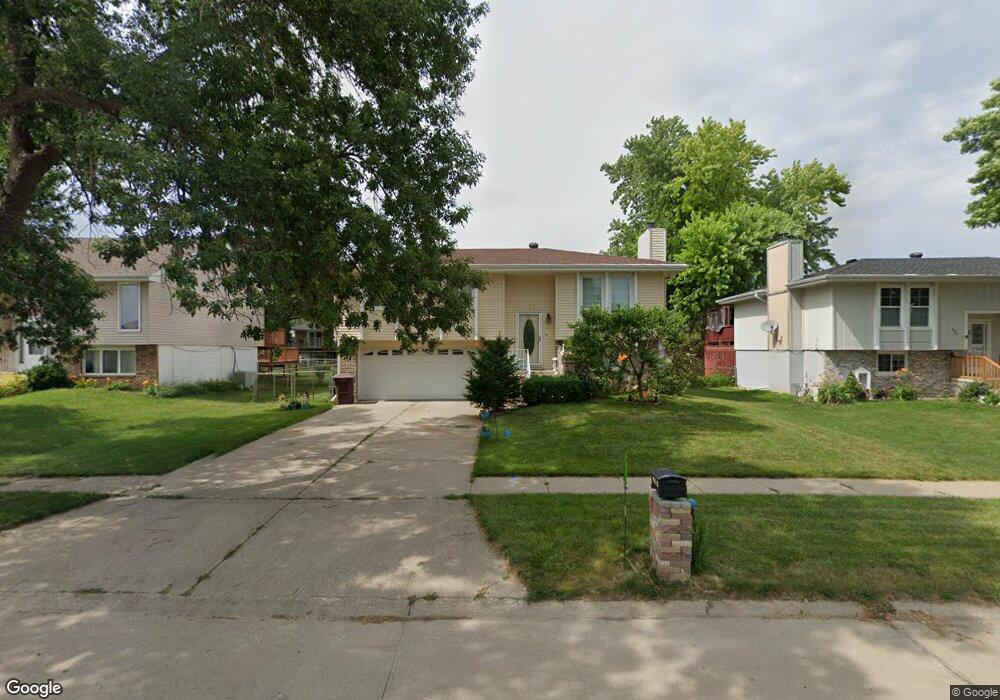

901 E 37th St South Sioux City, NE 68776

Estimated Value: $265,751 - $302,000

4

Beds

3

Baths

1,288

Sq Ft

$217/Sq Ft

Est. Value

About This Home

This home is located at 901 E 37th St, South Sioux City, NE 68776 and is currently estimated at $279,688, approximately $217 per square foot. 901 E 37th St is a home located in Dakota County with nearby schools including Cardinal Elementary School, South Sioux City Middle School, and South Sioux Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 28, 2009

Sold by

Zavala Roberto J and Garcia Nancy B

Bought by

Magana Isaias Magana and Magana Margarita Pineda De

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$91,575

Outstanding Balance

$59,920

Interest Rate

5.2%

Mortgage Type

FHA

Estimated Equity

$219,768

Purchase Details

Closed on

May 31, 2005

Sold by

Dillard Frank M and Dillard Kathryn M

Bought by

Zavala Roberto J and Garcia Nancy B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$117,653

Interest Rate

5.83%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 27, 2004

Sold by

Dillard Rickwa and Dillard Damien M Amra K

Bought by

Dillard Frank M and Dillard Kathryn M

Purchase Details

Closed on

Apr 3, 2001

Sold by

Remax International Relocation

Bought by

Rickwa and Dillard Damien M Amra K

Purchase Details

Closed on

Jun 29, 2000

Sold by

Mancilla Leoncio and Mancilla Maria

Bought by

Romo Roland B and Romo Ann M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Magana Isaias Magana | $128,000 | -- | |

| Zavala Roberto J | $93,333 | -- | |

| Dillard Frank M | $115,000 | -- | |

| Rickwa | $101,500 | -- | |

| Romo Roland B | $99,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Magana Isaias Magana | $91,575 | |

| Previous Owner | Zavala Roberto J | $117,653 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,871 | $220,260 | $17,025 | $203,235 |

| 2023 | $3,526 | $198,545 | $15,760 | $182,785 |

| 2022 | $3,323 | $173,780 | $15,760 | $158,020 |

| 2021 | $3,160 | $159,415 | $15,760 | $143,655 |

| 2020 | $3,130 | $156,555 | $15,760 | $140,795 |

| 2019 | $3,139 | $156,555 | $15,760 | $140,795 |

| 2018 | $3,079 | $152,315 | $14,490 | $137,825 |

| 2017 | $2,719 | $134,805 | $14,490 | $120,315 |

| 2016 | $2,131 | $107,495 | $14,490 | $93,005 |

| 2014 | $2,526 | $122,680 | $16,065 | $106,615 |

Source: Public Records

Map

Nearby Homes

- 825 Ash St

- 3819 Crescent Ln

- 3722 Le Mesa Way

- 324 Regency Ct

- 300 Kerri Ln

- 605 Stagecoach Rd

- 125 E 30th St

- 214 W 31st St

- 3652 Prairie Grove

- 438 Walnut Ln

- 3430 Walnut Ln

- 3530 Walnut Ln

- 3420 Walnut Ln

- 437 Walnut Ln

- 2101 F St

- 389 Willow Gardens

- 3312 Cedar Mill Way

- 3200 Cider Mill Way

- 114 Oakmont Dr

- 1840 Ogden Ct