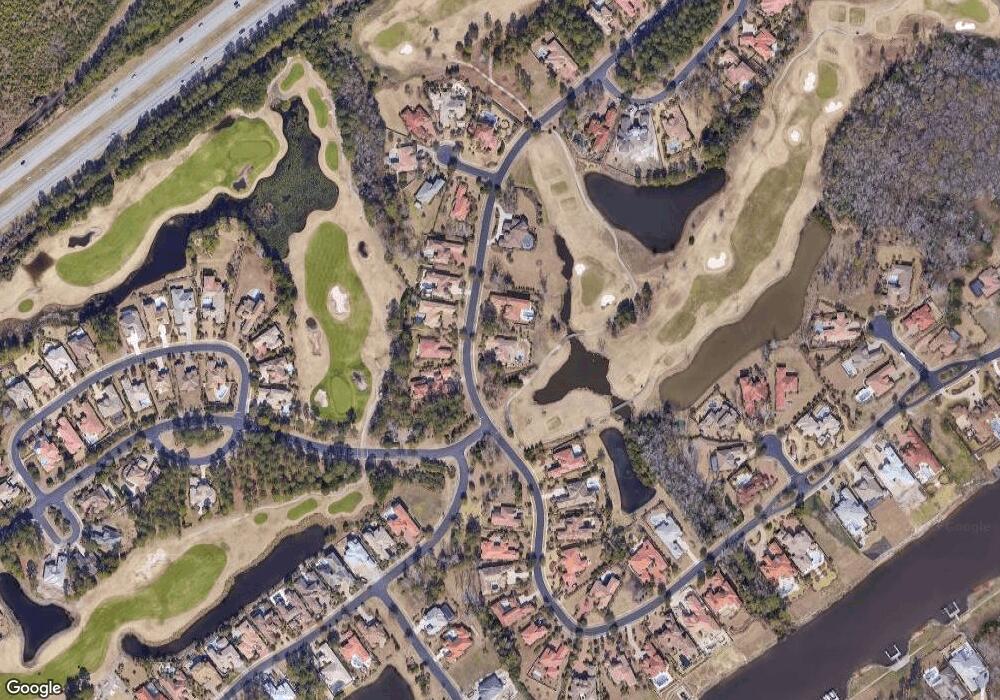

9020 Bellasera Cir Unit 176 Member's Club Myrtle Beach, SC 29579

Grande Dunes NeighborhoodEstimated Value: $1,577,202 - $1,853,000

4

Beds

5

Baths

5,500

Sq Ft

$303/Sq Ft

Est. Value

About This Home

This home is located at 9020 Bellasera Cir Unit 176 Member's Club, Myrtle Beach, SC 29579 and is currently estimated at $1,668,551, approximately $303 per square foot. 9020 Bellasera Cir Unit 176 Member's Club is a home located in Horry County with nearby schools including Myrtle Beach Child Development Center, Myrtle Beach Elementary School, and Myrtle Beach Primary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 21, 2021

Sold by

Vincent Clarence J

Bought by

Rotte Randolph Richard and Rotte Lisa Ann

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$900,000

Outstanding Balance

$801,692

Interest Rate

2.6%

Mortgage Type

VA

Estimated Equity

$866,859

Purchase Details

Closed on

Oct 23, 2019

Sold by

Vincent Clarence J

Bought by

Vincent Clarence J Tr and Barbara J Tr

Purchase Details

Closed on

Nov 14, 2011

Sold by

Yates Mark C

Bought by

Vincent Clarence J

Purchase Details

Closed on

Sep 17, 2007

Sold by

Classic Home Building & Design Inc

Bought by

Yates Mark C and Yates Katherine W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,272,055

Interest Rate

7.62%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 15, 2006

Sold by

Grande Dunes Development Co Llc

Bought by

Classic Home Building & Design Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,172,407

Interest Rate

6.41%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 4, 2005

Sold by

Burroughs & Chapin Co Inc

Bought by

Grande Dunes Development Co Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rotte Randolph Richard | $1,000,000 | -- | |

| Vincent Clarence J Tr | -- | -- | |

| Vincent Clarence J | $825,000 | -- | |

| Yates Mark C | $1,696,073 | Attorney | |

| Classic Home Building & Design Inc | $349,508 | None Available | |

| Grande Dunes Development Co Llc | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rotte Randolph Richard | $900,000 | |

| Previous Owner | Yates Mark C | $1,272,055 | |

| Previous Owner | Classic Home Building & Design Inc | $1,172,407 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,488 | $70,649 | $19,234 | $51,415 |

| 2023 | $4,488 | $45,792 | $10,324 | $35,468 |

| 2021 | $4,030 | $120,205 | $27,101 | $93,104 |

| 2020 | $3,486 | $120,205 | $27,101 | $93,104 |

| 2019 | $3,026 | $120,205 | $27,101 | $93,104 |

| 2018 | $2,680 | $94,725 | $16,500 | $78,225 |

| 2017 | $2,605 | $84,511 | $6,286 | $78,225 |

| 2016 | $0 | $84,511 | $6,286 | $78,225 |

| 2015 | -- | $36,086 | $6,286 | $29,800 |

| 2014 | $2,158 | $33,642 | $6,286 | $27,356 |

Source: Public Records

Map

Nearby Homes

- 1501 Serena Dr

- 9891 Bellasera Cir

- 8969 Bella Verde Ct

- 9684 Ravello Ct

- 9675 Ravello Ct

- 9765 Ravello Ct

- 9237 Bellasera Cir

- 9185 Marina Pkwy

- 9285 Bellasera Cir

- 1330 Villa Marbella Ct Unit 303

- 9235 Marina Pkwy Unit GRANDE DUNES BAL HAR

- 1346 Villa Marbella Ct Unit 2-102

- 9243 Marina Pkwy

- 9107 Marina Pkwy

- 9329 Marina Pkwy

- 9305 Cove Dr

- 9325 Cove Dr

- 9318 Cove Dr

- 9485 Ronda Ct

- 8121 Amalfi Place Unit 7-304

- 9020 Bellasera Cir

- 9044 Bellasera Cir

- 9050 Bellasera Cir Unit 174 Members Club

- 9021 Bellasera Cir

- 9031 Bellasera Cir

- 9031 Bellasera Cir Unit Lot 3 Members Club

- 9011 Bellasera Cir

- 4517 Bellasera Cir Unit 49 Members Club

- 9041 Bellasera Cir

- 9041 Bellasera Cir Unit 4 Members Club

- 9041 Bellasera Cir Unit 9041 Bellasara Circl

- 9051 Bellasera Cir

- 9936 Bellasera Cir Unit 94 Member's Club

- 9068 Bellasera Cir Unit Members Club

- 9928 Bellasera Cir

- 9921 Bellasera Cir

- 1461 Serena Dr

- 1461 Serena Dr Unit Lot 48

- 1525 Genoa Ct Unit 7 Members Club

- 1525 Genoa Ct