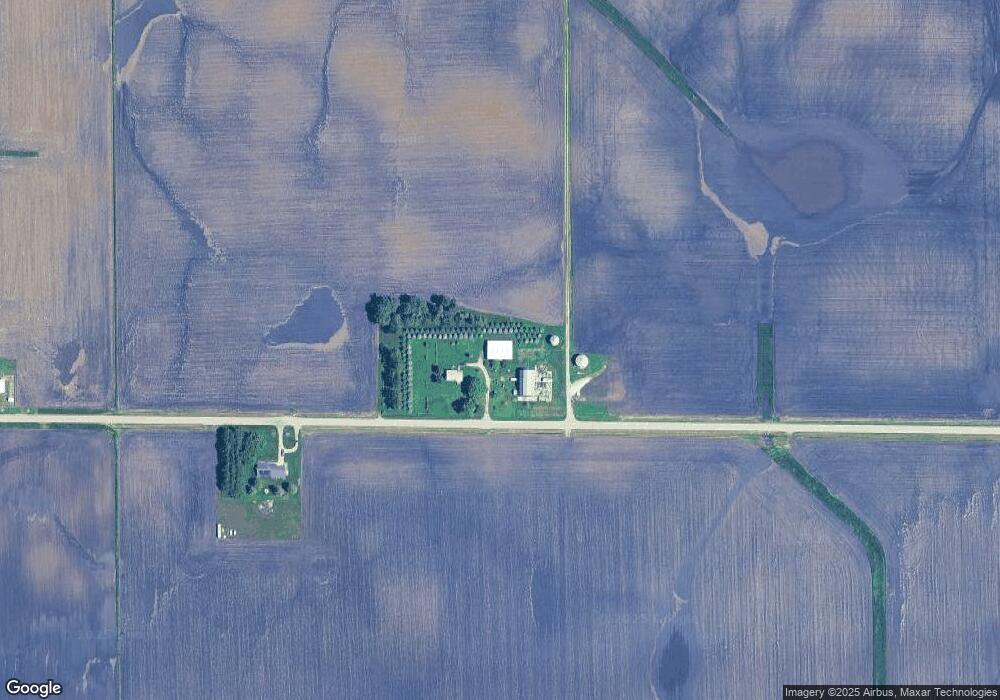

9269 Wesson Rd Leland, IL 60531

Estimated Value: $247,000 - $711,032

--

Bed

--

Bath

--

Sq Ft

40

Acres

About This Home

This home is located at 9269 Wesson Rd, Leland, IL 60531 and is currently estimated at $459,508. 9269 Wesson Rd is a home located in DeKalb County with nearby schools including Leland Elementary School and Leland High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 11, 2014

Sold by

Warren Alvin W

Bought by

Warren Alvin Wayne

Current Estimated Value

Purchase Details

Closed on

Jan 2, 2014

Sold by

Warren Alvin W

Bought by

Warren Alvin Wayne

Purchase Details

Closed on

Dec 30, 2013

Sold by

Warren Alvin W

Bought by

Warren Alvin Wayne

Purchase Details

Closed on

Nov 2, 2011

Sold by

Warren Trust

Bought by

Warren Alvin Wayne

Purchase Details

Closed on

Jan 3, 2011

Sold by

Warren Trust

Bought by

Warren Alvin Wayne

Purchase Details

Closed on

Dec 27, 2010

Sold by

Warren Alvin W

Bought by

Warren Alvin Wayne

Purchase Details

Closed on

Mar 30, 2010

Sold by

Warren Myrtie M

Bought by

Warren Trust

Purchase Details

Closed on

Jan 10, 2010

Sold by

Caves Judith W

Bought by

Warren Alvin W and Warren Myrtie M

Purchase Details

Closed on

Feb 2, 2009

Sold by

Natl Bk & Trt Co Sycamore

Bought by

Warren Susan and Warren Mark

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Warren Alvin Wayne | -- | -- | |

| Warren Alvin Wayne | -- | -- | |

| Warren Alvin Wayne | -- | -- | |

| Warren Alvin Wayne | $115,000 | -- | |

| Warren Alvin Wayne | -- | -- | |

| Warren Alvin Wayne | -- | -- | |

| Warren Trust | -- | -- | |

| Warren Alvin W | -- | -- | |

| Caves Judith W | -- | -- | |

| Caves Judith W | -- | -- | |

| Warren Susan | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,872 | $69,612 | $37,398 | $32,214 |

| 2023 | $4,872 | $64,324 | $34,799 | $29,525 |

| 2022 | $4,873 | $63,639 | $32,572 | $31,067 |

| 2021 | $4,600 | $60,083 | $30,619 | $29,464 |

| 2020 | $4,380 | $57,142 | $28,916 | $28,226 |

| 2019 | $4,289 | $54,637 | $27,405 | $27,232 |

| 2018 | $3,484 | $45,576 | $24,395 | $21,181 |

| 2017 | $3,868 | $42,758 | $22,722 | $20,036 |

| 2016 | $3,779 | $40,991 | $21,650 | $19,341 |

| 2015 | -- | $39,233 | $20,647 | $18,586 |

| 2014 | -- | $41,855 | $20,086 | $21,769 |

| 2013 | -- | $40,844 | $18,707 | $22,137 |

Source: Public Records

Map

Nearby Homes

- 0 Orchard Rd

- 5065 E Sleepy Hollow Rd

- 210 W Hall St

- 205 W North St

- 415 S Essex St

- 215 Morrow St Unit C

- 205 S Gage St

- 215 S Gage St

- 345 E Market St

- 980 Prairie View Dr

- 990 Prairie View Dr

- 985 Fox Trail Ln

- 1015 Fox Trail Ln

- 1020 Prairie View Dr

- 15080 Hiawatha Ln

- 142 E Lincoln Hwy Unit C

- 5Z Bonnie Ln

- 135 N Birch St

- 15582 Douglas Ave

- 205 N Birch St