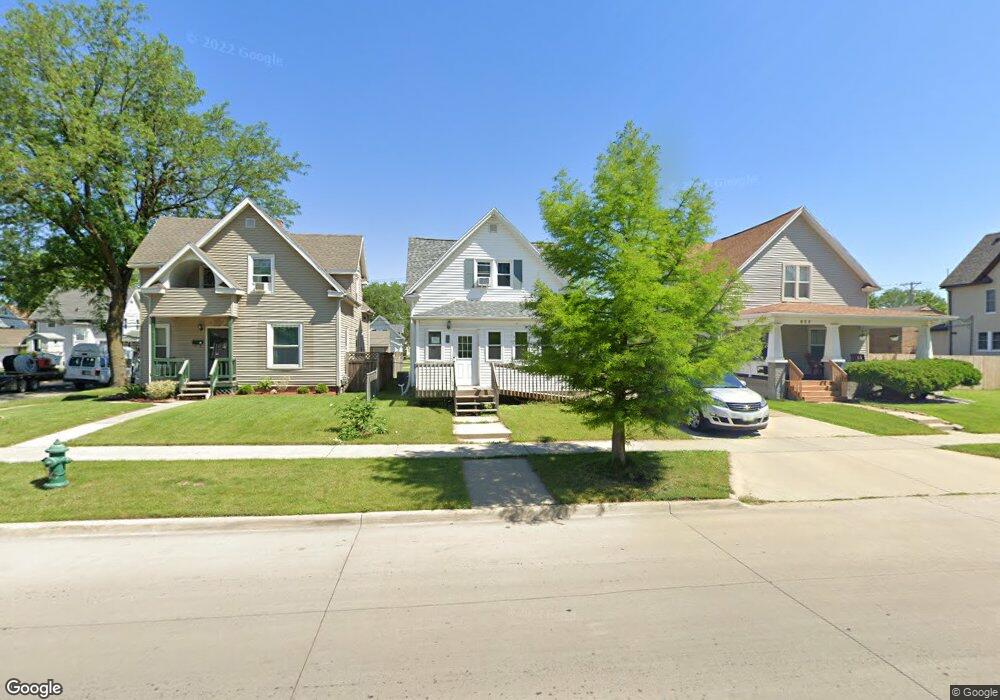

926 E Ave NW Cedar Rapids, IA 52405

Northwest Area NeighborhoodEstimated Value: $141,000 - $154,000

3

Beds

2

Baths

1,432

Sq Ft

$102/Sq Ft

Est. Value

About This Home

This home is located at 926 E Ave NW, Cedar Rapids, IA 52405 and is currently estimated at $145,770, approximately $101 per square foot. 926 E Ave NW is a home located in Linn County with nearby schools including Harrison Elementary School, Roosevelt Creative Corridor Business Academy, and Thomas Jefferson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 18, 2012

Sold by

Vogt Linda A and Vogt Paul E

Bought by

Vogt Linda A and Vogt Paul E

Current Estimated Value

Purchase Details

Closed on

Nov 22, 2005

Sold by

Corporan Darlene A and Vogt Linda A

Bought by

Corporon Darlene A and Vogt Paul E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vogt Linda A | -- | None Available | |

| Corporon Darlene A | -- | -- |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,614 | $123,100 | $27,000 | $96,100 |

| 2024 | $1,886 | $124,600 | $25,000 | $99,600 |

| 2023 | $1,886 | $117,300 | $22,000 | $95,300 |

| 2022 | $1,740 | $101,700 | $22,000 | $79,700 |

| 2021 | $1,792 | $96,400 | $22,000 | $74,400 |

| 2020 | $1,792 | $93,100 | $20,000 | $73,100 |

| 2019 | $1,592 | $85,600 | $16,000 | $69,600 |

Source: Public Records

Map

Nearby Homes

- 514 9th St NW

- 819 G Ave NW

- 1128 B Ave NW

- 816 10th St NW

- 816 9th St NW

- 1218 B Ave NW

- 1413 Seminole Ave NW

- 1020 A Ave NW

- 1338 Hinkley Ave NW

- 1155 A Ave NW

- 1221 A Ave NW

- 718 4th St NW

- 1629 C Ave NW

- 1118 2nd Ave SW

- 208 7th St SW

- 1722 B Ave NW

- 1238 Ellis Blvd NW

- 1602 1st Ave NW

- 531 9th St SW

- 1100 18th St NW

Your Personal Tour Guide

Ask me questions while you tour the home.