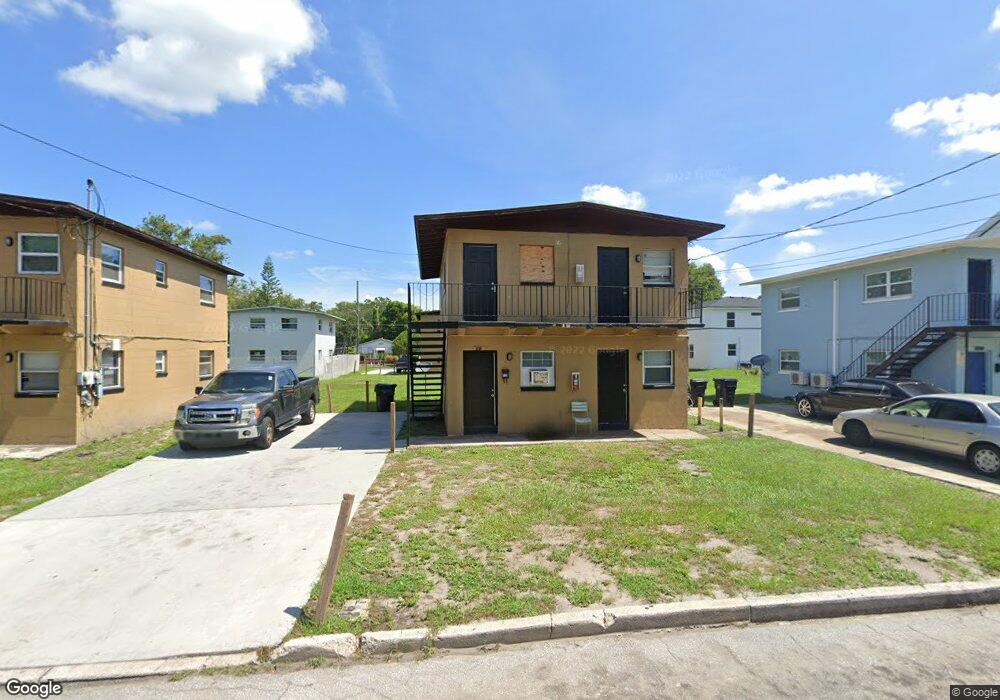

915 Randall St Orlando, FL 32805

Parramore NeighborhoodEstimated Value: $223,000 - $264,000

4

Beds

2

Baths

1,488

Sq Ft

$163/Sq Ft

Est. Value

About This Home

This home is located at 915 Randall St, Orlando, FL 32805 and is currently estimated at $242,833, approximately $163 per square foot. 915 Randall St is a home located in Orange County with nearby schools including OCPS Academic Center for Excellence, Jones High School, and Harvest Baptist Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 11, 2016

Sold by

Florida Lending Corp

Bought by

Shemuel Llc

Current Estimated Value

Purchase Details

Closed on

Oct 1, 2009

Sold by

Southeast Equity Holdings Llc

Bought by

Investor Trustee Services Llc

Purchase Details

Closed on

Sep 10, 2009

Sold by

Hsbc Bank Usa National Association

Bought by

Southeast Equity Holdings Llc

Purchase Details

Closed on

Aug 7, 2009

Sold by

Tazaz Tewodros

Bought by

Hsbc Bank Usa National Association

Purchase Details

Closed on

Apr 10, 2009

Sold by

Tazaz Tewodros T

Bought by

Hsbc Bank Usa National Association

Purchase Details

Closed on

Sep 6, 2006

Sold by

G & S Properties Llc

Bought by

Tazaz Tewodros

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$26,667

Interest Rate

6.2%

Mortgage Type

Stand Alone Second

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shemuel Llc | $57,000 | Southeast Professional Title | |

| Florida Lending Corp | $45,000 | Southeast Professional Title | |

| Investor Trustee Services Llc | $39,000 | Southeast Professional Ti | |

| Southeast Equity Holdings Llc | $28,000 | New House Title Llc | |

| Hsbc Bank Usa National Association | -- | Attorney | |

| Hsbc Bank Usa National Association | -- | Attorney | |

| Tazaz Tewodros | $133,400 | Park Place Title Winter Park |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Tazaz Tewodros | $26,667 | |

| Previous Owner | Tazaz Tewodros | $93,333 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,231 | $110,265 | -- | -- |

| 2024 | $1,864 | $110,265 | -- | -- |

| 2023 | $1,864 | $108,998 | $35,000 | $73,998 |

| 2022 | $1,664 | $92,004 | $30,000 | $62,004 |

| 2021 | $1,490 | $75,313 | $25,000 | $50,313 |

| 2020 | $1,370 | $76,354 | $25,000 | $51,354 |

| 2019 | $1,314 | $69,622 | $25,000 | $44,622 |

| 2018 | $1,235 | $65,899 | $26,000 | $39,899 |

| 2017 | $1,079 | $51,446 | $12,100 | $39,346 |

| 2016 | $902 | $48,130 | $9,500 | $38,630 |

| 2015 | $874 | $47,071 | $9,500 | $37,571 |

| 2014 | $831 | $44,836 | $18,000 | $26,836 |

Source: Public Records

Map

Nearby Homes

- 1013 Randall St

- 1017 Randall St

- 811 Colyer St

- 1025 Colyer St Unit A/B

- 1029 Colyer St

- 433 S Lee Ave

- 440 Mcfall Ave

- 509 Grove Ave

- 727 Quill Ave

- 0 Easy Ave

- 1232 Conley St

- 724 Grove Ave

- 1202 Cypress St

- 1023 W Gore St

- 1122 Dewitt Dr

- 544 Murphy St

- 107 Garden Ave

- 222 N Parramore Ave

- 907 Columbia St

- 210 Kent Ave

- 911 Randall St

- 919 Randall St

- 914 Colyer St

- 909 Randall St

- 920 Randall St

- 910 Colyer St

- 914 Randall St

- 912 Randall St

- 907 Randall St

- 908 Randall St

- 905 Randall St

- 902 Colyer St

- 424 Jernigan Ave

- 439 S Westmoreland Dr

- 910 Randall St

- 900 Randall St

- 904 Randall St

- 915 Colyer St

- 915 W Anderson St

- 900 Colyer St Unit 902