9123 W Sunrise Blvd Unit 182B Plantation, FL 33322

Estimated Value: $374,729 - $393,000

2

Beds

2

Baths

1,342

Sq Ft

$284/Sq Ft

Est. Value

About This Home

This home is located at 9123 W Sunrise Blvd Unit 182B, Plantation, FL 33322 and is currently estimated at $380,682, approximately $283 per square foot. 9123 W Sunrise Blvd Unit 182B is a home located in Broward County with nearby schools including Horizon Elementary School, Bair Middle School, and Plantation High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 6, 2010

Sold by

Jerry Michael C and Wang Hong

Bought by

Escott Stephanie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,272

Outstanding Balance

$85,290

Interest Rate

4.5%

Mortgage Type

FHA

Estimated Equity

$295,392

Purchase Details

Closed on

Mar 31, 2006

Sold by

Corbett Kevin and Corbett Ann Marie

Bought by

Jerry Michael Corey

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$39,450

Interest Rate

6.2%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Feb 17, 2004

Sold by

Diaz Miguel A

Bought by

Corbett Kevin and Madura Ann Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,000

Interest Rate

4.87%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 10, 2001

Sold by

Available Not

Bought by

Available Not

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Escott Stephanie | $130,000 | Classic Title & Abstract Inc | |

| Jerry Michael Corey | $263,000 | Windsor Title Services Inc | |

| Corbett Kevin | $160,000 | Peoples Title Of S Fl Inc | |

| Available Not | $109,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Escott Stephanie | $128,272 | |

| Previous Owner | Jerry Michael Corey | $39,450 | |

| Previous Owner | Corbett Kevin | $128,000 | |

| Closed | Corbett Kevin | $24,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,427 | $333,570 | -- | -- |

| 2024 | $6,022 | $333,570 | -- | -- |

| 2023 | $6,022 | $275,690 | $0 | $0 |

| 2022 | $5,224 | $250,630 | $0 | $0 |

| 2021 | $4,674 | $227,850 | $24,740 | $203,110 |

| 2020 | $4,470 | $218,220 | $24,740 | $193,480 |

| 2019 | $4,255 | $206,180 | $24,740 | $181,440 |

| 2018 | $4,016 | $198,950 | $24,740 | $174,210 |

| 2017 | $3,688 | $178,080 | $0 | $0 |

| 2016 | $1,545 | $114,810 | $0 | $0 |

| 2015 | $1,573 | $114,020 | $0 | $0 |

| 2014 | $1,570 | $113,120 | $0 | $0 |

| 2013 | -- | $111,450 | $24,740 | $86,710 |

Source: Public Records

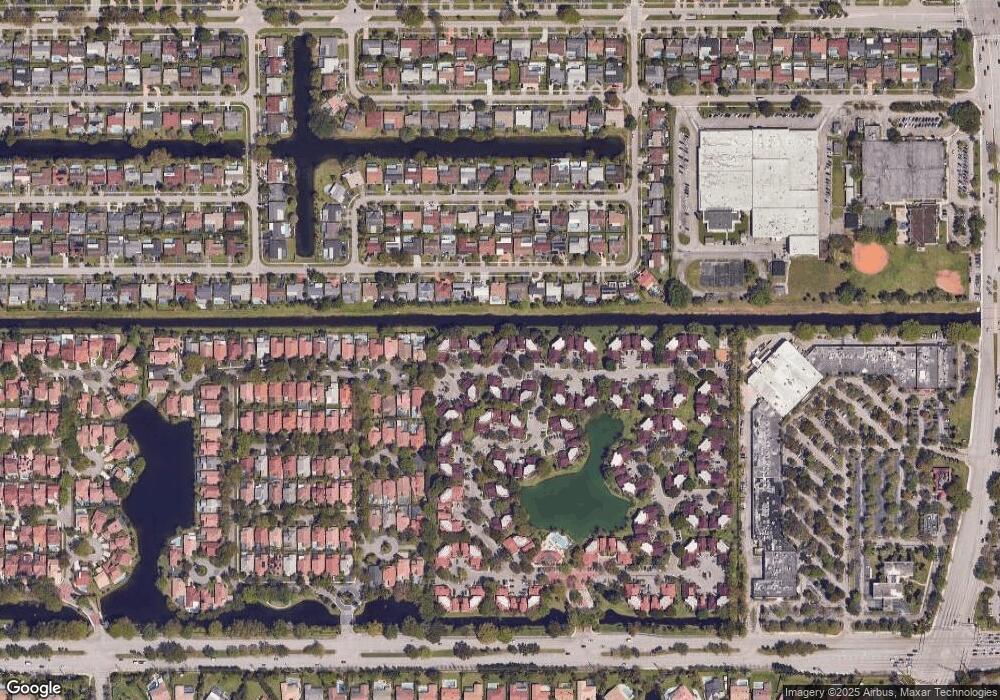

Map

Nearby Homes

- 9103 W Sunrise Blvd

- 9087 W Sunrise Blvd

- 9215 W Sunrise Blvd

- 1878 NW 93rd Terrace

- 9200 NW 21st Manor

- 9260 NW 21st Manor

- 1838 NW 93rd Terrace

- 8951 W Sunrise Blvd

- 8953 W Sunrise Blvd Unit 8953

- 9201 NW 21st Manor

- 2051 NW 93rd Ln

- 9081 NW 21st Manor

- 2161 NW 93rd Ln

- 9451 NW 20th Place

- 1838 NW 94th Ave

- 1840 NW 94th Ave

- 9050 NW 24th Ct

- 8981 NW 24th St

- 9451 Sunset Strip

- 9170 NW 24th Place

- 9123 W Sunrise Blvd

- 9123 W Sunrise Blvd

- 9121 W Sunrise Blvd

- 9125 W Sunrise Blvd

- 9119 W Sunrise Blvd

- 9117 W Sunrise Blvd Unit 185D

- 9177 W Sunrise Blvd

- 9177 W Sunrise Blvd Unit 1

- 9177 W Sunrise Blvd Unit 217B

- 9179 W Sunrise Blvd Unit 218

- 9175 W Sunrise Blvd Unit 216-D

- 9175 W Sunrise Blvd

- 9143 W Sunrise Blvd

- 9115 W Sunrise Blvd Unit 9115

- 9115 W Sunrise Blvd Unit 186C

- 9113 W Sunrise Blvd Unit 9113

- 9113 W Sunrise Blvd

- 9119 W Sunrise Bl

- 9173 W Sunrise Blvd

- 9141 W Sunrise Blvd