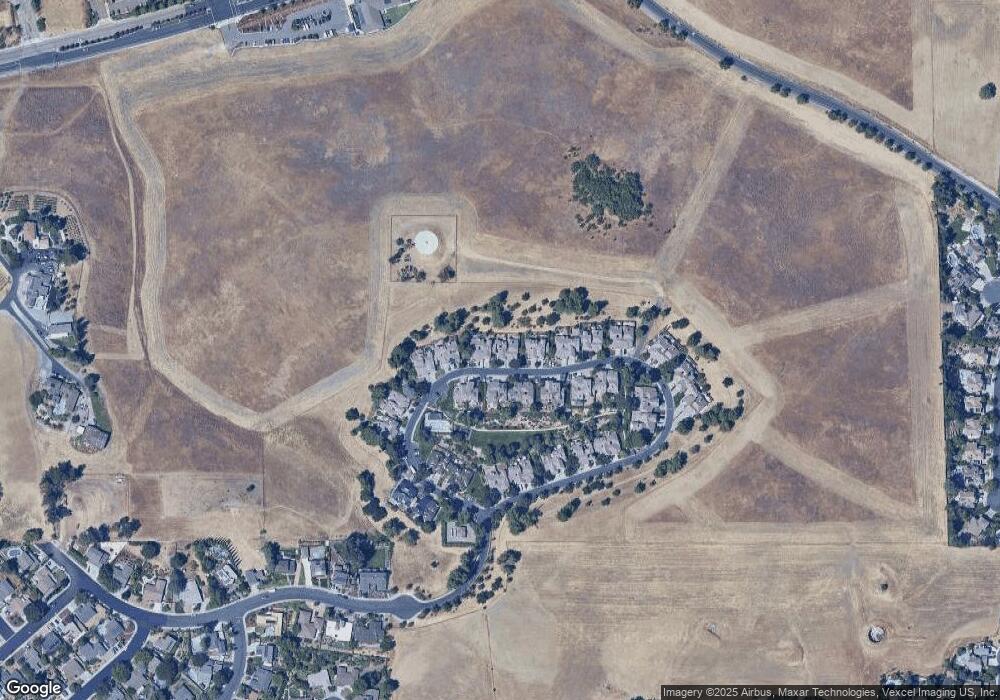

913 Waverly Common Livermore, CA 94551

Portola Glen NeighborhoodEstimated Value: $978,000 - $1,053,682

3

Beds

3

Baths

1,950

Sq Ft

$516/Sq Ft

Est. Value

About This Home

This home is located at 913 Waverly Common, Livermore, CA 94551 and is currently estimated at $1,006,671, approximately $516 per square foot. 913 Waverly Common is a home located in Alameda County with nearby schools including Junction Avenue K-8 School, Livermore High School, and Valley Montessori School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 9, 2015

Sold by

Hudson Elaine

Bought by

The Shefler Family Living Trust

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$488,000

Outstanding Balance

$375,535

Interest Rate

3.73%

Mortgage Type

New Conventional

Estimated Equity

$631,136

Purchase Details

Closed on

Apr 30, 2012

Sold by

Hudson Elaine

Bought by

Hudson Elaine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,000

Interest Rate

4.05%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 11, 1995

Sold by

Emc Mtg Corp

Bought by

Hudson Elaine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$154,800

Interest Rate

7.58%

Purchase Details

Closed on

May 1, 1995

Sold by

Great Western Bank

Bought by

Emc Mtg Corp

Purchase Details

Closed on

Mar 28, 1995

Sold by

Great Western Bank

Bought by

Great Western Bank

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| The Shefler Family Living Trust | $610,000 | Chicago Title | |

| Hudson Elaine | -- | Old Republic Title Company | |

| Hudson Elaine | $198,000 | Chicago Title Co | |

| Emc Mtg Corp | $156,000 | -- | |

| Great Western Bank | $153,098 | Chicago Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | The Shefler Family Living Trust | $488,000 | |

| Previous Owner | Hudson Elaine | $135,000 | |

| Previous Owner | Hudson Elaine | $154,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,069 | $726,103 | $219,931 | $513,172 |

| 2024 | $9,069 | $711,731 | $215,619 | $503,112 |

| 2023 | $8,940 | $704,641 | $211,392 | $493,249 |

| 2022 | $8,817 | $683,824 | $207,247 | $483,577 |

| 2021 | $8,643 | $670,282 | $203,184 | $474,098 |

| 2020 | $8,377 | $670,340 | $201,102 | $469,238 |

| 2019 | $8,395 | $657,201 | $197,160 | $460,041 |

| 2018 | $8,225 | $644,318 | $193,295 | $451,023 |

| 2017 | $8,022 | $631,684 | $189,505 | $442,179 |

| 2016 | $7,660 | $619,301 | $185,790 | $433,511 |

| 2015 | $3,516 | $273,678 | $82,103 | $191,575 |

| 2014 | -- | $268,318 | $80,495 | $187,823 |

Source: Public Records

Map

Nearby Homes

- 3473 Edinburgh Dr

- 513 Briarwood Ct

- 2845 Briarwood Dr

- 3370 Gardella Plaza

- 3971 Portola Common Unit 1

- 3713 First St

- 385 Kensington Common

- 2908 Worthing Common

- 2151 Elm St

- 1481 Calle de Las Granvas

- 3491 Madeira Way

- 2878 4th St Unit 1401

- 2145 Linden St

- 713 Tennyson Dr

- 635 Eliot Dr

- 3973 Duke Way

- 202 Sonia Way

- 3959 Purdue Way

- 1815 Pine St

- 2542 Fourth St

- 925 Waverly Common

- 911 Waverly Common

- 927 Waverly Common

- 895 Waverly Common

- 893 Waverly Common

- 910 Waverly Common

- 912 Waverly Common

- 906 Waverly Common

- 943 Waverly Common

- 936 Waverly Common

- 904 Waverly Common

- 945 Waverly Common

- 938 Waverly Common

- 889 Waverly Common

- 892 Waverly Common

- 957 Waverly Common

- 890 Waverly Common

- 887 Waverly Common

- 959 Waverly Common

- 886 Waverly Common