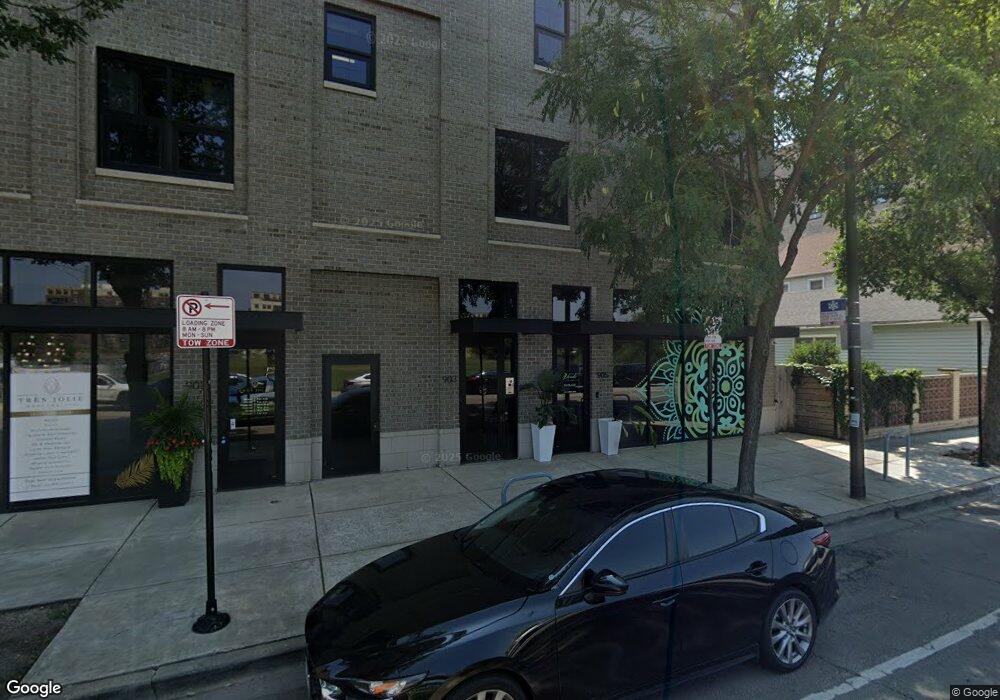

903 W 18th St Chicago, IL 60608

Pilsen NeighborhoodEstimated Value: $977,000

14

Beds

8

Baths

13,204

Sq Ft

$74/Sq Ft

Est. Value

About This Home

This home is located at 903 W 18th St, Chicago, IL 60608 and is currently estimated at $977,000, approximately $73 per square foot. 903 W 18th St is a home located in Cook County with nearby schools including Juarez Community Academy High School and Youth Connection Leadership Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 30, 2015

Sold by

Guzlas Roger and Guzlas Jessica K

Bought by

Msquared Properties Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$337,500

Outstanding Balance

$260,097

Interest Rate

3.77%

Mortgage Type

Commercial

Estimated Equity

$716,903

Purchase Details

Closed on

Feb 15, 2008

Sold by

Guzlas Roger

Bought by

Guzlas Roger and Guzlas Jessica K

Purchase Details

Closed on

Jul 23, 1998

Sold by

Christ Rita R and Bielanski Deborah

Bought by

Guzlas Roger

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$79,120

Interest Rate

6.99%

Mortgage Type

Commercial

Purchase Details

Closed on

Jul 21, 1998

Sold by

Christ Rita R and Christ William

Bought by

Christ Rita R and Bielanski Deborah L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$79,120

Interest Rate

6.99%

Mortgage Type

Commercial

Purchase Details

Closed on

Oct 29, 1993

Sold by

Christ Rita

Bought by

Christ Rita and Bielanski Deborah L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Msquared Properties Llc | $450,000 | None Available | |

| Guzlas Roger | -- | None Available | |

| Guzlas Roger | -- | -- | |

| Christ Rita R | -- | -- | |

| Christ Rita | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Msquared Properties Llc | $337,500 | |

| Previous Owner | Guzlas Roger | $79,120 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,852 | $55,339 | $7,585 | $47,754 |

| 2023 | $3,755 | $18,259 | $6,150 | $12,109 |

| 2022 | $3,755 | $18,259 | $6,150 | $12,109 |

| 2021 | $3,672 | $18,258 | $6,150 | $12,108 |

| 2020 | $14,752 | $66,223 | $4,817 | $61,406 |

| 2019 | $15,300 | $76,152 | $4,817 | $71,335 |

| 2018 | $4,830 | $24,453 | $4,817 | $19,636 |

| 2017 | $905 | $4,202 | $4,202 | $0 |

| 2016 | $3,887 | $21,905 | $4,202 | $17,703 |

| 2015 | $3,533 | $21,905 | $4,202 | $17,703 |

| 2014 | $3,010 | $18,791 | $3,690 | $15,101 |

| 2013 | $3,130 | $19,839 | $3,690 | $16,149 |

Source: Public Records

Map

Nearby Homes

- 1828 S Peoria St

- 947 W 18th St

- 1728 S Halsted St

- 1920 S Shelby Ct

- 1019 W 18th St

- 1017 W 19th St

- 1610 S Halsted St Unit 504

- 1001 W 16th St

- 1003 W 16th St Unit 3W

- 1003 W 16th St Unit 1E

- 1003 W 16th St Unit 2W

- 1024 W 18th Place

- 1024 W 19th St Unit 1

- 1036 W 18th St

- 718 W 17th St Unit 1W

- 833 W 15th Place Unit 315E

- 833 W 15th Place Unit 606W

- 833 W 15th Place Unit 514E

- 811 W 15th Place Unit 708

- 811 W 15th Place Unit 513

- 903 W 18th St Unit 2W

- 903 W 18th St Unit 4W

- 903 W 18th St Unit 2E

- 903 W 18th St

- 903 W 18th St

- 905 W 18th St

- 909 W 18th St

- 911 W 18th St

- 913 W 18th St

- 1800 S Peoria St

- 1800 S Peoria St Unit 2

- 1802 S Peoria St

- 1802 S Peoria St Unit 2

- 1802 S Peoria St Unit 1

- 914 W 18th Place

- 912 W 18th Place

- 916 W 18th Place

- 916 W 18th Place

- 916 W 18th Place Unit 2

- 922 W 18th Place