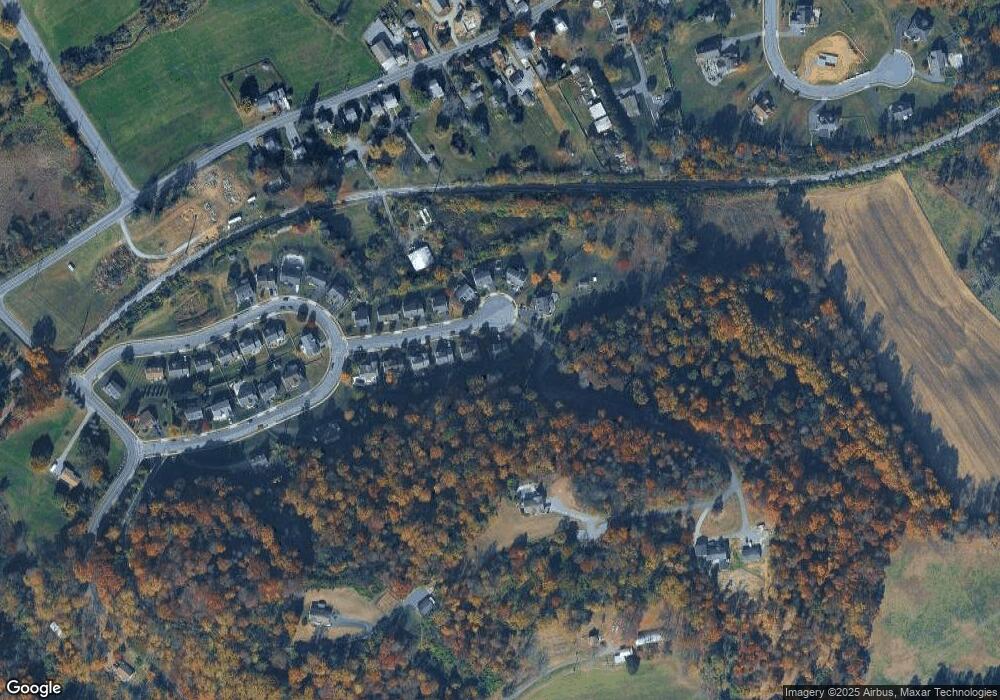

910 Connor Ct Reading, PA 19608

Estimated Value: $453,000 - $546,000

5

Beds

4

Baths

3,442

Sq Ft

$148/Sq Ft

Est. Value

About This Home

This home is located at 910 Connor Ct, Reading, PA 19608 and is currently estimated at $508,495, approximately $147 per square foot. 910 Connor Ct is a home located in Berks County with nearby schools including Shiloh Hills Elementary School, Wilson Southern Middle School, and Wilson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 28, 2009

Sold by

Chesapeake Loan Servicing Llc

Bought by

Eason Bob B and Eason Ann O

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,622

Outstanding Balance

$137,723

Interest Rate

4.87%

Mortgage Type

FHA

Estimated Equity

$370,772

Purchase Details

Closed on

Oct 28, 2009

Sold by

Drago Salvatore and Drago Wendy A

Bought by

Chesapeake Loan Servicing Llc

Purchase Details

Closed on

Jan 12, 2005

Sold by

Forino Co Lp and Smith John G

Bought by

Drago Salvatore and Drago Wendy A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,000

Interest Rate

5.61%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Eason Bob B | $230,000 | None Available | |

| Chesapeake Loan Servicing Llc | $202,500 | None Available | |

| Drago Salvatore | $257,723 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Eason Bob B | $210,622 | |

| Previous Owner | Drago Salvatore | $160,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,508 | $200,200 | $23,800 | $176,400 |

| 2024 | $8,566 | $200,200 | $23,800 | $176,400 |

| 2023 | $8,162 | $200,200 | $23,800 | $176,400 |

| 2022 | $7,961 | $200,200 | $23,800 | $176,400 |

| 2021 | $7,681 | $200,200 | $23,800 | $176,400 |

| 2020 | $7,681 | $200,200 | $23,800 | $176,400 |

| 2019 | $7,463 | $200,200 | $23,800 | $176,400 |

| 2018 | $7,399 | $200,200 | $23,800 | $176,400 |

| 2017 | $7,274 | $200,200 | $23,800 | $176,400 |

| 2016 | $2,188 | $200,200 | $23,800 | $176,400 |

| 2015 | $2,188 | $200,200 | $23,800 | $176,400 |

| 2014 | $2,188 | $200,200 | $23,800 | $176,400 |

Source: Public Records

Map

Nearby Homes

- 504 Longview Dr

- 90 Preston Rd

- 3314 E Galen Hall Rd

- 1181 LOT 3 Fritztown Rd

- 1192 Fritztown Rd

- 1185 Fritztown Rd

- 0 Cushion Peak Rd

- 1505 Old Fritztown Rd

- 310 Mail Route Rd

- 3137 E Galen Hall Rd

- 457 Epsilon Dr Unit 45

- 0 Preston Rd

- 11 Fiorino Way Unit 1

- 555 Lincoln Dr

- 514 Arrowhead Trail

- 125 Shire Ln

- 3101 Daniel Dr

- 709 Hill Rd Unit 7

- 62 Stella Dr

- 16 Wild Forest Dr