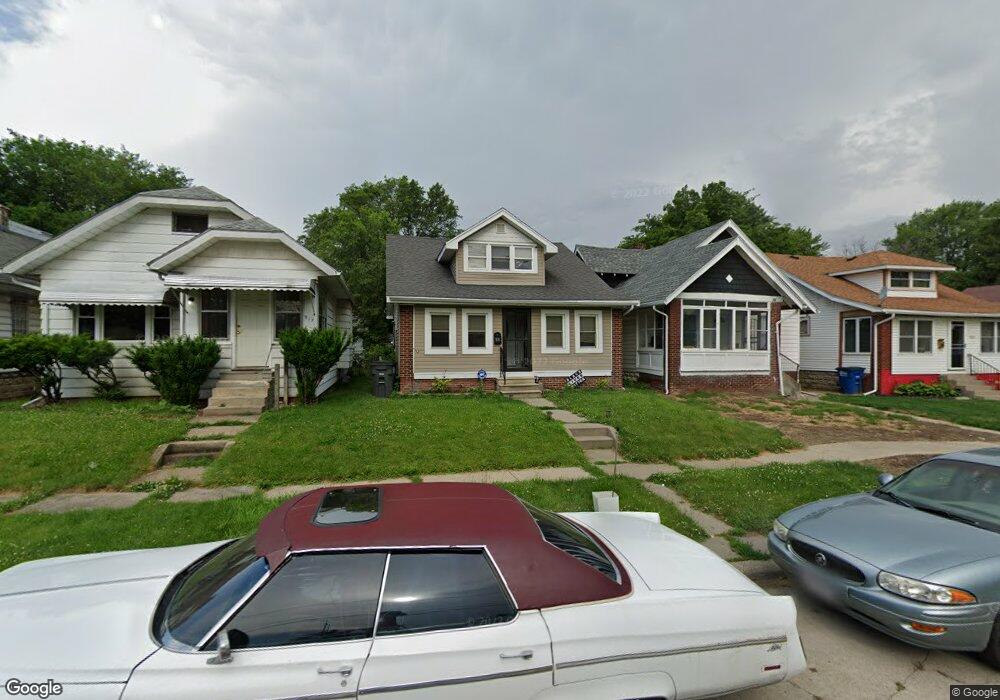

921 Shirley Ave Toledo, OH 43607

Scott Park NeighborhoodEstimated Value: $72,000 - $98,000

3

Beds

2

Baths

1,224

Sq Ft

$71/Sq Ft

Est. Value

About This Home

This home is located at 921 Shirley Ave, Toledo, OH 43607 and is currently estimated at $86,873, approximately $70 per square foot. 921 Shirley Ave is a home located in Lucas County with nearby schools including Jesup W. Scott High School, Explorers Academy, and Explorers Academy of Science and Technology.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 16, 2010

Sold by

Striegler Rory

Bought by

Dicenso Emily L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,634

Outstanding Balance

$28,135

Interest Rate

5.5%

Mortgage Type

FHA

Estimated Equity

$58,738

Purchase Details

Closed on

Jan 15, 2009

Sold by

Invest Smart Homes Llc

Bought by

Striegler Rory

Purchase Details

Closed on

Jan 8, 2009

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Invest Smart Homes Llc

Purchase Details

Closed on

Jul 3, 2008

Sold by

Ledyard James A

Bought by

Federal Home Loan Mortgage Corp

Purchase Details

Closed on

Mar 29, 2002

Sold by

Matthew Makins

Bought by

Ledyard James A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$33,750

Interest Rate

6.93%

Purchase Details

Closed on

Aug 8, 1990

Sold by

Webb Thomas Harlow and Webb Kim

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dicenso Emily L | $41,700 | Chicago Title Insurance Co | |

| Striegler Rory | $6,900 | Attorney | |

| Invest Smart Homes Llc | $4,500 | Attorney | |

| Federal Home Loan Mortgage Corp | $26,000 | None Available | |

| Ledyard James A | $37,500 | Midland | |

| -- | $26,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Dicenso Emily L | $40,634 | |

| Previous Owner | Ledyard James A | $33,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $574 | $17,115 | $5,110 | $12,005 |

| 2023 | $1,198 | $17,255 | $4,165 | $13,090 |

| 2022 | $1,197 | $17,255 | $4,165 | $13,090 |

| 2021 | $1,177 | $17,255 | $4,165 | $13,090 |

| 2020 | $1,131 | $14,385 | $3,430 | $10,955 |

| 2019 | $1,095 | $14,385 | $3,430 | $10,955 |

| 2018 | $1,089 | $14,385 | $3,430 | $10,955 |

| 2017 | $1,142 | $14,070 | $3,360 | $10,710 |

| 2016 | $1,118 | $40,200 | $9,600 | $30,600 |

| 2015 | $1,083 | $40,200 | $9,600 | $30,600 |

| 2014 | $885 | $14,070 | $3,360 | $10,710 |

| 2013 | $885 | $14,070 | $3,360 | $10,710 |

Source: Public Records

Map

Nearby Homes

- 908 Coventry Ave

- 913 Coventry Ave

- 2307 Avondale Ave

- 2145 Dorr St

- 1215 Woodstock Ave

- 1329 Parkside Blvd

- 1318 Addington Rd

- 2033 Crosswell Place

- 1131 Montrose Ave

- 605 Waverly Ave

- 1940 Crosswell Place

- 1513 Waverly Ave

- 1423 Roosevelt Ave

- 1420 Upton Ave

- 2000 Oakwood Ave

- 1723 Potomac Dr

- 1735 Perth St

- 1929 Foster Ave

- 1819 Oakwood Ave

- 1771 Kensington Rd

- 917 Shirley Ave

- 913 Shirley Ave

- 923 Shirley Ave

- 911 Shirley Ave

- 905 Shirley Ave

- 907 Shirley Ave

- 925 Shirley Ave

- 912 Coventry Ave

- 910 Coventry Ave

- 901 Shirley Ave

- 916 Coventry Ave

- 931 Shirley Ave

- 914 Coventry Ave

- 906 Coventry Ave

- 915 Parkside Blvd

- 920 Coventry Ave

- 919 Parkside Blvd

- 911 Parkside Blvd

- 918 Coventry Ave

- 923 Parkside Blvd