9020 Dancy Tree Ct Orlando, FL 32836

Dr. Phillips NeighborhoodEstimated Value: $784,213 - $918,000

4

Beds

3

Baths

2,577

Sq Ft

$329/Sq Ft

Est. Value

About This Home

This home is located at 9020 Dancy Tree Ct, Orlando, FL 32836 and is currently estimated at $848,303, approximately $329 per square foot. 9020 Dancy Tree Ct is a home located in Orange County with nearby schools including Bay Meadows Elementary School, Southwest Middle, and Orlando Jewish Day School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 23, 2016

Sold by

Fort Janice St and Fort Peter St

Bought by

Nayak Sandhya and Ramaiah Narendranath

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,000

Outstanding Balance

$333,084

Interest Rate

3.43%

Mortgage Type

New Conventional

Estimated Equity

$515,219

Purchase Details

Closed on

Feb 16, 2007

Sold by

St Fort Janice

Bought by

St Fort Peter and St Fort Janice

Purchase Details

Closed on

Dec 29, 2006

Sold by

Raby Antony C

Bought by

St Fort Janice

Purchase Details

Closed on

Apr 9, 2001

Sold by

Park Square Ents Inc C

Bought by

Raby Antony C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,700

Interest Rate

7.11%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Nayak Sandhya | $475,000 | Attorney | |

| St Fort Peter | -- | Attorney | |

| St Fort Janice | $850,000 | None Available | |

| Raby Antony C | $347,700 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Nayak Sandhya | $417,000 | |

| Previous Owner | Raby Antony C | $260,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,147 | $473,768 | -- | -- |

| 2024 | $6,662 | $473,768 | -- | -- |

| 2023 | $6,662 | $447,006 | $0 | $0 |

| 2022 | $6,445 | $433,986 | $0 | $0 |

| 2021 | $6,356 | $421,346 | $90,000 | $331,346 |

| 2020 | $6,192 | $424,328 | $90,000 | $334,328 |

| 2019 | $6,565 | $425,809 | $90,000 | $335,809 |

| 2018 | $6,602 | $423,141 | $95,000 | $328,141 |

| 2017 | $6,793 | $430,664 | $110,000 | $320,664 |

| 2016 | $7,696 | $437,406 | $110,000 | $327,406 |

| 2015 | $7,494 | $415,193 | $100,000 | $315,193 |

| 2014 | $7,243 | $400,557 | $95,000 | $305,557 |

Source: Public Records

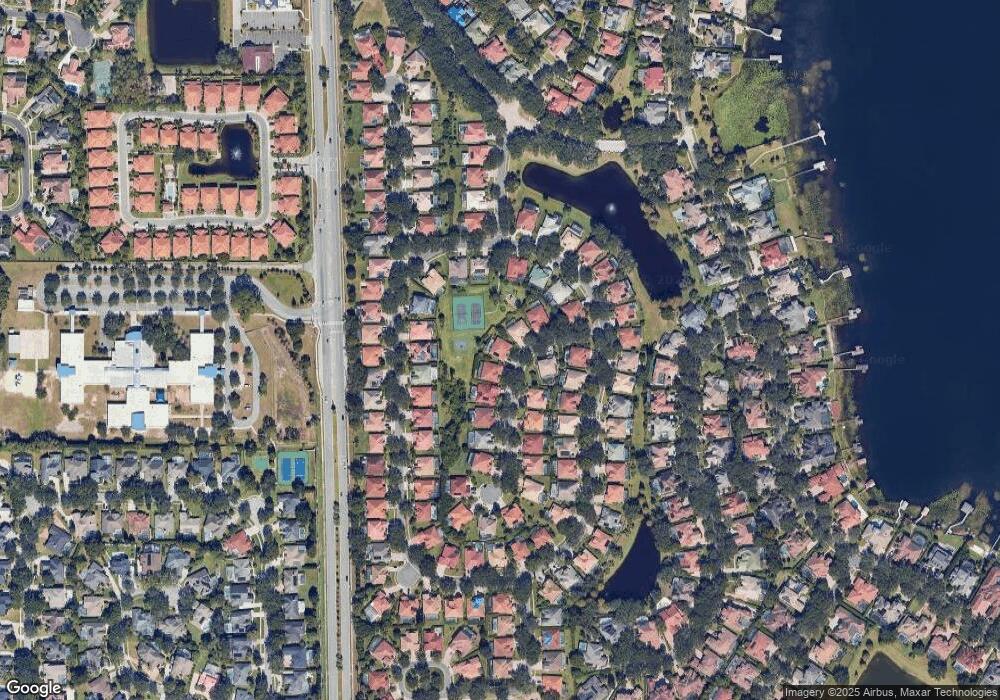

Map

Nearby Homes

- 9050 Dancy Tree Ct

- 8924 Heritage Bay Cir

- 9060 Heritage Bay Cir

- 8955 Heritage Bay Cir

- 8824 Elliotts Ct

- 8854 Oak Landings Ct

- 8888 Della Scala Cir

- 8915 Della Scala Cir

- 9285 Wickham Way

- 8714 Bristol Park Dr

- 9245 Southern Breeze Dr

- 8740 Ingleton Ct

- 9233 Southern Breeze Dr

- 9142 Southern Breeze Dr

- 9602 Bay Vista Estates Blvd Unit 2

- 9102 Southern Breeze Dr

- 8629 Granada Blvd

- 8743 Alegre Cir

- 8744 Alegre Cir

- 9564 Kilgore Rd

- 9014 Dancy Tree Ct

- 9026 Dancy Tree Ct

- 9032 Dancy Tree Ct

- 9008 Dancy Tree Ct

- 9033 Dancy Tree Ct

- 9038 Dancy Tree Ct

- 8862 Heritage Bay Cir

- 8846 Heritage Bay Cir

- 9054 Heritage Bay Cir

- 8814 Heritage Bay Cir

- 9039 Dancy Tree Ct

- 9066 Heritage Bay Cir

- 8900 Heritage Bay Cir

- 8808 Heritage Bay Cir

- 8826 Heritage Bay Cir

- 8838 Heritage Bay Cir

- 9048 Heritage Bay Cir

- 8906 Heritage Bay Cir

- 9072 Heritage Bay Cir