy Christopher | -- | None Available | |

| Hepler Jeremy Christopher | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Hepler Jeremy Christopher | $164,500 | |

| Closed | Hepler Jeremy Christopher | $168,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,857 | $277,100 | $64,700 | $212,400 |

| 2022 | $1,857 | $269,400 | $61,000 | $208,400 |

| 2021 | $1,687 | $213,300 | $46,900 | $166,400 |

| 2020 | $1,478 | $196,000 | $43,800 | $152,200 |

| 2019 | $1,368 | $183,200 | $31,800 | $151,400 |

| 2018 | $1,361 | $178,400 | $30,600 | $147,800 |

| 2017 | $1,297 | $179,100 | $30,600 | $148,500 |

| 2016 | $1,102 | $171,200 | $31,300 | $139,900 |

| 2014 | $1,046 | $160,300 | $28,600 | $131,700 |

Source: Public Records

Map

Nearby Homes

- 606 N Thayer St

- 600 W Liberty Ave

- 301 E North St

- 301 E Center St

- 301 S Washington St

- 9135 W 750 N

- 6974 Lincoln Hwy

- 7217 11a Rd

- 320 N Walnut St

- Vacant land 3rd Rd

- 8585 8a Rd

- 2960 Sycamore Ln

- 8919 9b Rd

- 4110 3rd Rd

- 136 Tulip Cir

- 4346 2c Rd

- 124 E Grant St

- 169 Beechwood Dr

- 516 S Shumaker Dr

- 11557 Jute Rd

- 8945 Chestnut Rd

- 8930 Chestnut Rd

- 8983 Chestnut Rd

- 9175 Chestnut Rd

- 9000 Chestnut Rd

- 8509 Chestnut Rd

- 8508 Chestnut Rd

- 9148 State Road 331

- 8671 State Road 331

- 9175 State Road 331

- 2778 9b Rd

- 8262 Chestnut Rd

- 2675 9b Rd

- 8220 Chestnut Rd

- 2781 9b Rd

- 0 Cedar Rd

- 0 Cedar Rd Unit 201846971

- 8159 Chestnut Rd

- 3058 9b Rd

- 8200 State Road 331

Your Personal Tour Guide

Ask me questions while you tour the home.