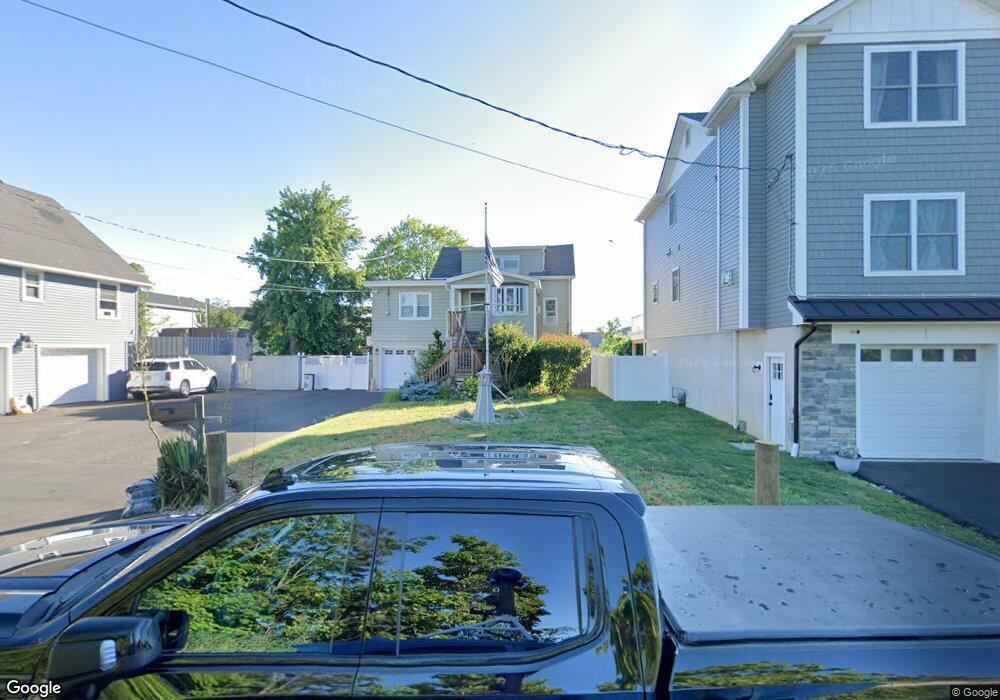

919 4th St Union Beach, NJ 07735

Estimated Value: $430,000 - $492,000

4

Beds

1

Bath

1,262

Sq Ft

$363/Sq Ft

Est. Value

About This Home

This home is located at 919 4th St, Union Beach, NJ 07735 and is currently estimated at $458,064, approximately $362 per square foot. 919 4th St is a home located in Monmouth County with nearby schools including Memorial School and Baytul-Iman Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 14, 2022

Sold by

Forte Nicole S and Forte Anthony L

Bought by

Forte Anthony L

Current Estimated Value

Purchase Details

Closed on

Jan 13, 2012

Sold by

Forte Anthony L and Forte Nicole S

Bought by

Forte Anthony L and Forte Nicole S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$238,271

Interest Rate

4.25%

Mortgage Type

FHA

Purchase Details

Closed on

Nov 29, 2005

Sold by

Rose Jackson Estate

Bought by

Forte Anthony L and Liberti Nicole S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$254,985

Interest Rate

6.17%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Forte Anthony L | -- | None Listed On Document | |

| Forte Anthony L | -- | Transtar National Title | |

| Forte Anthony L | $257,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Forte Anthony L | $238,271 | |

| Previous Owner | Forte Anthony L | $254,985 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,844 | $418,400 | $214,400 | $204,000 |

| 2024 | $7,499 | $380,400 | $186,400 | $194,000 |

| 2023 | $7,499 | $350,400 | $162,100 | $188,300 |

| 2022 | $6,361 | $291,000 | $120,100 | $170,900 |

| 2021 | $6,361 | $259,100 | $106,300 | $152,800 |

| 2020 | $6,016 | $239,100 | $96,300 | $142,800 |

| 2019 | $5,769 | $223,700 | $87,500 | $136,200 |

| 2018 | $5,691 | $212,100 | $80,000 | $132,100 |

| 2017 | $4,943 | $177,100 | $67,500 | $109,600 |

| 2016 | $4,563 | $163,600 | $70,000 | $93,600 |

| 2015 | $4,500 | $164,300 | $75,000 | $89,300 |

| 2014 | $4,721 | $142,100 | $77,800 | $64,300 |

Source: Public Records

Map

Nearby Homes