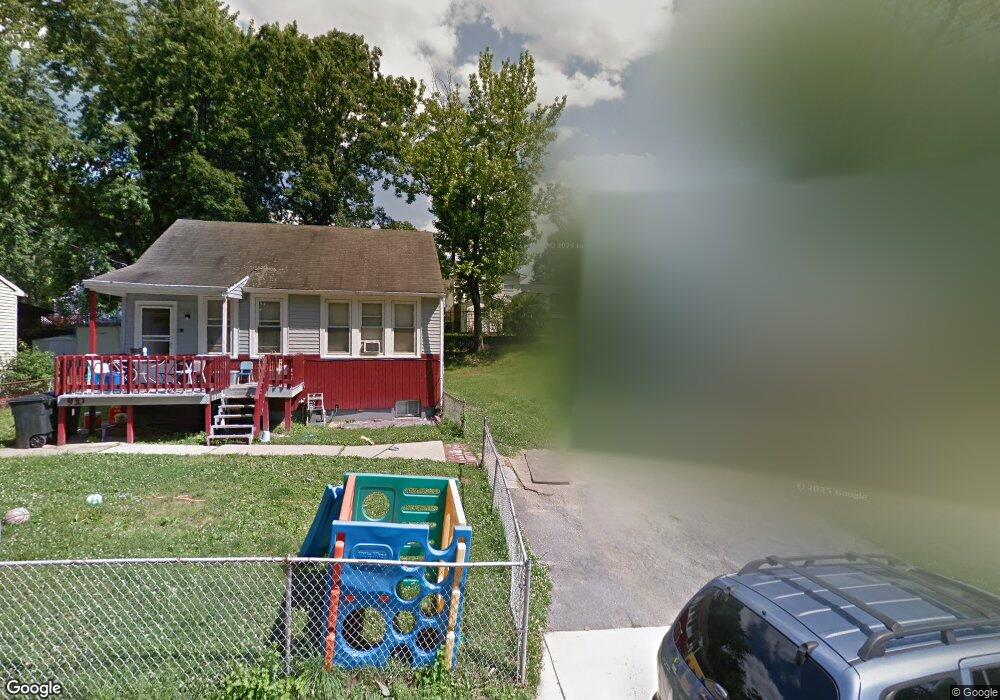

910 Abel Ave Capitol Heights, MD 20743

Estimated Value: $277,000 - $330,000

Studio

1

Bath

672

Sq Ft

$439/Sq Ft

Est. Value

About This Home

This home is located at 910 Abel Ave, Capitol Heights, MD 20743 and is currently estimated at $295,155, approximately $439 per square foot. 910 Abel Ave is a home located in Prince George's County with nearby schools including William W. Hall Academy, Suitland High School, and Rocketship Dc Public Charter School - Legacy Prep.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 12, 2022

Sold by

Dora Denny Marlene

Bought by

Williams Marlene D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$205,000

Outstanding Balance

$194,881

Interest Rate

5%

Mortgage Type

New Conventional

Estimated Equity

$100,274

Purchase Details

Closed on

Jul 7, 2003

Sold by

Braddock Angelo J

Bought by

Denny Marlene D

Purchase Details

Closed on

Dec 31, 2001

Sold by

Braddock Angelo J Etal

Bought by

Braddock Angelo J and Braddock Barbara A

Purchase Details

Closed on

Sep 18, 1997

Sold by

Wych Douglas

Bought by

Braddock Angelo J Etal

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Williams Marlene D | -- | First American Title | |

| Williams Marlene D | -- | First American Title | |

| Denny Marlene D | $125,000 | -- | |

| Braddock Angelo J | -- | -- | |

| Braddock Angelo J Etal | $84,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Williams Marlene D | $205,000 | |

| Closed | Williams Marlene D | $205,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,743 | $220,100 | -- | -- |

| 2024 | $2,743 | $202,800 | -- | -- |

| 2023 | $2,618 | $185,500 | $60,400 | $125,100 |

| 2022 | $2,490 | $172,033 | $0 | $0 |

| 2021 | $4,855 | $158,567 | $0 | $0 |

| 2020 | $4,575 | $145,100 | $45,200 | $99,900 |

| 2019 | $1,982 | $138,433 | $0 | $0 |

| 2018 | $2,138 | $131,767 | $0 | $0 |

| 2017 | $2,071 | $125,100 | $0 | $0 |

| 2016 | -- | $119,167 | $0 | $0 |

| 2015 | $2,067 | $113,233 | $0 | $0 |

| 2014 | $2,067 | $107,300 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 922 Abel Ave

- 921 Balboa Ave

- 944 Balboa Ave

- 1007 Drum Ave

- 4607 Gunther St

- 5221 F St SE

- 5219 F St SE

- 5131 Hanna Place SE

- 1001 Iago Ave

- 5100 F St SE Unit 7

- 815 Kayak Ave

- 628 Clovis Ave

- 905 Kayak Ave

- 5032 Hanna Place SE

- 5002 Kimi Gray Ct SE

- 623 Elfin Ave

- 5019 H St SE

- 1201 Abel Ave

- 4968 Benning Rd SE Unit 4972

- 4962-4966 Benning Rd SE

Your Personal Tour Guide

Ask me questions while you tour the home.