915 Dakota Dr Castle Rock, CO 80108

Estimated Value: $1,865,217 - $2,156,000

5

Beds

6

Baths

6,159

Sq Ft

$337/Sq Ft

Est. Value

About This Home

This home is located at 915 Dakota Dr, Castle Rock, CO 80108 and is currently estimated at $2,076,054, approximately $337 per square foot. 915 Dakota Dr is a home located in Douglas County with nearby schools including Buffalo Ridge Elementary School, Rocky Heights Middle School, and Rock Canyon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 23, 2009

Sold by

Richey Roman A and Richey Maria

Bought by

Haines David L and Haines Hiemi K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,000

Interest Rate

5.09%

Mortgage Type

Unknown

Purchase Details

Closed on

Aug 12, 2005

Sold by

Bailey Rick D and Bailey Karyn L

Bought by

Richey Roman A and Richey Maria

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$960,000

Interest Rate

5.65%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jul 6, 2000

Sold by

Huntington Homes Llc

Bought by

Bailey Rick D and Bailey Karyn L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$650,000

Interest Rate

8%

Purchase Details

Closed on

May 15, 1998

Sold by

Fidelity Castle Pines Ltd

Bought by

Huntington Homes Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,864

Interest Rate

7.18%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Haines David L | $900,000 | Chicago Title Co | |

| Richey Roman A | $1,200,000 | Guardian Title | |

| Bailey Rick D | $1,064,000 | -- | |

| Huntington Homes Llc | $120,960 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Haines David L | $417,000 | |

| Previous Owner | Richey Roman A | $960,000 | |

| Previous Owner | Bailey Rick D | $650,000 | |

| Previous Owner | Huntington Homes Llc | $108,864 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $12,666 | $118,650 | $35,290 | $83,360 |

| 2023 | $12,766 | $118,650 | $35,290 | $83,360 |

| 2022 | $8,301 | $79,690 | $21,860 | $57,830 |

| 2021 | $8,616 | $79,690 | $21,860 | $57,830 |

| 2020 | $9,345 | $80,910 | $20,380 | $60,530 |

| 2019 | $9,373 | $80,910 | $20,380 | $60,530 |

| 2018 | $10,570 | $90,120 | $16,600 | $73,520 |

| 2017 | $10,011 | $90,120 | $16,600 | $73,520 |

| 2016 | $9,739 | $86,400 | $17,200 | $69,200 |

| 2015 | $4,955 | $86,400 | $17,200 | $69,200 |

| 2014 | $3,866 | $64,100 | $10,750 | $53,350 |

Source: Public Records

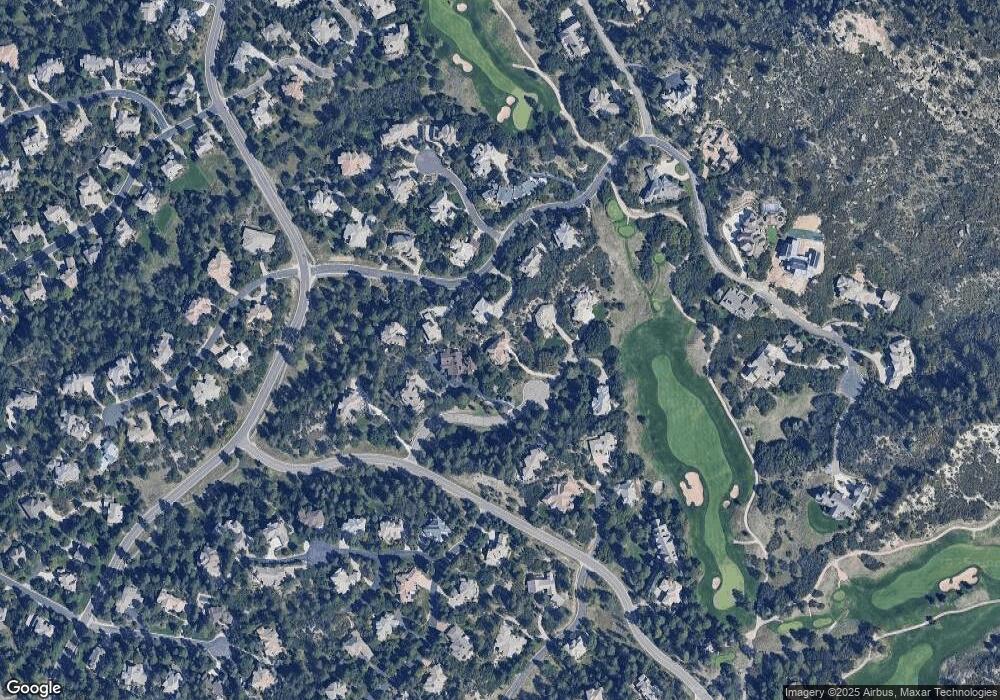

Map

Nearby Homes

- 218 Hidden Valley Ln

- 811 Moffat Ct

- 874 Wolverine Ct

- 867 Homestake Ct

- 870 Homestake Ct

- 1202 Wildcat Bend Ct

- 1062 Cypress Way

- 6190 Massive Peak Cir

- 1072 Cypress Way

- 910 Equinox Dr

- 1094 Golf Estates Point

- 122 Silver Leaf Way

- 1095 Golf Estates Point Unit 13

- 1083 Golf Estates Point

- 3122 Ramshorn Dr

- 6186 Oxford Peak Ln

- 6436 Holy Cross Ct

- 6188 Oxford Peak Ln

- 6111 Huron Place

- Residence 3 Plan at The Village at Castle Pines - The Summit at Castle Pines

- 916 Dakota Dr

- 914 Dakota Dr

- 921 Anaconda Dr

- 920 Anaconda Dr

- 912 Dakota Dr

- 913 Dakota Dr

- 922 Anaconda Dr

- 911 Dakota Dr

- 926 Utica Dr

- 919 Anaconda Dr

- 213 Equinox Dr

- 923 Anaconda Dr

- 932 Anaconda Dr

- 927 Utica Dr

- 924 Anaconda Dr

- 261 Lead Queen Dr

- 212 Equinox Dr

- 231 Lead King Dr

- 260 Lead Queen Dr

- 933 Country Club Pkwy