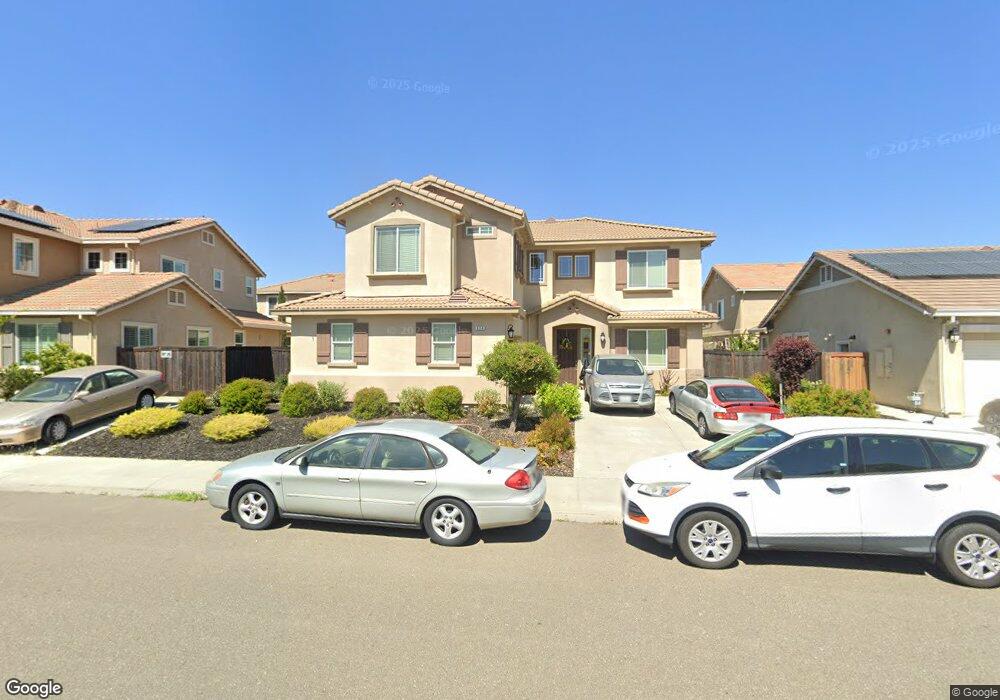

924 Noble Rd Vacaville, CA 95688

Estimated Value: $681,850 - $714,000

5

Beds

3

Baths

2,398

Sq Ft

$291/Sq Ft

Est. Value

About This Home

This home is located at 924 Noble Rd, Vacaville, CA 95688 and is currently estimated at $698,713, approximately $291 per square foot. 924 Noble Rd is a home located in Solano County with nearby schools including Edwin Markham Elementary School, Orchard Elementary School, and Willis Jepson Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 20, 2019

Sold by

Matthewson Kenneth

Bought by

Matthewson Kenneth and Matthewson Iris Patricia

Current Estimated Value

Purchase Details

Closed on

Oct 13, 2017

Sold by

Matthewson Iris and Matthewson Patricia L

Bought by

Matthewson Kenneth

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$487,336

Outstanding Balance

$406,625

Interest Rate

3.78%

Mortgage Type

VA

Estimated Equity

$292,088

Purchase Details

Closed on

Oct 12, 2017

Sold by

Haven North Village Llc

Bought by

Matthewson Kenneth

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$487,336

Outstanding Balance

$406,625

Interest Rate

3.78%

Mortgage Type

VA

Estimated Equity

$292,088

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Matthewson Kenneth | -- | None Available | |

| Matthewson Kenneth | -- | Old Republic Title Company | |

| Matthewson Kenneth | $485,500 | Old Republic Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Matthewson Kenneth | $487,336 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,174 | $552,070 | $113,781 | $438,289 |

| 2024 | $8,174 | $541,246 | $111,550 | $429,696 |

| 2023 | $7,892 | $530,634 | $109,363 | $421,271 |

| 2022 | $7,694 | $520,230 | $107,219 | $413,011 |

| 2021 | $7,614 | $510,030 | $105,117 | $404,913 |

| 2020 | $7,689 | $504,802 | $104,040 | $400,762 |

| 2019 | $7,667 | $494,904 | $102,000 | $392,904 |

| 2018 | $7,519 | $485,200 | $100,000 | $385,200 |

| 2017 | $3,219 | $132,255 | $54,055 | $78,200 |

| 2016 | $920 | $52,996 | $52,996 | $0 |

Source: Public Records

Map

Nearby Homes

- 625 Guild Rd

- 526 Epic St

- 438 Tilden Cir

- 452 Aster St

- 424 Wren Ln

- 771 Del Mar Cir

- 924 Monticello Ct

- 724 Razorbill St

- 1001 Swift Ct

- 757 Embassy Cir

- 761 Razorbill St

- 536 Aster St

- 1164 Parkside Dr

- 1012 Feather River Ct

- 524 Feather River Way

- 131 Del Paso Dr

- 4665 Midway Rd

- 124 Del Paso Dr

- 7115 Browns Valley Rd

- 240 Grand Canyon Dr