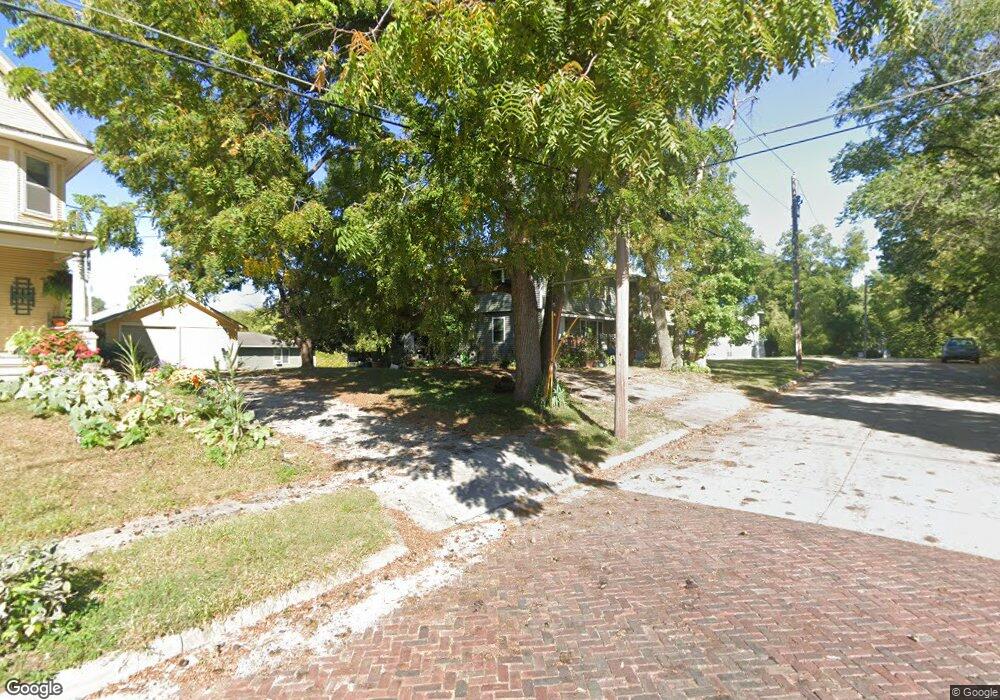

913 Dewey St Iowa City, IA 52245

Goosetown NeighborhoodEstimated Value: $277,000 - $348,000

4

Beds

2

Baths

2,244

Sq Ft

$140/Sq Ft

Est. Value

About This Home

This home is located at 913 Dewey St, Iowa City, IA 52245 and is currently estimated at $313,167, approximately $139 per square foot. 913 Dewey St is a home located in Johnson County with nearby schools including Horace Mann Elementary School, Southeast Junior High School, and City High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 23, 2020

Sold by

Austin Matthew R

Bought by

Austin Anah V

Current Estimated Value

Purchase Details

Closed on

Feb 13, 2017

Sold by

Kolosik Adam G and Kolosik Kasie L

Bought by

Heckart Jay Wylie and Wagner Kelly Ann

Purchase Details

Closed on

Jun 13, 2016

Sold by

Esgate Maryanne J

Bought by

Ravuri Suren and Kollu Vidya

Purchase Details

Closed on

Apr 24, 2015

Sold by

Parsons David Lee and Parsons David L

Bought by

Leuer Travis and Leuer Megan

Purchase Details

Closed on

Jul 24, 2014

Sold by

Tauchen Richard A and Tauchen Jane A

Bought by

Bitterman Christie J and Martins Janice C

Purchase Details

Closed on

Mar 8, 2013

Sold by

Gatts Mason T and Gatts Hannah N

Bought by

Crall Kevin M and Crall Emily L

Purchase Details

Closed on

Oct 2, 2012

Sold by

Esgate Maryanne J

Bought by

Esgate Maryanne J and Maryanne J Esgate Revocable Trust

Purchase Details

Closed on

Aug 23, 2011

Sold by

Leahy Edward J and Leahy Joan K

Bought by

Leahy Edward J and Edward J Leahy Revocable Trust

Purchase Details

Closed on

May 24, 2006

Sold by

Reinking Benjamin E

Bought by

Esgate Maryanne J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Austin Anah V | -- | None Available | |

| Heckart Jay Wylie | -- | None Available | |

| Ravuri Suren | -- | None Available | |

| Leuer Travis | $230,000 | None Available | |

| Bitterman Christie J | $215,000 | None Available | |

| Crall Kevin M | $187,500 | None Available | |

| Esgate Maryanne J | -- | None Available | |

| Leahy Edward J | -- | None Available | |

| Esgate Maryanne J | $217,000 | None Available |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,634 | $269,030 | $53,950 | $215,080 |

| 2024 | $4,576 | $243,260 | $48,560 | $194,700 |

| 2023 | $4,374 | $243,260 | $48,560 | $194,700 |

| 2022 | $4,180 | $201,840 | $45,860 | $155,980 |

| 2021 | $4,164 | $201,840 | $45,860 | $155,980 |

| 2020 | $4,164 | $192,570 | $43,160 | $149,410 |

| 2019 | $3,874 | $192,570 | $43,160 | $149,410 |

| 2018 | $3,874 | $176,370 | $40,460 | $135,910 |

| 2017 | $3,770 | $176,370 | $40,460 | $135,910 |

| 2016 | $3,696 | $171,510 | $40,460 | $131,050 |

| 2015 | $3,696 | $171,510 | $40,460 | $131,050 |

| 2014 | $3,564 | $164,740 | $40,460 | $124,280 |

Source: Public Records

Map

Nearby Homes

- 911 N Governor St

- 902 N Dodge St

- 910 N Dodge St

- 908 N Dodge St

- 900 N Dodge St

- 828 Church St

- 523 Brown St

- 529 Ronalds St

- 427 Brown St

- 415 N Governor St

- 906 E Davenport St

- 419 Pleasant St

- 912 E Bloomington St

- 1255 Dodge Street Ct

- 415 Church St

- 320 N Dodge St

- Lot Whiting Ave

- 515 E Davenport St

- 1016 Rochester Ave

- 420 N Gilbert St

- 917 Dewey St

- 819 Dewey St

- 908 N Governor St

- 900 N Governor St

- 921 Dewey St

- 916 N Governor St

- 817 Dewey St

- 837 N Summit St

- 914 Dewey St

- 814 Dewey St

- 927 Dewey St

- 918 N Governor St

- 915 N Summit St

- 813 Dewey St

- 909 N Governor St

- 909 N Governor St

- 909 N Governor St Unit A

- 909 N Governor St Unit 101

- 812 Dewey St

- 905 N Governor St