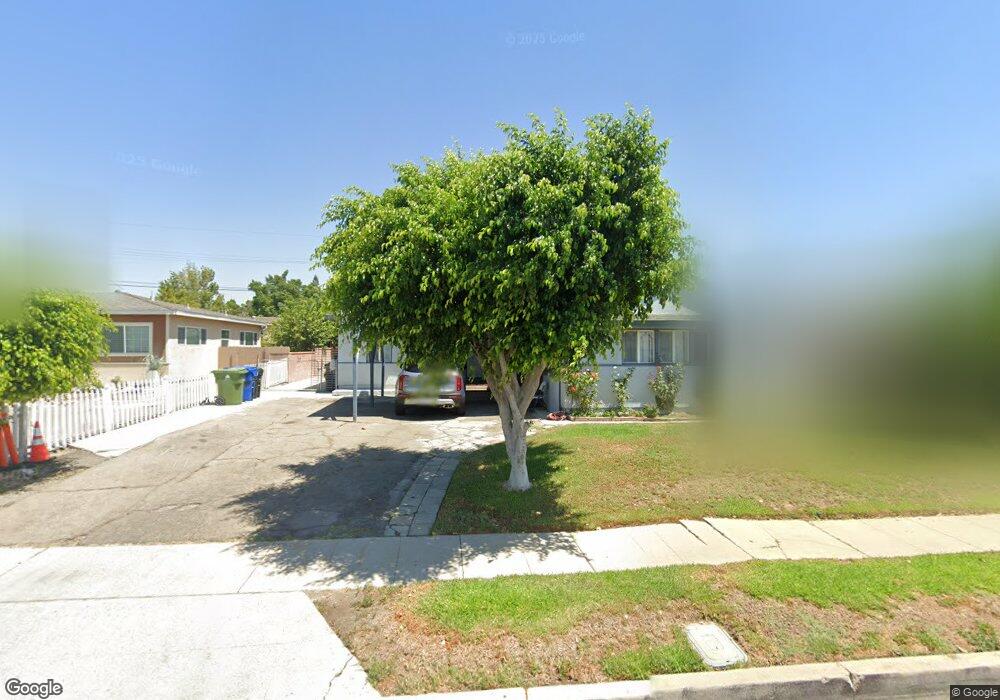

8940 Bartee Ave Arleta, CA 91331

Estimated Value: $836,348 - $957,000

4

Beds

2

Baths

1,587

Sq Ft

$552/Sq Ft

Est. Value

About This Home

This home is located at 8940 Bartee Ave, Arleta, CA 91331 and is currently estimated at $876,587, approximately $552 per square foot. 8940 Bartee Ave is a home located in Los Angeles County with nearby schools including Vena Avenue Elementary School, Richard E. Byrd Middle School, and John H. Francis Polytechnic.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 30, 2008

Sold by

Rodriguez Elizabeth

Bought by

Alcaraz Eodan

Current Estimated Value

Purchase Details

Closed on

Jan 18, 2007

Sold by

Alcaraz Eodan

Bought by

Alcaraz Eodan

Purchase Details

Closed on

Sep 25, 2006

Sold by

Neff Hal

Bought by

Alcaraz Eodan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$109,600

Interest Rate

6.39%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Apr 7, 2006

Sold by

Blake Christopher P and Blake Patricia S

Bought by

Neff Hal

Purchase Details

Closed on

Mar 24, 2006

Sold by

Blake Patricia

Bought by

Blake Christopher

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Alcaraz Eodan | -- | None Available | |

| Alcaraz Eodan | -- | Accommodation | |

| Alcaraz Eodan | $548,000 | First Southwestern Title Co | |

| Alcaraz Eodan | -- | First Southwestern Title Co | |

| Neff Hal | $380,000 | First Southwestern Title Co | |

| Neff Hal | -- | First Southwestern Title Co | |

| Blake Christopher | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Alcaraz Eodan | $109,600 | |

| Previous Owner | Alcaraz Eodan | $438,400 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,983 | $734,187 | $587,355 | $146,832 |

| 2024 | $8,983 | $719,792 | $575,839 | $143,953 |

| 2023 | $8,812 | $705,680 | $564,549 | $141,131 |

| 2022 | $8,405 | $691,844 | $553,480 | $138,364 |

| 2021 | $8,301 | $678,279 | $542,628 | $135,651 |

| 2019 | $6,867 | $557,000 | $444,000 | $113,000 |

| 2018 | $5,776 | $463,000 | $369,000 | $94,000 |

| 2016 | $5,312 | $428,000 | $341,000 | $87,000 |

| 2015 | $4,943 | $397,000 | $316,700 | $80,300 |

| 2014 | $5,060 | $397,000 | $316,700 | $80,300 |

Source: Public Records

Map

Nearby Homes

- 12966 Crowley St

- 13021 Crowley St

- 13040 Wentworth St

- 9106 Lev Ave

- 13151 Crowley St

- 9352 Condor Ct

- 9123 Amboy Ave

- 13164 Bracken St

- 12406 Haley St

- 12745 Muscatine St

- 9205 Haddon Ave

- 9147 Haddon Ave

- 9502 Laurel Canyon Blvd

- 13329 Chase St

- 2125 N Laurel Canyon Blvd

- 13068 Mineola St

- 13150 Millrace St

- 9562 Sundance St

- 9264 Cayuga Ave

- 13509 Montague St

- 8934 Bartee Ave

- 8946 Bartee Ave

- 8967 Patrick Ave

- 8961 Patrick Ave

- 8973 Patrick Ave

- 8952 Bartee Ave

- 8941 Bartee Ave

- 9001 Patrick Ave

- 8947 Bartee Ave

- 8935 Bartee Ave

- 8958 Bartee Ave

- 8953 Bartee Ave

- 12838 Tonopah St

- 12832 Tonopah St

- 9007 Patrick Ave

- 12844 Tonopah St

- 12826 Tonopah St

- 8964 Bartee Ave

- 12850 Tonopah St

- 8966 Patrick Ave