900 W 1st St West Concord, MN 55985

Estimated Value: $225,872 - $243,000

2

Beds

1

Bath

1,108

Sq Ft

$211/Sq Ft

Est. Value

About This Home

This home is located at 900 W 1st St, West Concord, MN 55985 and is currently estimated at $234,218, approximately $211 per square foot. 900 W 1st St is a home located in Dodge County with nearby schools including Triton Elementary School, Triton Middle School, and Triton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 19, 2008

Sold by

Farmers State Bank Of West Concord

Bought by

Albert Ii Floyd T and Albert Sandra S

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,500

Interest Rate

5.03%

Mortgage Type

VA

Purchase Details

Closed on

Aug 25, 2008

Sold by

Hoaglund Engine Service Llc

Bought by

Farmers State Bank Of West Concord

Purchase Details

Closed on

Jul 18, 2005

Sold by

City Of West Concord

Bought by

Hoaglund Engine Service Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Albert Ii Floyd T | -- | North American Title Co | |

| Farmers State Bank Of West Concord | -- | Atypical Title Inc | |

| Hoaglund Engine Service Llc | $40,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Albert Ii Floyd T | $138,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,156 | $213,900 | $15,500 | $198,400 |

| 2024 | $3,102 | $205,900 | $15,500 | $190,400 |

| 2023 | $3,116 | $205,200 | $15,500 | $189,700 |

| 2022 | $3,224 | $197,300 | $15,500 | $181,800 |

| 2021 | $3,300 | $172,300 | $15,500 | $156,800 |

| 2020 | $3,204 | $171,800 | $16,200 | $155,600 |

| 2019 | $2,702 | $152,200 | $16,200 | $136,000 |

| 2018 | $2,544 | $119,300 | $16,200 | $103,100 |

| 2017 | $2,470 | $109,200 | $16,200 | $93,000 |

| 2016 | $2,006 | $107,500 | $16,200 | $91,300 |

| 2015 | $1,988 | $89,000 | $16,200 | $72,800 |

| 2014 | $1,902 | $0 | $0 | $0 |

Source: Public Records

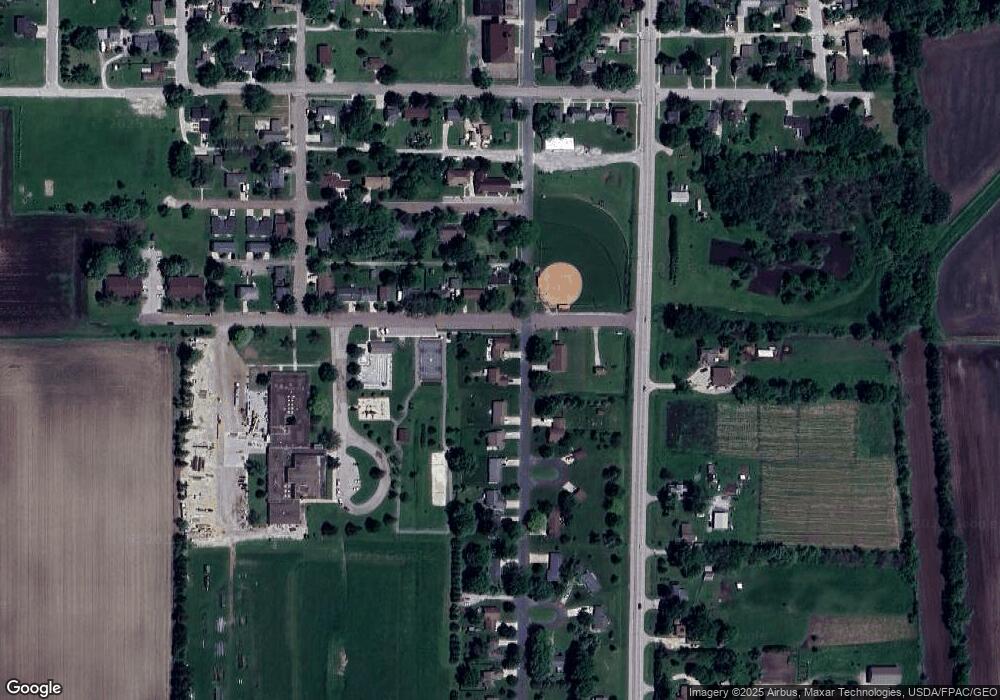

Map

Nearby Homes

- 55570 State Highway 56

- 501 Shady Ln

- 520 State St

- 113 Olive St

- 416 State St

- 215 Irvin St

- 124 Ellington St

- 18216 535th St

- County Road 22

- 20128 554th St

- 59879 185th Ave

- 54185 232nd Ave

- 20918 604th St

- 22842 530th St

- xxxxx 530th St

- 62539 185th Ave

- 1218 Highway St N

- 809 5th Ave NW

- 406 7th St NW

- 107 4th Ave NE